What Is Happening With Crypto?

Is the crypto market offering an opportunity, or should investors stay aside?

BTC, ETH, MSTR and BMNR are all going through a strong market downturn, along with the rest of crypto.

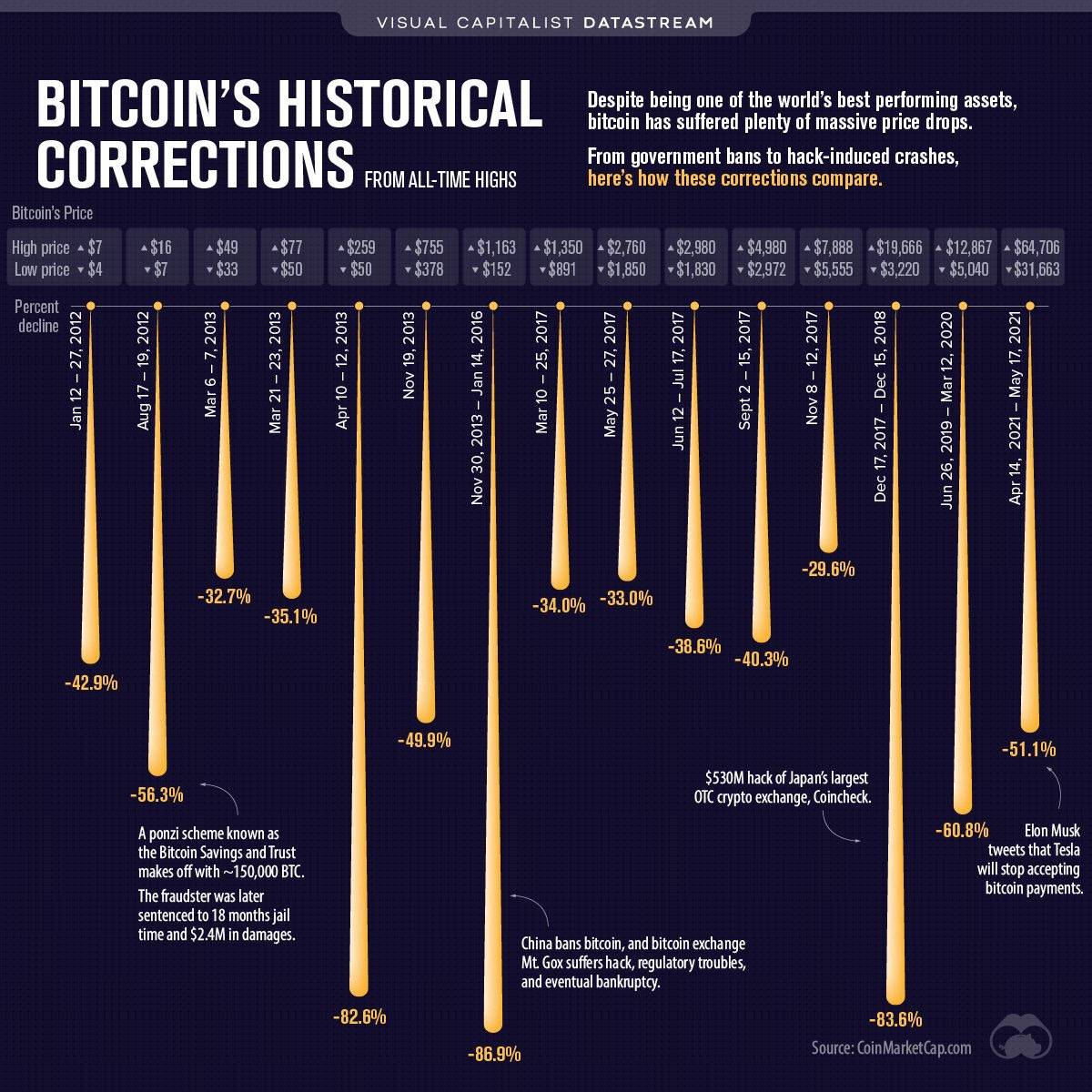

What started as a standard pullback after geopolitical tensions that hurt equities and crypto has now turned into a strong drawdown.

Why is this happening

There is one main culprit that has created a domino effect across the whole ecosystem:

Derivatives leverage.

Perpetual futures and other leveraged trades built up to extreme levels in Q3, while spot prices for BTC, ETH and most of the market were grinding higher.

Once the macro picture weakened and crypto started to roll over, that stack of leverage acted like a fuse. Prices moved down, liquidation engines started triggering and you got the largest one day futures liquidation event in crypto history, with more than 19B dollars in positions forced out and heavy automatic deleveraging across venues like Hyperliquid, Bybit and Binance.

That first big unwind started with traders running very high leverage on perpetual futures, funding momentum trades with strategies that only work while volatility stays low and prices move gradually upward. When the market gapped down, even accounts using what looked like modest leverage were dragged into the cascade.

Once those positions were forced out, every part of the ecosystem even slightly connected to crypto prices started to feel it.

From there, there was a domino effect.

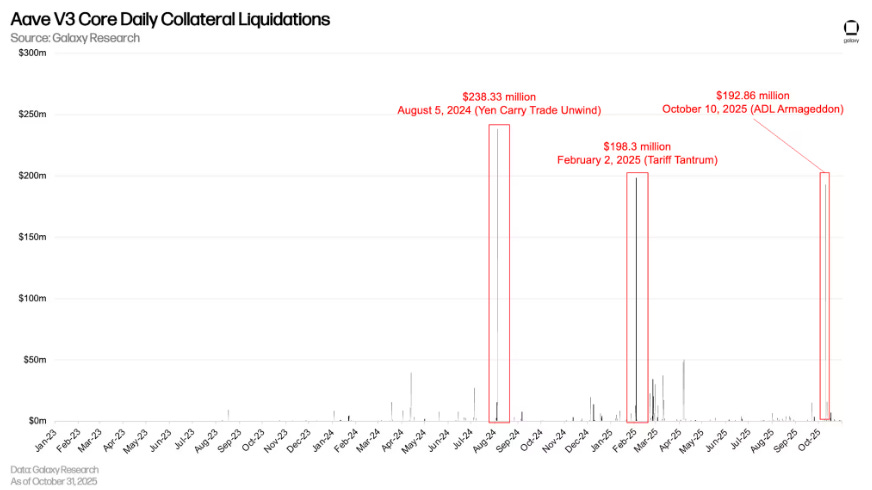

Spot BTC and ETH were sold to meet margin calls, and onchain loans backed by volatile collateral were partly repaid or liquidated.

Leverage alone does not explain how disastrous this situation has felt.

The Binance Glitch: When a Correction Turned Into a Crash

As Tom Lee explained, what should have been a normal correction turned into a cascade because Binance’s systems briefly mispriced some of the collateral used on the exchange.

On 10 October, Binance’s pricing engine showed wrong prices for three tokens used as collateral in margin and futures accounts: USDe, BNSOL and wBETH.

For a short window of around 40 minutes, USDe, a dollar stablecoin, traded on Binance in the 0.60 to 0.70 dollar range, even though it was much closer to 1 dollar on other major venues. BNSOL and wBETH also plunged far more on Binance than elsewhere, which suddenly wiped out a large part of the collateral value for many traders.

From the point of view of Binance’s risk engine, it looked like these traders had just lost a significant part of their collateral. The system treated them as if they were far more leveraged than they actually were. Once that happened, Binance began force-selling positions to protect the exchange.

As perpetual futures started dumping and the liquidation bots went into overdrive, liquidity disappeared, order books went thin and many of the internal reference prices that other products depend on stopped matching the real market.

That created more depegs on Binance:

Perpetual futures on BTC and other coins traded far below or above the spot price on other exchanges.

USDe, which is supposed to trade near one dollar, printed in the 60 to 70 cent area on Binance while being much closer to its peg elsewhere.

Wrapped staking tokens like wBETH and BNSOL moved far more on Binance than on other venues, which instantly slashed the collateral value that the system assigned to them.

For anyone using those tokens as collateral, or using Binance prices to hedge, this was a disaster. Traders who thought they were running low risk strategies or modest leverage suddenly saw their positions liquidated at levels that never appeared on other platforms. 1.6 million traders were liquidated in 24 hours.

These depegs show how structurally fragile crypto still is today:

Heavy dependence on automatic price indices that are not verified against prices on other major exchanges.

A lot of hidden leverage inside products that look safe to the average user.

Liquidation logic that keeps selling into a falling market, pushing prices even further away from fair value and dragging more traders into the spiral.

Binance later admitted the issue and announced it would reimburse users affected by these mispricings, as well as adjust its risk controls and index calculation, but by that time the damage was irreparable.

Temporary, not structural

All of this looks bad, but it does not mean the crypto ecosystem is broken.

What we are seeing looks like the fallout from a specific market structure shock, not a permanent collapse in crypto lending or in BTC and ETH themselves.

The October 10 event was a perfect storm:

Record perpetual futures positioning, very high leverage, a pricing problem and a stablecoin depeg on a major venue that triggered massive forced liquidations in a single day. That wave did not come from listed treasuries defaulting or from hidden uncollateralized lenders blowing up, it came from a singular glitch that proved that crypto still has a lot of work to reach the resilience of traditional finance.

30% of market makers went bankrupt, and those who survived ended up with big losses, so they have been de-risking, widening spreads and shrinking their trading activity instead of stepping in to stabilize prices. This is similar to quantitative tightening for crypto. If the closest thing this market has to central banks are wounded, everything trades heavier until they repair their balance sheets.

Liquidity has been returning to healthy levels, but patching holes is an 8 to 10 week process. Getting back to the liquidity and risk appetite we had before the 10th of October will take months.

On the lending side, the backdrop has been even stronger than in 2021 to 2022. Data from Galaxy Digital shows that most lending now is overcollateralized, more visible and concentrated in BTC, ETH and stable, yield bearing assets, not in risky tokens. The big problems this time were not hidden centralized lenders defaulting on each other. They were mechanical liquidations doing what they are programmed to do in a stressed and thin market. That hurts, but it is very different from discovering that a large part of the lending market has no backing.

In conclusion, what broke in October was market plumbing, not the core thesis for the main assets. This is a temporary overhang while balance sheets heal, not a structural reason why BTC, ETH or the better run listed treasuries cannot make new highs later in the cycle.

The case of Strategy (MSTR)

Strategy has undergone a massive drawdown, as the price of BTC has rapidly gone from $123,000 to $92,000.

However, Strategy has gone down much more than BTC this year. This is explained by three things:

Strategy trades at a premium to BTC that expands in a bull market. Once the trend of BTC reverses, that premium contracts and amplifies the downside. This effect also appears on the upside when the trend turns bullish and the premium expands.

Strategy is the most liquid short in the market. When any institution or individual wants to short crypto, they tend to short Strategy. This creates heavy selling pressure, specially after bearish events like the recent ones.

Strategy has increased its leveraged bet on BTC through preferreds. This works well in bullish markets, but once weakness appears, it increases fear and risk around the stock.

In summary, Strategy is the best bet for a BTC bull when the market is rising, but this comes with outsized negatives in bear markets.

Capital Structure

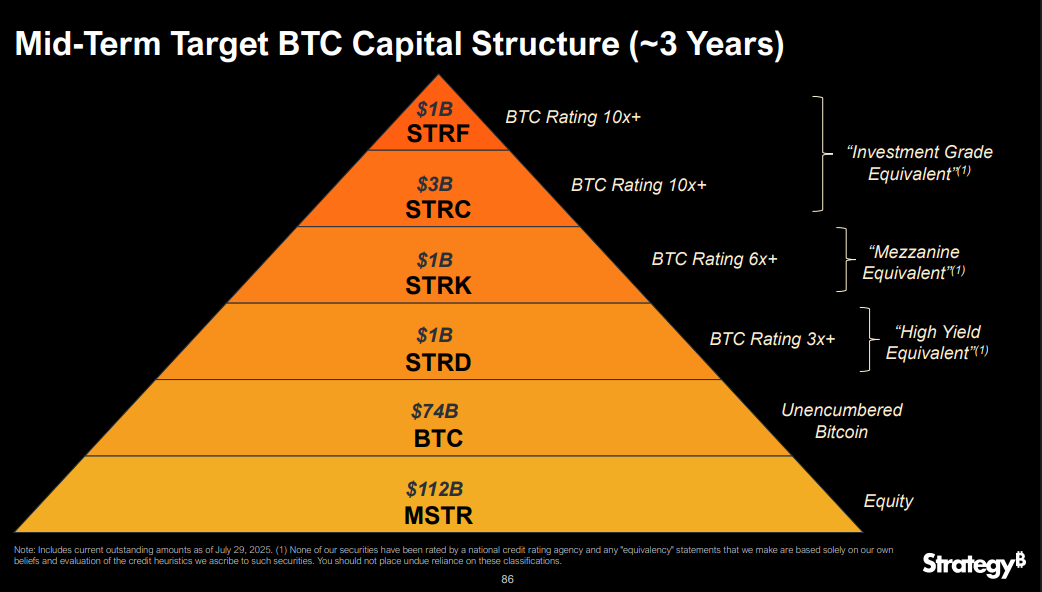

Strategy holds roughly 650000 BTC with a value of 60 billion financed with a mix of:

At the market offerings

Around 8.2B dollars of convertible notes

Roughly 7.8B dollars of preferred stock

A 1.44B dollar reserve in cash set aside to pay interest and preferred dividends

The combination of debt interest and preferred dividends is running at about 800M dollars per year.

Debt layer

MSTR has around 8.2B dollars of convertible notes with an average maturity of slightly over 2 years. These sit above everything else. Coupons are relatively low, but the principal must be refinanced or converted at maturity.

When the stock trades at a large premium to its BTC per share value, conversions are easy and the debt is manageable. When BTC and MSTR sell off together, refinancing risk and dilution risk become more visible.

Preferred layer

Above the debt sit five listed preferred series, traded as STRF, STRC, STRE, STRK and STRD, with a combined 7.8B dollars of notional value. The market now demands double digit yields across all of them.

These instruments are legally equity but behave like very long dated credit that must be serviced if MSTR wants to maintain access to capital markets.

One by one:

STRF is a 10% perpetual preferred with about 1.27B dollars of notional. Dividends accumulate if unpaid.

STRC is a variable rate preferred with close to 3B dollars of notional. The rate can be adjusted to support its price, but this raises funding costs when BTC and MSTR weaken.

STRE is a euro denominated 10% preferred with around 900M dollars of notional and adds euro exposure in addition to BTC risk.

STRK is an 8% preferred that can convert into common stock. After the sell off, the conversion option is far out of the money, so the market values STRK like a high yield bond.

STRD is another 10% perpetual preferred with about 1.26B dollars of notional and a high market yield. Missing payments here would damage credibility and future fundraising ability.

Together, these preferreds form a permanent high coupon layer between the debt and the equity. They provide long dated capital but lock in a heavy annual cash requirement that is independent of BTC’s short term price movements.

The logic behind the preferreds

Strategy issues preferred shares, receives dollars, and converts that cash into BTC. Preferred holders receive a fixed coupon in dollars.

If Saylor is correct and BTC outperforms USD long term, the trade is attractive:

He turns yield focused investors into a steady source of dollar inflows.

He converts those inflows into BTC at current prices.

He only needs to pay coupons later in dollars that may be weaker in real terms.

If BTC compounds at 30% as Saylor expects, this is similar to borrowing at a -20% interest rate.

The new USD reserve

Strategy created a 1.44B dollar cash reserve funded by selling 8.2M new shares through the at the market program at a premium to NAV. This reserve is designated to pay preferred dividends and debt interest.

Management says it covers 21 months of obligations and wants at least 12 months funded, targeting 24 months over time.

Even if BTC moves sideways for almost 2 years, these payments are now secured by a separate pool of USD.

This has a bullish side and a bearish side:

It is reassuring to know that Strategy can meet interest and dividend obligations for almost 2 years.

It raises doubts about management’s near term confidence. If BTC is expected to rise strongly, why build a USD reserve instead of staying fully exposed to BTC?

My interpretation:

Saylor likely believed we were mid-cycle when he raised liquidity through the preferreds. After the instability in markets, he now fears we may have been late cycle, meaning he placed an aggressive USD short and BTC long at the wrong moment and is now hedging that risk.

This is not structurally concerning, since BTC is likely to make new highs within 21 months, but it does reduce optimism for the next 12 months, given the uncertainty around management decisions.

Bitmine: The MSTR(but safer) of ETH

Bitmine (BMNR) is the leading ETH treasury, led by Tom Lee.

Unlike MSTR, they do not have a stack of bonds or preferred shares sitting ahead of the common equity. They have essentially no financial debt. That removes the risk of margin calls or loan covenants forcing them to sell into weakness.

BMNR’s business model is simpler than MSTR and carries less risk. They raise equity when the stock trades at a premium to the value of the ETH they hold. They then use those dollars to buy more ETH, stake it and slowly grow ETH per share over time.

As long as the stock trades at or above the value of ETH per share for a good part of the cycle, Bitmine can keep this flywheel running.

At the moment, and despite the drawdown, BMNR is still trading above NAV and can keep adding ETH at lower prices with no leverage behind it. As long as this premium continues, BMNR gets to perform its NAV arbitrage at lower Ether prices, which will make the upside in the next bullish trend more explosive.

There is no risk of bankruptcy, and when Ether returns to new highs and BMNR’s premium expands, the share price will be far above where it was in the last ETH highs because of the increase in Ether per share.

On a multi-year timeframe, it is almost impossible to not imagine Ethereum being much more embedded into global finances, as the superiority of blockchain technology becomes more obvious by the day

What I plan to do

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.