The Investor’s Guide to the AI Supercycle

A Short Guide to the Full AI Opportunity

1. The Beginning of a New Era

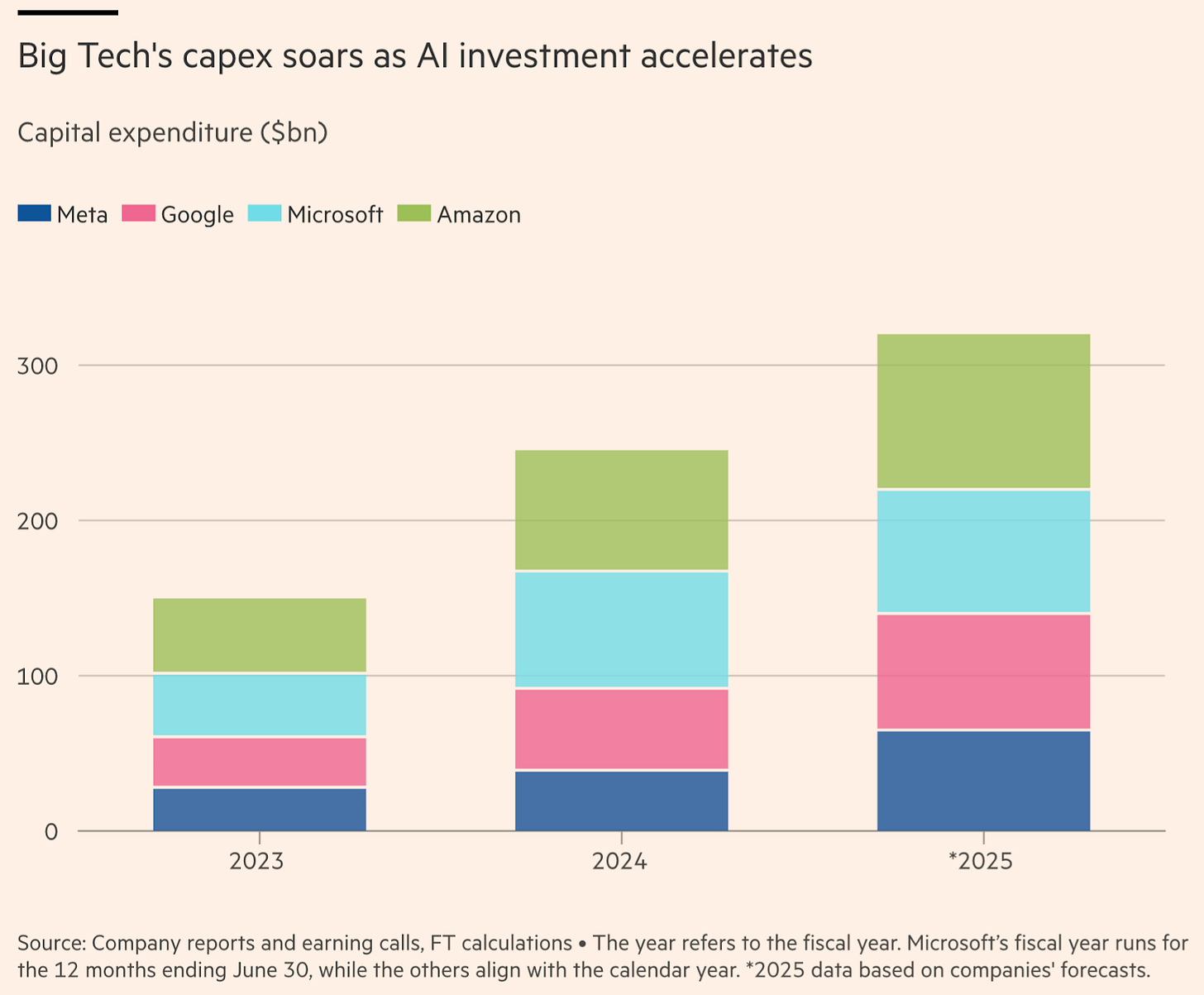

The ChatGPT moment turned Nvidia($NVDA) into the largest company in the world, and transformed data centers from a necessary piece of technology to the most appreciated asset in the world. The numbers speak clearly of this. Meta($META), Amazon($AMZN), Alphabet($GOOG), and Microsoft($MSFT) intend to spend as much as $320 billion combined on AI technologies and data center buildouts in 2025. By 2030, the AI capex is expected to reach $1 trillion annually worldwide.

And this isn’t a short-term, huge spending phase where growth will decelerate. When AGI is reached, AI will become the asset with the highest ROIC in the world. AGI will allow millions of workers to be replaced, companies will become orders of magnitude more productive, and the global economy will reach rates of growth never seen in the history of mankind.

This may sound like an exaggeration, but it isn’t. AI is already extremely competent in many tasks. It has high reasoning capacity, can be optimized for any database in the world, and has already reached PhD-level performance in tasks like mathematics, law, or medicine.

2. AI Agents

Now, the only thing missing is building agentic AI, as this intelligence keeps getting smarter. When AI is optimized to take advantage of this incredible intelligence and apply it to real-world, real-time tasks, AI will transform the world.

The work that once needed to be completed by a human with 30 years between studies and work experience will now be done by an AI that was adapted to that task by a development team. One and done. Once you optimize the AI to run the specific workloads that your company needs, you don’t need more retraining, more hiring, more payrolls. You just need one AI that can be multiplied and can run tasks non-stop, at a price that would be insignificant compared to a human worker.

And considering the rate of progress, where we went from an AI that could barely solve simple math problems and generate crude images, to the current AI that can generate incredibly realistic visuals and show high-level reasoning, it’s fair to assume that AGI will likely be achieved in the next 10 years.

3. The AI Change

How big is this opportunity? Well, world GDP is $113 trillion. Services account for 62% of that, with industry at 26%, manufacturing at 15%, and agriculture at 4%. AI will likely increase productivity in descending order, most in services, least in agriculture.

Boosting productivity in the service sector will be the easiest. Coding is the first and most AI-optimized task. Microsoft($MSFT) already announced that 30% of its code is written by AI and recently revealed plans to replace 6,000 workers with AI. Google($GOOG), for its part, stated that 25% of its code is now AI-generated. This is just the beginning of the AI-driven layoffs, and soon, most people will have to ask themselves how much time they have left before they’re replaced.

Take healthcare. AI will boost productivity by helping develop new drugs through machine learning, assisting doctors in diagnosing patients more accurately, and uncovering correlations between specific genes or traits and diseases that were previously unknown.

Now, consider finance. All the reports, calculations, models, and accounting work that used to require teams of humans putting in long hours in billion-dollar skyscrapers will soon be done in minutes by AI.

Consider law next. Attorneys need to stay current with legal updates, analyze new verdicts, and invest hours developing strategies. AI will be able to scan every law on record, cross-reference millions of verdicts, and generate a legal defense or prosecution plan faster and more efficiently than any human could.

Think about the billions earned by finance, legal, tax, and business consultants for offering expert advice. In many cases, AI will do this better. Companies will be able to load their entire databases into an intelligent model, run inference in-house to avoid data leaks, and generate tailored solutions or strategic insights, essentially replacing the traditional consultant.

4. The $200 Trillion Dollar Opportunity

And I could go on forever. Marketing specialists, graphic designers, nutritionists, teachers… millions of highly paid jobs will become obsolete because of AI. The professionals who remain employed will become dramatically more productive thanks to AI’s capabilities.

And that was just the service sector, which will be impacted the most. But industrials, manufacturing, and even agriculture will also undergo massive transformation. AI is already optimizing industrial processes, improving processing plant efficiency, and helping manage workers, machinery, and resources more intelligently.

One example is Foxconn, one of the world’s most important manufacturing companies, which uses physically accurate digital twins powered by Nvidia Omniverse($NVDA) to design, deploy, and manage complex, high-volume production facilities. BMW has also integrated the same technology. Soon, most companies will have a virtual model to simulate and optimize operations before applying changes in the real world.

And all this is just the short-term outlook. AI will also accelerate world-changing developments: nuclear fusion, quantum computing, hydrogen-powered vehicles, advanced health optimization treatments, and revolutionary machinery. It will likely become the foundation for breakthroughs across every sector.

Of course, predicting AI’s full economic impact is difficult. A few years ago, no one could’ve foreseen ChatGPT. But for the sake of this discussion, let’s assume an optimistic 10-year scenario. Imagine AGI is achieved, AI agents are fully developed, and 90% of workers use AI between 20% and 80% of the time.

Let’s say productivity improves by 30% in services, 15% in manufacturing, 10% in industry, and 5% in agriculture over the next decade. If the rest of the economy (excluding AI) grows at a 3% annual rate, the net productivity gain from AI could reach $39 trillion, likely making AI the largest economic sector on Earth.

Now, imagine AI companies capture 50% of the revenue from those gains, and that revenue continues to grow as AGI evolves into ASI. Applying a 10x price-to-sales multiple to that revenue implies a potential $195 trillion in market cap gains from AI alone.

5. The Cycle Has Already Started

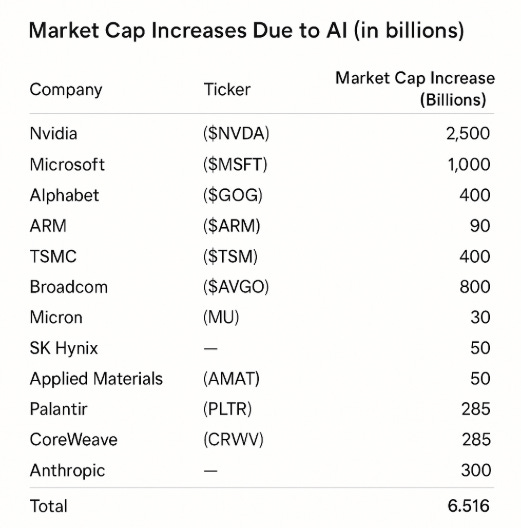

This number may seem crazy, but Nvidia($NVDA) has already added $2.5 trillion in market cap because of AI. Microsoft($MSFT) is up about $1 trillion. Alphabet($GOOG) has gained roughly $400 billion. ARM($ARM) has added $90 billion. TSMC($TSM) has grown by $400 billion. Broadcom($AVGO) is up $800 billion. Micron($MU) gained $30 billion. SK Hynix about $50 billion. KLA($KLAC) and Applied Materials($AMAT) are each up $50 billion.

Palantir($PLTR) went from a $15 billion company to $300 billion in under two years. CoreWeave($CRWV) is already worth $50 billion. OpenAI is valued at $300 billion. Anthropic sits at $61 billion.

The combined market cap gain due to AI, just in these early stages, and before AGI is even close, is already around $10 trillion. And that doesn’t even account for the productivity gains many companies are already seeing.

So, when you factor in AGI development, the approach of ASI, and the hundreds of millions of jobs that will either be created or replaced by AI, $195 trillion in the next decade doesn’t seem like an exaggeration.

6. AI Accelerators

The AI era will create massive companies. The demand for compute will be so immense that any company capable of offering a compelling solution will grow into a behemoth. It’s not just about Nvidia($NVDA), Broadcom($AVGO), and Marvell($MRVL) are already semiconductor giants, thanks to their ASIC offerings and partnerships with Google($GOOG) on TPUs, Amazon($AMZN) on Trainium, Meta($META), and Microsoft($MSFT).

AMD($AMD) also has the potential to reach a multi-trillion valuation if it can deliver large-scale AI products capable of handling the vast workloads that agentic AI will demand.

There are also smaller players like Groq and Cerebras, not public yet, and without the same industry impact as the big names, but they’ve developed very interesting accelerators that are extremely well suited for specific AI workloads.

The future of compute won’t rely on a single solution. Different workloads will need different architectures. These smaller companies, if successful in cornering niche markets, could become excellent investments as the AI boom accelerates.

7. The Obvious Winners

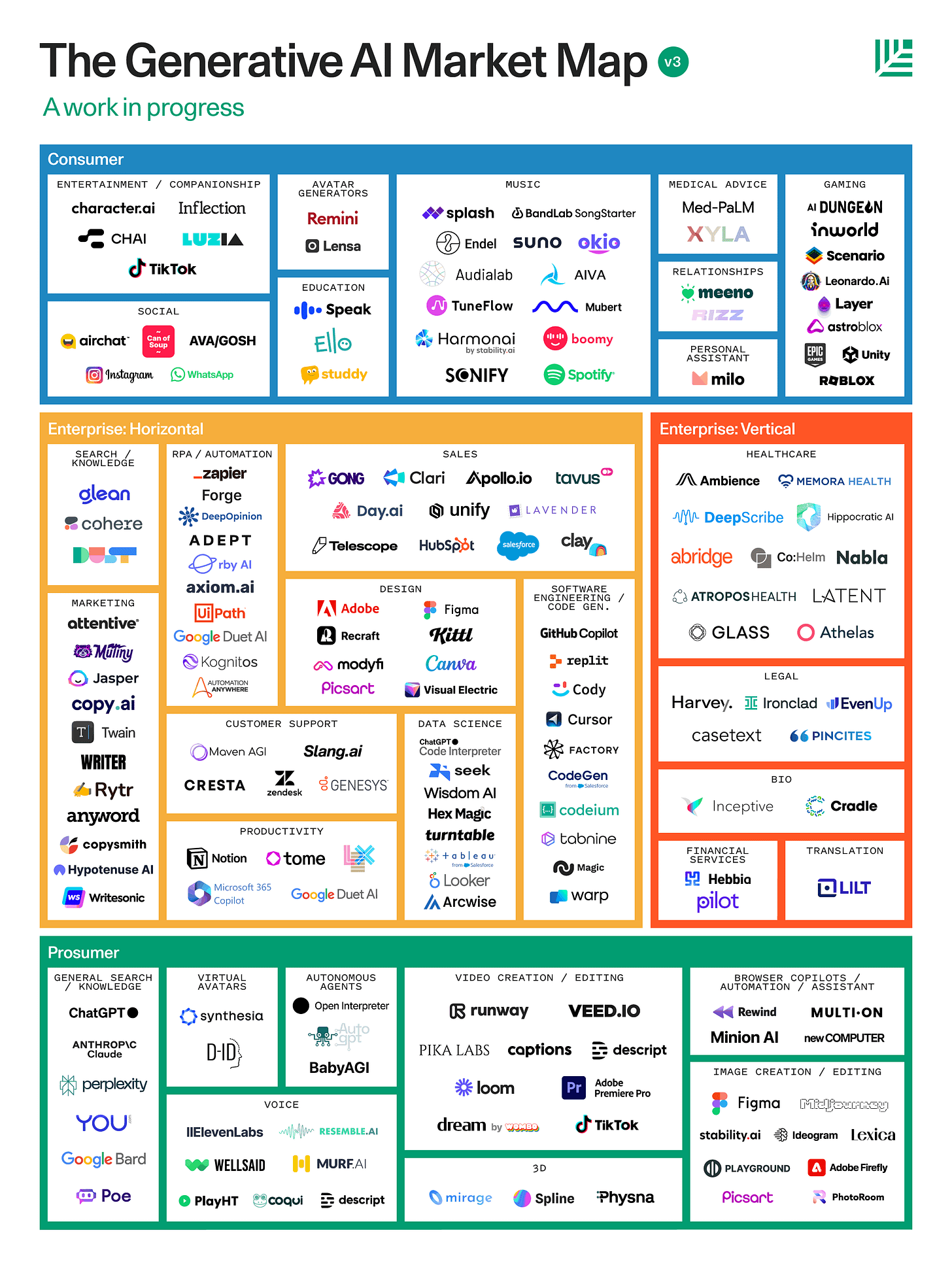

The companies that will benefit the most are those building highly capable AI agents and state-of-the-art generative AI models. Likely winners include OpenAI, Google($GOOG), Meta($META), DeepSeek, Alibaba($BABA), and Anthropic. While most of them aren’t public yet, the AI world extends beyond the largest players, and there's a strong chance we’ll see more OpenAI-like success stories emerge.

Here is a comprehensive market map highlighting the key companies driving the GenAI space:

But it doesn’t stop there. All the companies surrounding the AI accelerator ecosystem will also benefit massively. Micron($MU), SK Hynix, and Samsung dominate the memory market. ASML($ASML) holds a monopoly on chip-making lithography machines. TSMC($TSM), Samsung, and Intel($INTC) lead in the foundry space. KLA($KLAC), Lam Research($LRCX), and Applied Materials($AMAT) supply the essential machinery to manufacture and test semiconductors. Astera Labs($ALAB) is one of the leaders in interconnect technology, along with photonic interconnect companies like Coherent($COHR), which are developing the next generation of chip-to-chip communication.

AI and semiconductors will likely become the central pillar of humanity’s technological progress.

But powering all this introduces a growing challenge. Current energy sources won’t be enough to support billions of AI agents and continuous inference workloads. The development of small nuclear reactors will likely accelerate, and the companies that solve this problem will see tremendous appreciation.

Right now, data centers must connect to the electric grid. This slows development, puts stress on local infrastructure, and limits where new facilities can be built; data centers can’t stray too far from existing population centers.

That all changes with small nuclear reactors. Once this technology is approved, data centers could be deployed in remote locations without energy constraints, expensive land requirements, or bureaucratic delays. You’ll be able to drop a data center anywhere.

That’s why I believe investing in small and nano nuclear reactor companies like Oklo($OKLO), NANO Nuclear($NNE), NuScale Power($SMR), and Rolls-Royce($RR) is something to watch closely in the coming years.

8. AI Cloud

AI cloud companies can also become excellent investments.

Just as Azure($MSFT), AWS($AMZN), and Google Cloud($GOOG) met the general-purpose compute needs of the past decade, AI cloud platforms will now offer both the hardware and software to support AI development and deployment.

Companies like CoreWeave($CRWV), which partners with OpenAI, Nebius($NBIS), which offers the best cloud experience for small and midsize companies, and Iris Energy($IREN), which is pivoting from Bitcoin mining to supplying AI data centers, are aggressively building toward this future.

In private markets, startups like Lambda, TensorWave, Crusoe, and Runpod are also enabling access to rented AI compute and infrastructure. And of course, the hyperscalers are deploying massive capex to scale their own AI compute offerings.

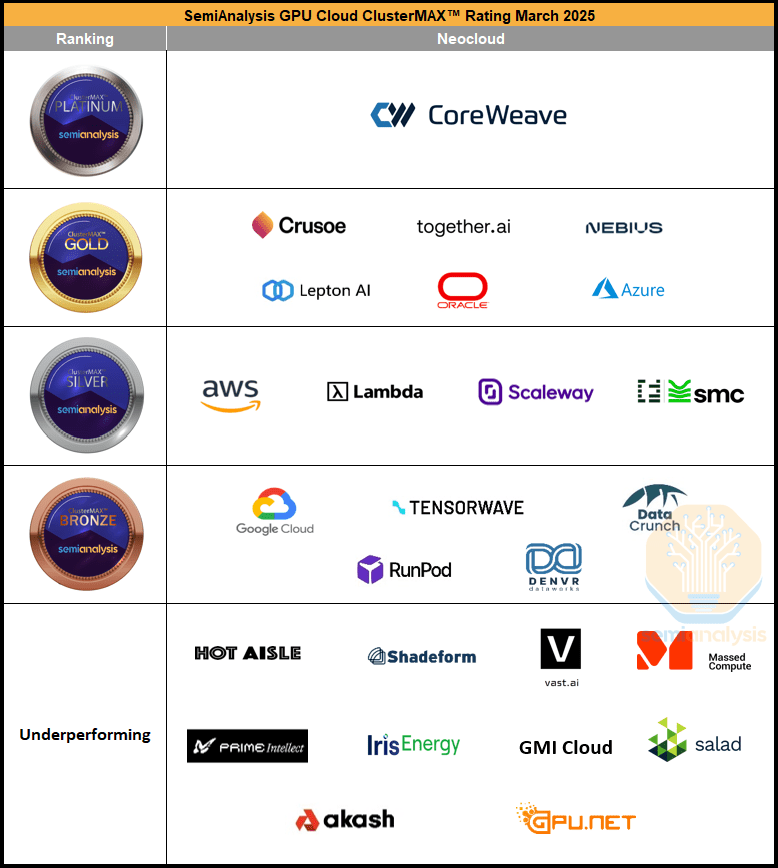

Semianalysis has ranked the top AI cloud providers by quality. Here's how they stack up:

It’s easy to identify some of the beneficiaries of the AI megacycle: supercomputer manufacturers, major AI labs, data center operators, automation companies, and next-generation energy providers are all obvious winners.

9. Real-World AI

Now, a harder question is: who will benefit from AI beyond the obvious players? What happens in the real world?

AI makes this tricky. On one hand, it will revolutionize industrials, manufacturing, manual labor, and transportation, primarily through robotics and automation technologies like self-driving cars, trucks, buses, planes, and helicopters.

The future of transportation is autonomous. Soon, humanoid and non-humanoid robots will likely outnumber humans in the workforce. This is a much harder task than building an AI video generator, but the pace of development has never been faster.

The clearest leader is Tesla($TSLA), which is building both full self-driving technology and humanoid robots. These two sectors alone will become multi-trillion-dollar industries in the next 10 years.

While Tesla($TSLA) is clearly the most advanced in terms of technology, Waymo is making big strides in the robotaxi space with a more pragmatic approach. Their systems are already operational in several U.S. cities. Unless Tesla’s more complex solution ends up clearly superior, Waymo could become just as valuable as the rest of Alphabet($GOOG).

There are other strong players, though many aren’t public. Figure AI and Boston Dynamics are likely the next best humanoid robot developers. Chinese companies like Unitree, AgiBot, and BYD($BYD) are also progressing quickly.

Still, in terms of innovation, manufacturing scale, and execution, Tesla($TSLA) stands out. It’s hard to bet against the company that built the first popular electric vehicle and the leader of SpaceX. Tesla’s megafactory experience, camera-based self-driving system, and vertically integrated operations could give it a lasting edge, even if it's currently facing a rough phase. Given the size of the opportunity, Tesla’s current valuation may be more than justified.

10. Software Deflation

On the other hand, AI is a massive threat to many established companies, especially in the software space. AI is causing a kind of coding deflation. As AI makes software easier to write, existing code becomes easier to replicate, reducing its economic value.

We're already seeing this in day-to-day areas. Writers, advertisers, marketing specialists, graphic designers, web developers… many are being replaced or reshaped by AI.

Take Adobe($ADBE), for example. What happens to products like Photoshop and Illustrator when people can create the same output in a fraction of the time using AI tools? Sure, Adobe is integrating AI into its software, but image generation and editing are among the fastest-advancing AI capabilities.

What happens when generating and editing images becomes so easy, so widely available, that it adds no real value? Eventually, companies like Google($GOOG) or OpenAI might offer these tools for free, effectively undercutting Adobe’s value proposition.

At some point, the AI tools in Photoshop may stop feeling impressive, they’ll just be standard utilities, like adjusting brightness on your phone. When that happens, Adobe($ADBE) could lose much of its competitive edge. People might still use their software, but if 90% of the work that used to require Adobe’s tools can now be done elsewhere, the company’s total addressable market will shrink drastically.

11. Software as a Commodity(SaaC)

And Adobe($ADBE) isn’t alone. Take Microsoft($MSFT). Right now, AI tools for making presentations still fall short, but it's not because the technology is inherently hard. It's simply that not enough effort has gone into improving this specific use case.

In a few years, you’ll likely be able to generate high-level, well-designed presentations with AI, just by uploading a script, outlining a structure, or asking for a general deck on a topic.

Maybe Microsoft($MSFT) will be the one to offer this, and maybe it keeps justifying its subscription pricing. But what if, once again, the software becomes so mundane and easy that Microsoft loses its edge?

It’s not even just about making PowerPoints with AI. At the end of the day, PowerPoint, Word, Google Search... these things are just code, lines of code that will become increasingly replicable and modifiable.

That’s what I mean by software deflation. In the near future, a single person may be able to recreate what entire software teams once built. When that happens, software-based companies will face brutal commoditization. Their products will lose pricing power, and their moats will shrink or disappear altogether.

This is why I’d be cautious with software stocks, especially those not rooted in AI. As solid as some of these companies might look today, AI will make many products and services obsolete, including things most investors would never imagine becoming irrelevant.

It’s happened before with the internet, smartphones, and PCs. It will happen again.

12. Investing in the AI Era

AI is the clearest generational wealth opportunity in modern history. Not even the internet had the potential to change the world this fast and this much.

But as much as the opportunity is massive, the risks are just as real. AI will create enormous winners and enormous losers. It will generate tens of trillions in new market value while eroding the foundation of entire industries.

Picking the right companies and staying updated on where the breakthroughs are happening is more important than ever.

We’re witnessing the dawn of the most disruptive force the global economy has ever seen. Make sure you’re positioned for it.

How big is this opportunity? Well, world GDP is $113 trillion. Services account for 62% of that, with industry at 26%, manufacturing at 15%, and agriculture at 4%. AI will likely increase productivity in descending order, most in services, least in agriculture…your numbers don’t add up to 100%…what you defining as “industry at 26%” assume mining utilities, but be specific please