AI Small Cap Energy Supplier

xAI has contracted this $3B small cap for the largest data center in the world

This article will be part of a series on data center suppliers.

AI capex is on track to reach $1 trillion per year by the end of the decade.

These estimates from Goldman Sachs date back to June:

Since then we’ve seen Meta raise its capex outlook, Oracle announce a $300B deal with OpenAI, and NVIDIA commit $100B to provide OpenAI with capital to buy GPUs.

We’re still in the early innings of the AI supercycle, which is why it makes sense to revisit some data center suppliers.

I believe the industry remains tremendously undervalued. Many investors hesitate because these names have already run up, but that mindset is a mistake. It’s the anchoring fallacy, and it has stopped people from making money.

Why do I say this industry still trades cheap? Let’s look at the valuations of some key suppliers for data center buildouts (EV/EBITDA):

Vertiv 25x

nVent 20x

Modine Manufacturing 17x

AMD 28x

NVIDIA 28x

Micron 7x

Dell 9x

Super Micro Computer 13x

All of these companies are core suppliers to large-scale AI infrastructure deployments. The same industry is seeing massive capex plans, yet the multiples don’t reflect this wave of spending. The market still isn’t valuing the sector for what it is: the foundation of AGI. A supercycle of investment to replace human labor with AI, both intellectual and physical.

Even if you aren’t hyper-bullish on AI, the reality is clear: these capex plans are locked in, and growth will be explosive, even if the investments don’t end up being accretive. The pick-and-shovel suppliers profit when gold is being chased, not only when it’s found. Earnings will come one way or another. With valuations still reasonable, and this being a decade-long opportunity, studying these companies for investment makes a lot of sense.

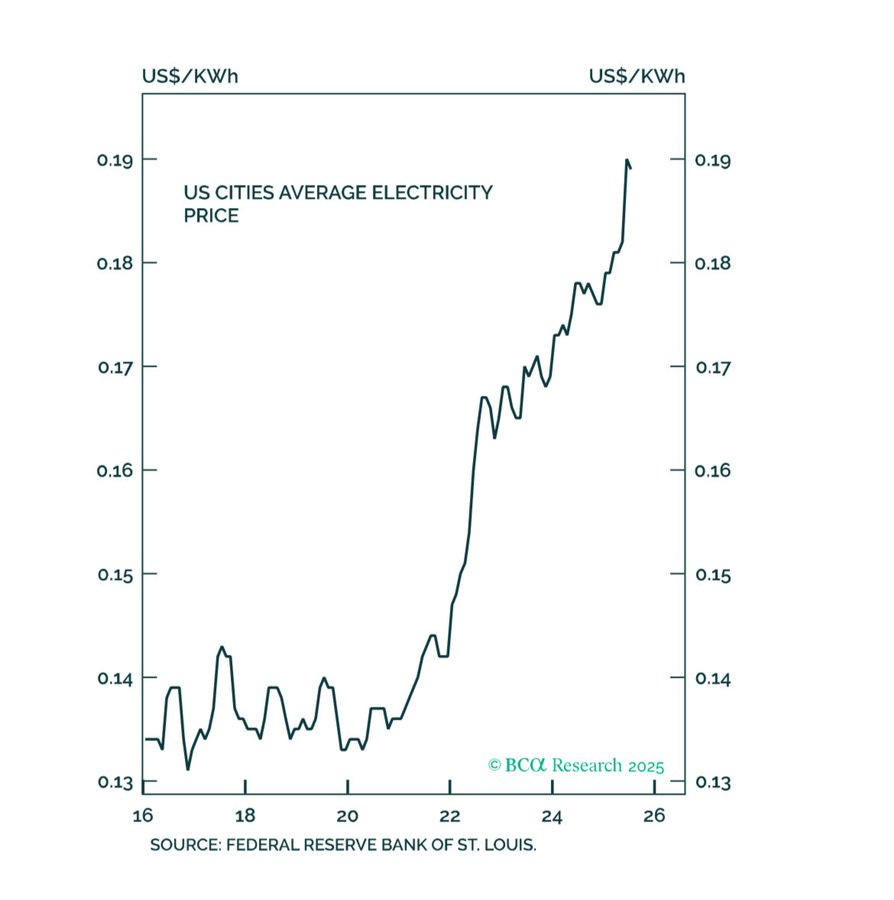

On the deployment side, the biggest non-compute bottleneck is energy. This shortage is already pushing up electricity prices across the US, straining both companies and households.

Of course, much of this comes from the war in Ukraine, but data center energy demand as a share of total consumption is expected to double by 2030.

The demand for electricity is so high that data center developers are desperate for energy approvals, yet securing them can take years, a timeline many cannot accept. This is why valuations of ex-Bitcoin miners have surged.

Bitcoin mining is no longer as profitable as it once was, but these companies already hold capacity approvals that allow them to draw hundreds of megawatts from the grid. They were sitting on a diamond mine without realizing it, and now they have the opportunity either to be acquired or to use that capacity directly for AI workloads.

Beyond this, companies that know how to position themselves as electricity providers for data center operators will be some of the biggest winners of this cycle. That’s exactly the case with the company I’ll be covering today.

I first came across it in SemiAnalysis’ latest article on the xAI Colossus 2 buildout. I already knew Elon Musk planned to use gas turbines to speed up energization, but I didn’t realize the supplier was a $2.5B Texas-based company.

Given the level of interest in opportunities like this, I’ll break down what the company does and how large the opportunity could be.

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.