The Goldman Sachs of Crypto

AI data centers and crypto services trusted by institutions like Goldman Sachs. Could these two trends create the next multibagger?

Not every day you encounter a company trying to become a giant in both crypto and data centers.

I’m not just talking about mining Bitcoin and having 50 MW leased to a random AI lab.

This company is aiming to become the financial backbone of the crypto world, and at the same time, build out multiple GWs of AI data centers.

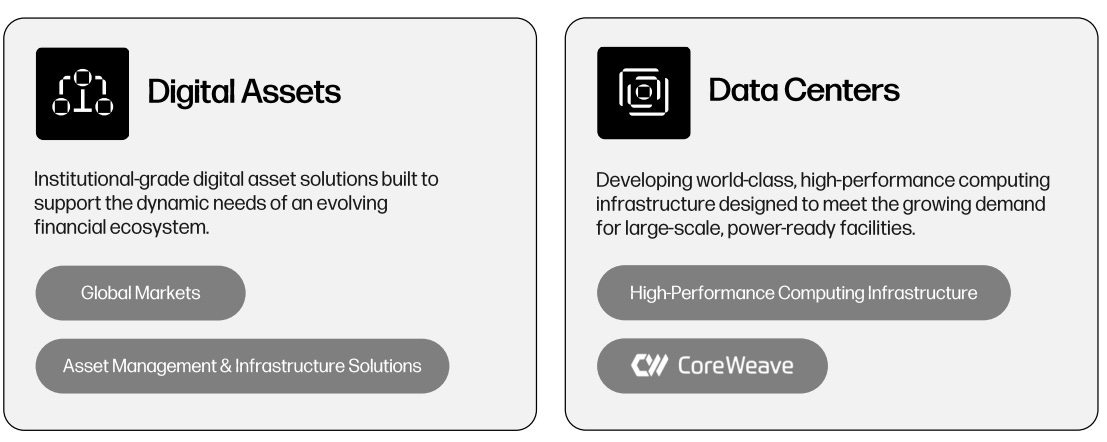

Galaxy is an institutional platform built around digital assets and AI infrastructure.

On one side, it operates a full-service crypto investment bank: trading desks for OTC spot and derivatives, financing and prime-style services, structured products, custody, asset management, and staking. It serves more than a thousand institutional counterparties, including banks, hedge funds, asset managers, and corporates.

On the other side, it is investing heavily in mega data centers to meet the surge in demand for AI compute, positioning itself at the intersection of finance and infrastructure.

Galaxy is often called the Goldman Sachs of crypto for its role in bridging traditional finance (TradFi) with the on-chain economy. Its platform offers regulated products like ETFs, transparent risk disclosures, and integrations with established custodians.

The firm has proven that Tier-1 banks and regulators are willing to work with it, from executing Goldman’s first OTC crypto option to managing the unwind of the FTX estate.

Today, Galaxy is no longer just a crypto trading shop but a diversified financial and infrastructure company with ambitions to capture flows across trading, asset management, custody, staking, tokenization, stablecoins, and AI data centers.

Management

Galaxy is led by Mike Novogratz, a former Fortress hedge fund manager and long-time crypto investor who founded the firm in 2018. Novogratz is the public face of Galaxy, often described as both its biggest strength and its biggest risk.

His Wall Street pedigree and high-profile presence in the media helped Galaxy build credibility in the early days of institutional crypto, attracting blue-chip clients and counterparties.

Surrounding him is a management team with deep experience across trading, banking, and technology. Christopher Ferraro, President and CIO, joined from Apollo Global Management and plays a central role in risk oversight and investment strategy.

This blend of Wall Street discipline and crypto-native expertise gives Galaxy the ability to operate like a traditional financial institution, while also building new businesses in staking, tokenization, and AI infrastructure.

Index

A – Crypto Ecosystem

Global Markets

Asset Management

Infrastructure Solutions

B – AI Data Centers

Acquisition & Buildout

Timeline & Contracts

Financing

Risks

C – Financials

Growth & Margins

Balance Sheet

Treasury & Investments

D – Valuation

Segment Valuations

Sum-of-Parts

Goldman Sachs Model

E – Conclusion

Global Markets

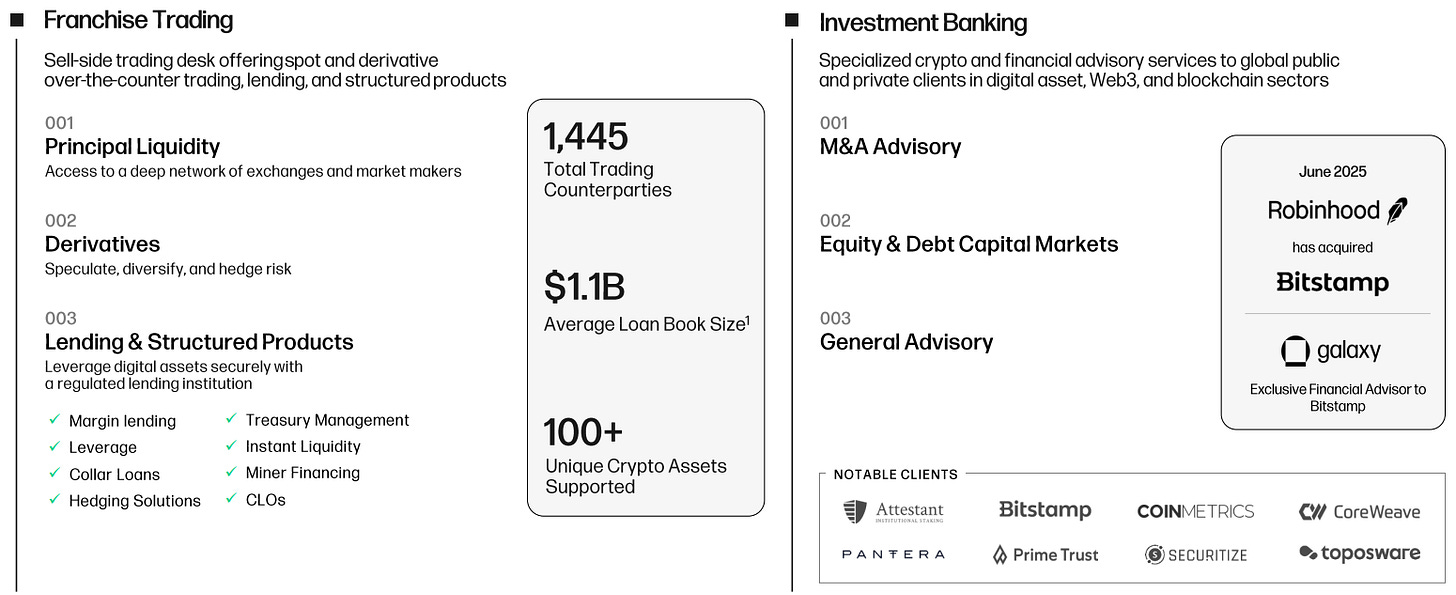

Galaxy’s Global Markets division is the engine of its trading and liquidity operations. It connects institutions to deep crypto markets while providing execution, financing, and risk solutions at scale.

Core Activities:

OTC spot and derivatives. Provides principal liquidity, block futures, options, and structured solutions for institutions that need confidential, capital-efficient execution.

Financing and prime-style services. Borrows and lends digital assets, posts and accepts collateral, and runs cross-margin for professional counterparties.

Risk and hedging. Trades listed and OTC derivatives to manage inventory and tailor client exposures.

Goldman Sachs recognition

And what’s better recognition than Goldman Sachs choosing you for these services? In March 2022, Goldman executed the first OTC crypto options trade by a major US bank with Galaxy as principal counterparty, after the two had already worked together on Goldman’s initial CME Bitcoin futures trades. This is the most public proof that Tier-1 banks trust Galaxy’s desk to warehouse risk and deliver.

Tom Lee’s BitMine

BitMine announced plans to partner with Galaxy Digital, alongside FalconX and Kraken, to build a world-class ETH treasury. Custody is set to remain with BitGo and Fidelity Digital. This suggests Galaxy’s role is focused on execution, liquidity, and potentially derivatives/risk management, not exclusive custody.

Another example:

Why Galaxy over Coinbase?

You might ask: why wouldn’t this person just use Coinbase like anyone else? The answer lies in scale and sophistication. If you’re a retail investor or even a small fund, Coinbase is fine. You can buy spot BTC or ETH, maybe access some listed derivatives, and custody assets with Coinbase Custody.

But for institutions moving hundreds of millions or billions, Coinbase has limits.

Galaxy’s advantages:

Principal risk-taking. Unlike Coinbase’s agency-only desk, Galaxy’s OTC desks warehouse and distribute size, allowing institutions to move multi-billion trades without slippage.

Complete product set. Galaxy goes beyond listed markets with structured notes, bespoke options, cross-margin financing, and prime-style services, giving clients tools that Coinbase doesn’t yet match.

Institutional trust. Galaxy has a longer track record working with dozens of institutions.

Broader infrastructure. Galaxy operates across staking at scale, GK8 tokenization, Fireblocks-integrated custody, euro stablecoin issuance (EURAU), and AI data centers. It's more than just a trading platform.

Transparency. As a dual-listed firm (TSX and Nasdaq), Galaxy publishes detailed quarterly filings on derivatives, collateral, and staking flows. Coinbase does not disclose risk at this level.

Asset Management

A caveat for starters:

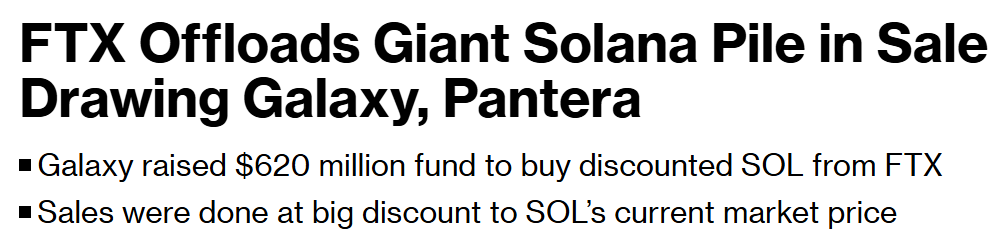

When FTX collapsed, its bankruptcy estate needed to liquidate billions in crypto assets.

That’s not something you can just dump on Coinbase or Binance without destroying the market. The estate appointed Galaxy to handle the unwind because of its OTC block execution, derivatives expertise, and track record with institutional flows.

Galaxy was paid to manage, hedge, and sell down FTX’s portfolio in an orderly fashion. By Q2 2025, about $483M of AUM in Galaxy’s Asset Management line was tied directly to this mandate.

This makes it a one-off revenue event. It inflates AUM and fees in the short term, but it doesn’t reflect organic client growth or recurring inflows. For investors, the FTX mandate is proof that regulators trust Galaxy with high-profile, sensitive work, but it also distorts the numbers, something we’ll see in more depth later.

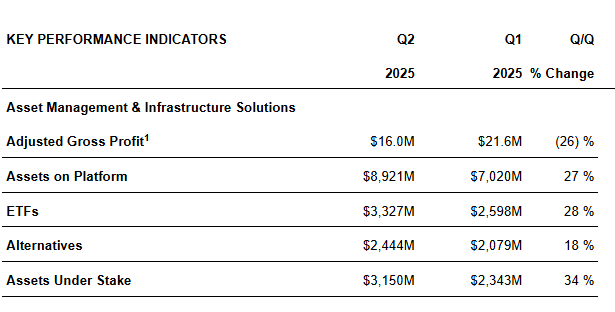

Scale and Composition

The growth shows that inflows are not just a temporary boost from the FTX mandate but driven by organic expansion. Institutions are allocating more capital, and Galaxy is capturing that demand with new products and mandates that stick beyond one-off events.

AUM. $5.8B as of June 30, 2025, +28% YoY, +23% QoQ.

Core AUM (ex-FTX). $5.3B (+33% YoY).

Galaxy is now partnering with over 20 crypto treasury companies. Through capital execution and asset management, these partnerships have likely added close to $2 billion of assets on the platform.

Funds and ETFs

Passive and active ETFs in the US, Brazil, Canada, and Europe. Long-biased and long-short hedge funds. Multi-manager venture funds. Thematic strategies like the Liquid Crypto Fund and the Absolute Return Fund launched in 2025.

Main ETFs

US Spot Bitcoin ETF. Invesco Galaxy Bitcoin ETF (BTCO), launched Jan 11, 2024. 0.25% management fee, 0.25% TER.

SPDR Galaxy Active ETFs. On Sep 10, 2024, State Street Global Advisors debuted three actively managed funds with Galaxy as sub-advisor, including DECO and HECO, focused on the digital-asset ecosystem and hedged variants.

A diversified and proven platform

Multiple access points. Direct crypto exposure via spot ETF, equity-linked ecosystem exposure via SPDR Galaxy funds, or bespoke alternatives, all within traditional fund wrappers and custody.

Operational credibility. The FTX unwind mandate demonstrates that regulators and estate administrators trust Galaxy to execute complex, highly scrutinized orders at scale. The fact that crypto treasuries, along with Goldman Sachs and other advisory clients, also rely on Galaxy highlights the reliability of its services.

Infrastructure Solutions

Validator network

A validator network is the backbone of a proof-of-stake blockchain. Instead of miners burning electricity like in Bitcoin, blockchains such as Ethereum, Solana, or Avalanche rely on validators, nodes that lock up tokens as collateral (staking) and then take turns verifying transactions, producing blocks, and securing the chain.

The more tokens a validator stakes, the higher its chance of being chosen to validate the next block. In return, it earns rewards in the form of new tokens and transaction fees.

Galaxy runs validators on 10 blockchains, including Ethereum and Solana, with the 4th largest Solana validator.

Distribution through existing custodians

The Fireblocks integration (July 9, 2025) is a key milestone for Galaxy.

It opens Galaxy staking to 2,000+ institutions already using Fireblocks, allowing delegation without moving assets out of custody, a major friction killer for compliance teams.

Normally, staking requires transferring tokens into a validator’s custody, raising red flags around compliance and risk management. With Fireblocks plugged into Galaxy’s platform, clients can keep assets in custody and still delegate staking rights to Galaxy validator nodes. That means no custody chain break, no new approvals, and smoother workflows for institutions that previously avoided staking.

Fee capture

Galaxy generated $41.2M customer blockchain rewards in Q2 and $112.3M YTD, driven by validator operations. Its net take-rate on third-party staking rewards stood at 5–10% as of June 30, 2025, the core revenue lever for staking.

Staking is the process of locking tokens to secure a proof-of-stake chain. In return, the staker earns rewards. similar to interest, but instead of consuming energy like mining, it relies on capital at risk.

Galaxy also benefited from the delegation of restricted SOL from the FTX estate, and a 2024 acquisition helped ramp both rewards and client distributions.

These large, special-situation flows show how Galaxy can translate unique opportunities into staking revenue at scale.

The Galaxy Advantage

Capital efficiency and control

Institutions can delegate from approved custodians, keep assets in compliant vaults, and still earn rewards.

For example, SharpLink deployed 99.7% of its ETH holdings to staking protocols with institutional providers including Galaxy, Anchorage, and Coinbase.

Composability

Galaxy’s staking model isn’t standalone. It’s designed to be layered with other services:

Staking for base network rewards (ETH, SOL, etc.).

Hedging instruments from Galaxy’s Global Markets desk (options, futures, swaps) to smooth volatility.

Financing solutions such as borrowing against staked assets or cross-margining them, so capital isn’t idle.

The result is a composable yield stack, exposures that are income-generating, risk-managed, and capital-efficient.

Instead of choosing between yield and liquidity, institutions get a toolkit that keeps rewards flowing while protecting against swings and unlocking collateral for other strategies.

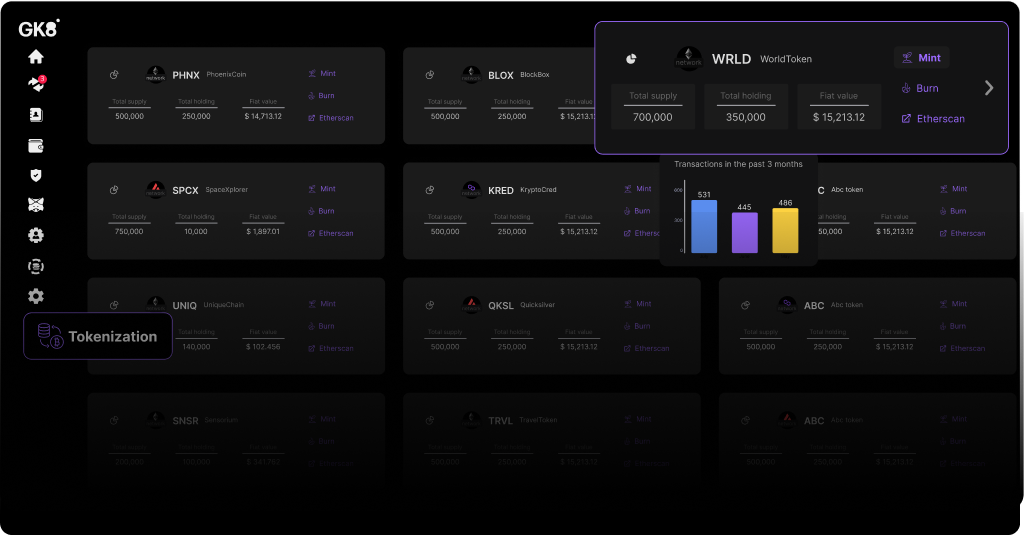

Custody and tokenization: GK8

Services

Self-custody at bank grade.

GK8 is Galaxy’s custody tech subsidiary offering an air-gapped cold vault and MPC stack. Keys never touch the internet; transaction creation and signing happen in isolated hardware. That matters for regulated clients who cannot outsource key control.

Tokenization toolkit.

GK8 Tokenization Wizard lets institutions issue, manage, and store tokenized assets with admin keys kept in the cold vault. The objective is to remove the key-management risks that have derailed pilots at banks and AMs.

Advantages

Custody plus issuance

When you can both hold assets securely and also issue and manage them on-chain, you control more of the process. That includes creation, trading, servicing, and handling payouts or updates. This gives Galaxy more control over the full value chain.

Institutional fit

Galaxy’s custody system uses offline storage and multi-party approval flows. These match the internal control frameworks that banks and large asset managers already use.

Stablecoin rails in Europe: AllUnity

AllUnity is a joint venture of DWS, Flow Traders, and Galaxy.

Galaxy owns 33% of AllUnity.

In July 2025, AllUnity received BaFin e-money license approval and launched EURAU, a MiCA-aligned, fully reserved euro stablecoin.

This will be the first fully regulated euro stablecoin. Circle, the issuer of USDC, the second most used USD stablecoin, is valued at $34 billion.

Given that the USD is the standard global trade currency, EURAU won’t reach a similar scale, but it’s still an interesting benchmark to use when assessing its potential.

The importance for Galaxy:

Regulated EUR on-chain rail that can plug into ETFs, tokenized funds, and institutional payments workflows in the EU.

Natural synergy with GK8 custody and Global Markets liquidity: issuance, redemption, and market-making can live on the same stack.

Early commentary from DWS points to a very large addressable market for regulated stablecoins in capital markets settlement, not just crypto trading.

Risks(Crypto Business)

Stablecoin reserve and legal title risk.

Filings detail how different reserve constructs and bankruptcy-estate treatment could affect redemption and peg stability, citing historical de-peg episodes and issuer discretion over reserves. Any systemic stablecoin shock would ripple across Galaxy’s clients and flows.

Market-cycle beta.

The desk’s P&L is sensitive to crypto prices and volumes; filings break out how gains or losses on BTC, ETH, and tokenized instruments swing results.

Regulatory interpretation.

Asset-management products that involve digital assets remain subject to evolving rules; the filings flag conflicts-management and regulatory-scope risks that can affect product design and distribution.

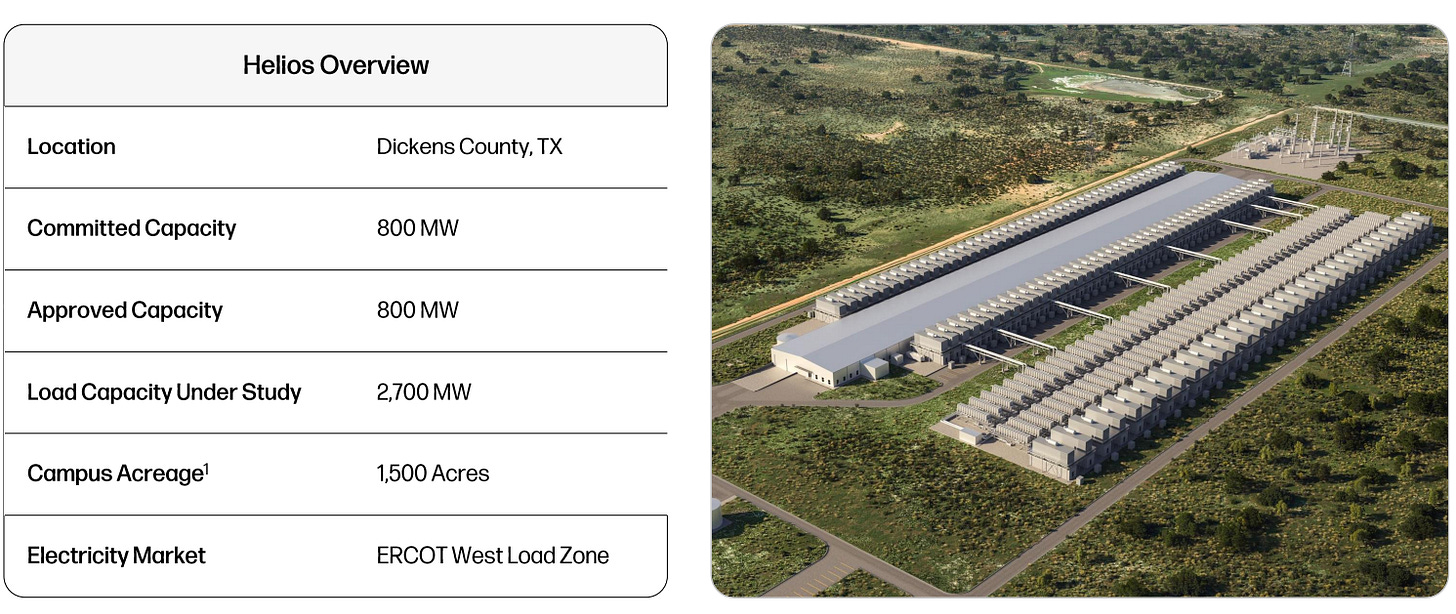

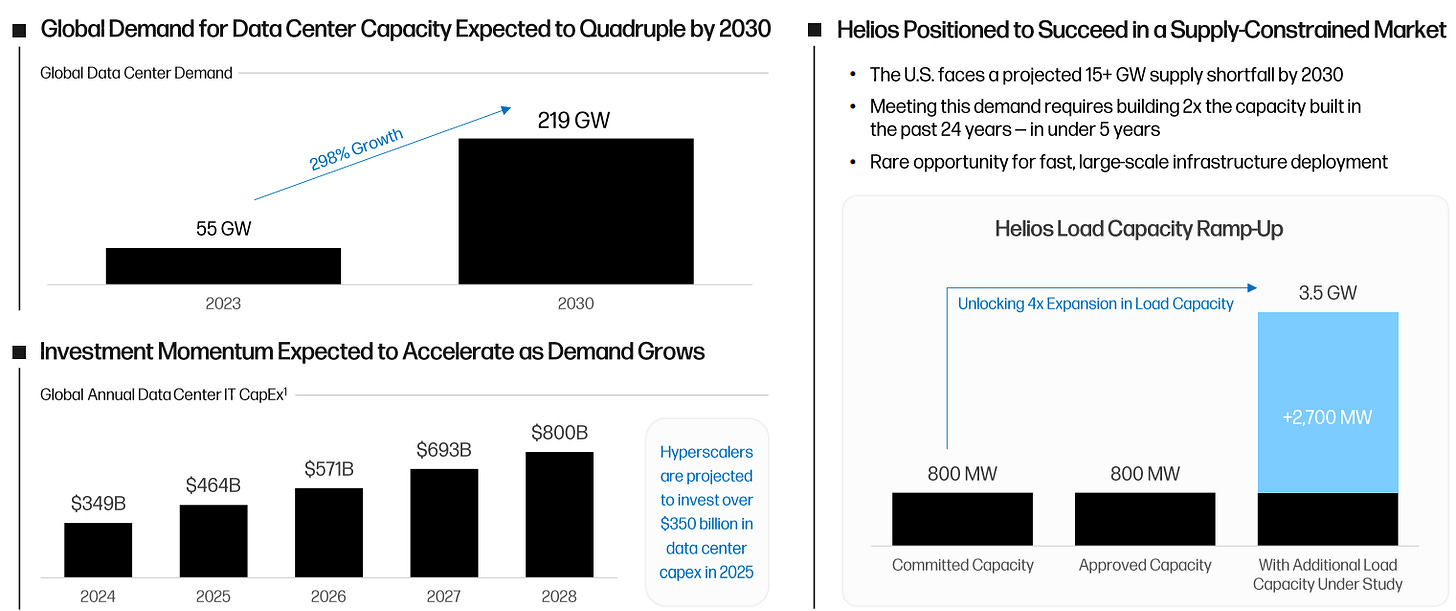

Helios AI Data Centers Campus

Galaxy’s entry into the data center business came through the distressed acquisition of the Helios campus in West Texas, originally developed by Argo Blockchain.

In late 2022, Argo was under severe financial pressure during the crypto bear market, weighed down by debt and rising energy costs from its Bitcoin mining operations.

To avoid bankruptcy, Argo agreed to sell Helios, then a 200 MW operational mining facility with expansion rights up to 800 MW, to Galaxy for $65M in cash. As part of the deal, Galaxy also extended a $35M asset-backed loan to stabilize Argo’s remaining business.

What looked like a distressed asset sale has since become a cornerstone of Galaxy’s pivot into AI and high-performance computing infrastructure. By acquiring Helios at a fraction of replacement cost, Galaxy secured a fully permitted, large-scale energy site with major expansion rights.

Management quickly realized the economics of renting power and rack space to GPU-heavy tenants like CoreWeave were far more compelling than legacy crypto mining. The model offers long-term contracted cash flows and higher margins compared to volatile Bitcoin mining revenues.

In essence, what began as a distressed rescue deal evolved into the foundation of Galaxy’s AI data center business line.

This move highlights Galaxy’s broader management philosophy under Mike Novogratz: lean into distress when others are forced sellers, then reposition assets for the next structural growth cycle. Helios was acquired in the depths of the crypto winter, but instead of leaving it as a Bitcoin mine, Galaxy retooled it into a high-value AI compute campus.

Site

The Helios campus sits on existing ERCOT electrical infrastructure with regulatory approval for 800 MW of high-voltage interconnect capacity. Prior to 2025, Galaxy had already installed six main power transformers at the on-site substation to make that approval usable. This is important because substation readiness and interconnect capacity are the main bottlenecks for AI and HPC development. Most new sites wait years just to secure grid access. Helios already has it.

To meet the cooling demands of high-density AI workloads, Galaxy built a ~10 million-gallon freshwater pond in 2024. It supports the site’s liquid-cooling systems and adds thermal resilience during the long, dry summers common in West Texas. This kind of infrastructure is essential. Without robust cooling, the site wouldn’t be viable at scale.

Management has consistently said that Helios can scale up to 800 MW using the current interconnect.

But in Q2 2025, Galaxy disclosed it had acquired rights to another 1 GW of capacity around the Helios site. If fully developed, that would bring the campus to 3.5 GW, making it one of the largest data center sites in the world. The full path will take time and capital, but the groundwork is already underway

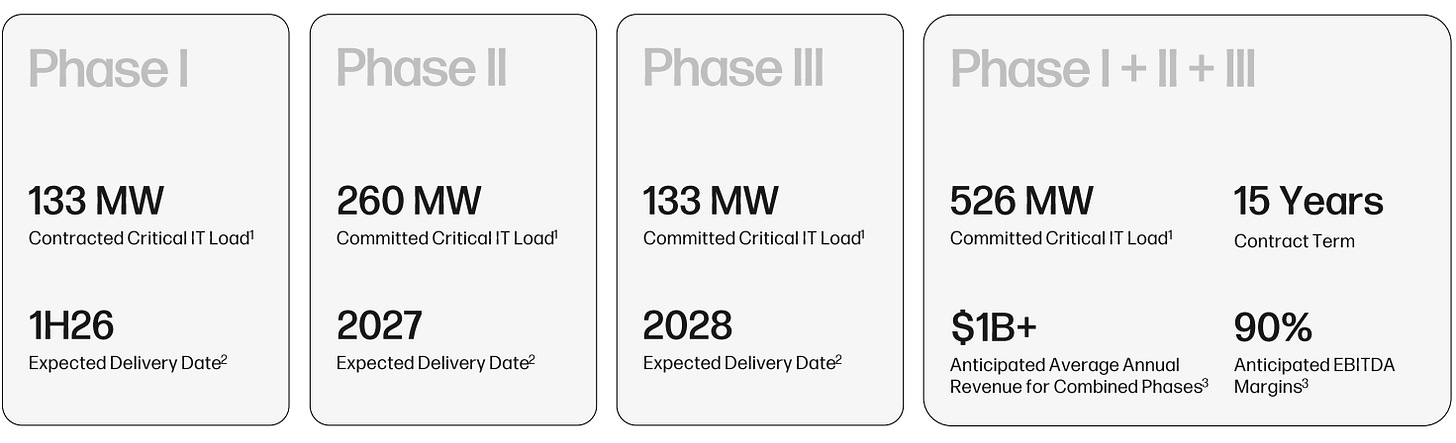

Contract Structure

As of the August 15 update, Galaxy states that CoreWeave has committed to the full 800 MW of approved power at Helios.

This covers critical IT ramps through Phases I to III, with remaining power set aside for site overhead and potential future expansions.

This is expected to bring over $1B average annual revenue across the 15-year term based on internal assumptions and full utilization.

Timeline

Phase I – H1 2026 (133 MW)

Site retrofitting, substation and cooling complete by Q4 2025

Long-lead equipment ordered, project financing drawn

133 MW delivered and accepted by CoreWeave

Revenue begins in H1 2026

Phase II – 2027 (260 MW)

Option exercised April 2025

Staged deliveries begin in 2027

Revenue recognized as capacity is accepted

Phase III – 2028 (133 MW)

Option exercised August 2025

Deliveries begin 2028

Target: Full 526 MW critical IT load online by year-end

Financing

$1.4B Non-Recourse Facility Secured for Helios Phase I

On August 15, 2025, Galaxy announced it had closed a $1.4 billion non-recourse project financing for Helios Phase I.

The deal covers roughly 80% of total build costs, with Galaxy committing $350 million in equity. The facility carries a 36-month term and is secured solely by Phase I assets.

Unlike corporate debt, this structure isolates project risk at the asset level, no parent-level guarantees. That provides several advantages:

Lowers the blended cost of capital for Galaxy overall

Reduces covenant friction with other business lines

Aligns debt service directly with asset cash flows

Before securing the project facility, Galaxy funded Helios through a combination of:

A $402.5M exchangeable note issuance (November 2024)

A $477.8M equity raise via follow-on offering (June 2025)

Contract specifics

In its August 15 update, Galaxy stated it expects average annual revenue exceeding $1 billion over the 15-year term of its contract with CoreWeave, assuming full utilization of the contracted critical IT load and the company's capex envelope.

Importantly, no revenue is recognized from the Data Centers segment until power is delivered and accepted under contract, meaning revenue only begins once the infrastructure is energized and meets Customer Ready-For-Service (RFS) standards.

Risks (Data Centers)

Single-tenant concentration: Helios depends entirely on CoreWeave. Non-renewal, delays, or missed milestones would materially impact revenue. The Phase I contract includes termination rights.

Capital intensity: Phase II and III are unfunded. Additional debt or equity will be required to continue conversion and expansion.

Lack of data center development expertise: This is Galaxy’s first AI data center project, large-scale, complex, and outside their core competency. Execution will depend heavily on the strength of the team they’ve assembled.

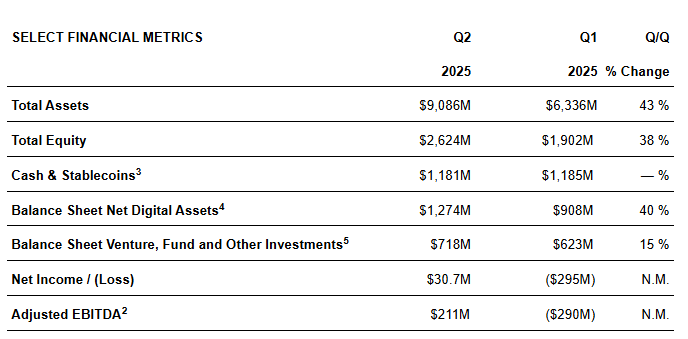

Consolidated Financials

Galaxy’s financials are currently 100% driven by its crypto platform. The Data Center segment hasn’t started contributing revenue yet.

Revenue Volatility and the FTX Effect

Reported revenue has fluctuated sharply:

Q2 2025: $8.66B

Q1 2025: $12.98B

Q4 2024: $15.81B

Q3 2024: $8.57B

Q2 2024: $8.88B

Q1 2024: $9.34B

At first glance, this looks like a business with collapsing revenue, down more than a third quarter over quarter, and basically flat year over year. But the drop is misleading. It reflects the end of Galaxy’s mandate to unwind the FTX estate.

When FTX collapsed, the bankruptcy estate appointed Galaxy to manage and sell off billions in crypto assets. By mid-2025, $483M of AUM in Asset Management was tied to that mandate. It temporarily inflated fee income and transaction volumes in late 2024 and early 2025, which pushed headline revenue into the $13–16B range.

Now that the FTX unwind is nearly complete, revenues have normalized to around $8–9B per quarter. So while reported growth looks negative, the core business is holding steady.

The more relevant metric is ex-FTX AUM. That reached $5.3B in Q2 2025, up 33% year over year, showing solid organic traction beneath the headline noise.

Margins

Galaxy’s cost structure is dominated by pass-through expenses. In Q2:

Transaction expenses were $8.63B

That’s over 97% of total operating costs

The rest was modest: compensation $65M, G&A $19M, technology $12M, professional fees $23M

Net income for the quarter came in at $30.7M, or $0.10/share. Year-to-date, the company swung to a net loss of $264.7M, a reversal from the $262.5M profit booked in the same period last year.

Margins remain structurally thin. Most of Galaxy’s revenue comes from low-take, flow-based businesses:

OTC and derivatives desks earn tight spreads due to competition

Prime financing is collateralized, with yields compressed by market pressure

Asset management is skewed toward ETFs and passive products with sub-1% fees

All of this sits on top of a fixed institutional-grade cost base, including compliance, risk, infrastructure, and headcount.

Unless crypto volatility spikes or client flow surges, the revenue pool doesn’t produce enough operating leverage to widen margins meaningfully.

In Q2, client activity also slowed. Spot trading volumes fell by 22 to 28%, depending on the source, which slowed down Galaxy’s growth.

Balance Sheet

Net Treasury Assets

Crypto Treasury

Galaxy reports $3.56B of digital assets as of Q2 2025. Core holdings include:

17,102 BTC ($1.83B)

90,521 ETH ($225M)

USDC $263M

SOL ~$170M

HYPE ~$92M

USDG ~$47M

XRP ~$34M

Other tokens ~$238M

It also held $691M in cash and equivalents.

But these are gross numbers. The crypto treasury includes borrowed coins, collateral Galaxy controls on behalf of clients, and coins it posted as collateral elsewhere.

The key number is net crypto. The Q2 filings break it down:

Digital-asset assets: $5.18B

Digital-asset liabilities: $4.69B

Net digital assets: ~$492M

Add cash: $691M

Total net liquid resources: ~$1.18B

This is the clean, ready-to-deploy liquidity pool, not the full $3.56B.

Galaxy Ventures and Other Investments

Galaxy also carries $1.61B in broader investments. These include:

Spot BTC and ETH ETFs (~$613M)

LP interests in Galaxy-sponsored funds (~$353M)

Ripple equity stake (~$97M)

Ventures ($326M) like BitMine, Bullish, and DoubleZero

Net Financial Position

To get a full snapshot of Galaxy’s financial resources, subtract debt:

Notes payable: $726M

Loans payable: $348M

Total debt: ~$1.07B

Now run the net assets math:

Net crypto: $492M

Cash: $691M

Investments: $1.61B

Debt: –$1.07B

Net financial assets: ~$1.72B

This is the cushion Galaxy holds across liquid assets, investments, and balance sheet debt.

After Q2 ended, Galaxy also secured $1.4B of non-recourse project financing for the Helios campus. This is backed by long-term CoreWeave leases. But since it closed post-quarter, it’s not included in the $1.72B figure above.

Ex-Treasury Valuation

Galaxy’s market cap is currently around $8.9B. Subtract $1.72B in net financial assets.

That leaves an ex-treasury value of $7.2B.

This is what investors are effectively paying for Galaxy’s operating platform: Global Markets, Asset Management, Crypto Infrastructure, and the Data Center segment.

Valuation

Investors are paying $7.2B for the crypto ecosystem (excluding treasury) and data center business.

The $7.2B figure does not include the latest financing facility Galaxy raised for the wholly owned Helios campus, which is valued at $535M. Galaxy has full ownership of the campus, including the land, transmission rights, and partially built infrastructure.

It also does not include something important: their financing facility announced 5 days ago. Galaxy closed a $1.4 billion non-recourse project financing facility. Non-recourse means the loan is tied strictly to the project, and lenders have a claim on the Helios Phase I assets, but not on Galaxy’s wider balance sheet.

Helios Valuation

The deal was structured at 80% loan-to-cost, with Galaxy putting in the remaining 20%, or about $350 million in equity. That equity was funded partly by a share offering earlier in the year, which diluted existing shareholders but gave Galaxy the firepower to match the debt financing.

In total, Phase I secured $1.75 billion of capital.

That pool of money is enough to cover the first phase of development, with approximately 200 MW of gross power capacity, of which 133 MW of critical IT load is already contracted to CoreWeave under a long-term lease.

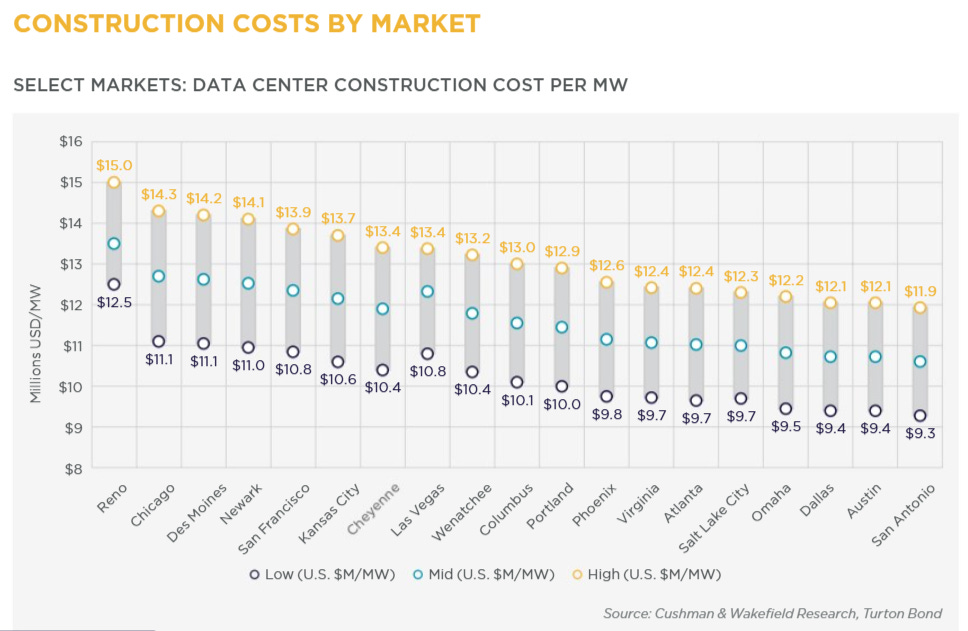

From this, we can calculate the cost per MW of IT load:

$1.75B ÷ 133 MW = $13.1M per MW

This is quite expensive. For comparison, Iren is forecasting $6.5M per MW of IT load:

Is Iren being too optimistic?

Or is this just a sign that Galaxy's lack of experience in data center construction is showing?

Two things could be happening:

Either Iren is a leader in data center construction efficiency

Or they’re simply too optimistic

Take a look at the market average for data center cost:

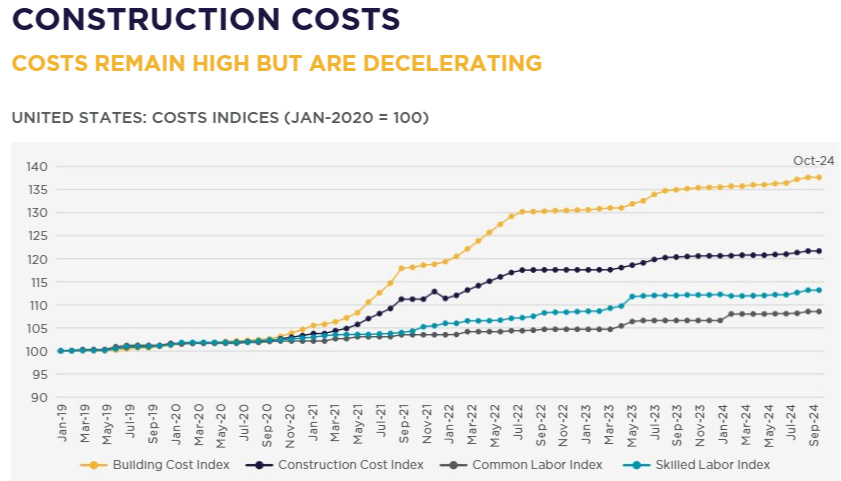

It may also be a factor that data center construction costs are rising, meaning that 2026 builds could be more expensive than those completed in prior years:

Considering this, I wouldn’t consider Helios’ expected costs unreasonable.

What value can be assigned to Helios?

For starters, they’re fully financed for the first 133 MW of IT load.

CoreWeave is paying $1.25M per MW of IT load, which implies:

$1.25M × 133 MW = $166M in Annual Recurring Revenue (ARR)

Galaxy expects 90% EBITDA margins at full utilization:

$166M × 90% = $149M in annual EBITDA

We can estimate three valuation scenarios for Phase I based on EBITDA multiples:

Low case (10x EBITDA): $149M × 10 = $1.49B

Base case (15x EBITDA): $149M × 15 = $2.24B

High case (20x EBITDA): $149M × 20 = $2.98B

These estimates apply only to the first phase. The full valuation potential depends on:

Growth beyond 800 MW

Type and quality of colocation clients

Execution efficiency and margin sustainability

Crypto Business Valuation

Now, to finish, let’s value the Crypto Services business segment.

We’ll exclude the appreciation of the crypto treasury.

Being bullish on crypto is clearly a core part of the Galaxy thesis, and yes, you can count the treasury as a valuable asset. But due to seasonality and volatility, it’s more conservative to leave it out of the valuation.

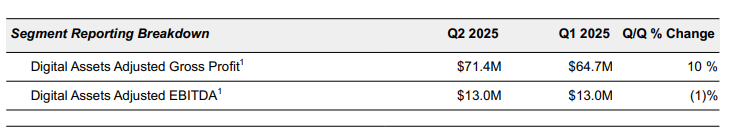

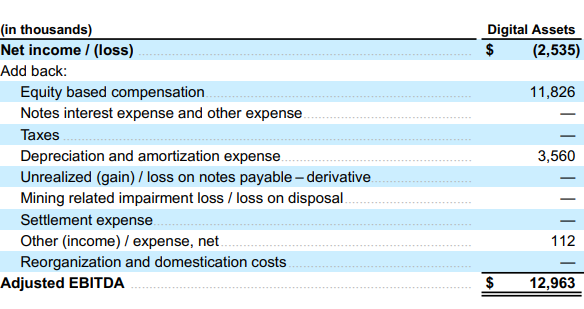

So for the crypto business (also referred to as Digital Assets), we’ll focus only on the operating segments:

Asset Management

Global Markets

Infrastructure Solutions

Same performance in Q1 and Q2. We’re not in a moment of huge trading inflow growth. On an annualized basis, this would give us $52M in earnings.

Now, it depends on the price we assign to the segment.

Given that there is no interest expense for this business line, we can treat this adjusted EBITDA as adjusted net income.

If Galaxy is the Goldman Sachs of crypto, let’s use Goldman’s P/E to calculate a possible valuation for Galaxy’s Digital Assets segment.

Goldman’s current P/E is 15x. Galaxy may have higher growth potential given the upcoming catalysts in the crypto industry, but Goldman offers a safer benchmark.

At 15x P/E, Galaxy’s Digital Assets segment would be valued at $780M.

But what if we use a higher P/E?

At the end of the day, crypto is expected to grow much faster than traditional finance. With altseason approaching, institutional interest increasing, and tokenization and stablecoins emerging as two of the biggest financial trends, Galaxy looks like a clear long-term beneficiary.

The problem is that the industry lacks clean public comps:

Circle business model is different

Coinbase is more retail-focused

Robinhood (HOOD) is even less relevant

Let’s use a blended approach:

Assume Galaxy is 50% Goldman Sachs and 50% growth crypto platform.

Now we need to find a fair P/E for the crypto side:

Circle: 150x P/E (private)

Coinbase: 47x P/E

Robinhood: 53x P/E

Let’s stay conservative and use a 30x P/E for Galaxy’s crypto exposure.

So, the blended P/E becomes:

(15 + 30) / 2 = 22.5x

Applying a 22.5x P/E to the segment’s $52M in annualized earnings:

$52M × 22.5 = $1.17B

So under this blended valuation, Galaxy’s Digital Assets segment could be worth $1.17 billion.

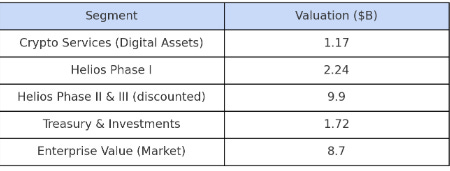

Sum-of-Parts Valuation

Considering their treasury, Digital Assets business, and Phase 1 of Helios, Galaxy would land at around a $5.1B valuation.

But this is not the full picture.

You still need to add the rest of the Helios data center. It’s not only ERCOT approved for 800 MW, but already has:

The electrical installation set

The foundational infrastructure underway

A long-term contract signed with CoreWeave

If Galaxy manages to secure funding and bring in clients for the full buildout, and generates over $1B in EBITDA at 90%+ margins, the data center segment alone could easily be worth over $15B.

Let’s assume exactly that:

A ~16x EBITDA multiple on Phases 1, 2, and 3.

That would imply a valuation of approximately $15B for the full Helios campus.

Assuming the entire project is completed in 3 years, and applying a 15% discount rate (to account for execution risk, depreciation, interest costs, etc.), the present value of Helios in 2028 would be around $9.9B.

Add that to the rest of the business, and you get a total valuation of ~$13B.

Valuation Conclusion

With a current enterprise value of ~$8.7B, there is upside potential, but not much room for error. Once you factor in:

The debt burden

The equity dilution likely required to fund later phases

The upside begins to look less impressive.

This feels more like a base-case or even slightly bearish scenario. But it helps to show that Galaxy isn’t a no-brainer.

What Would It Take to Be Bullish on Galaxy?

You’d need to believe in both execution and tailwinds. That includes:

Trust in Galaxy’s ability to deliver Helios on time and on budget

A bullish stance on crypto, which would raise the value of their treasury

Optimism around institutional crypto adoption, which would drive higher asset management fees

An optimistic take on getting approval for the other 2.7GW for Helios

Galaxy’s management is hungry

That’s clear from the opportunistic acquisition of Helios and their aggressive expansion across the crypto ecosystem.

They’re already a behemoth in the crypto world, not just a mid-cap, but trusted by the largest institutions and new Crypto treasuries.

If you’re bullish on crypto, and you believe this is the beginning of a revolution in the financial system, that’s when Galaxy becomes a no-brainer.

Because in that world, we wouldn’t need more traditional financial services, we’d need:

OTC crypto trading

Secure custody solutions

Staking platforms to earn interest

Validators to keep networks running

In short, the world would need Galaxy.

Galaxy isn’t tremendously undervalued right now, but if you truly believe in crypto as a system-level disruptor, then Galaxy could be a generational wealth opportunity.

Valuation Summary

Goldman Sachs Valuation Model

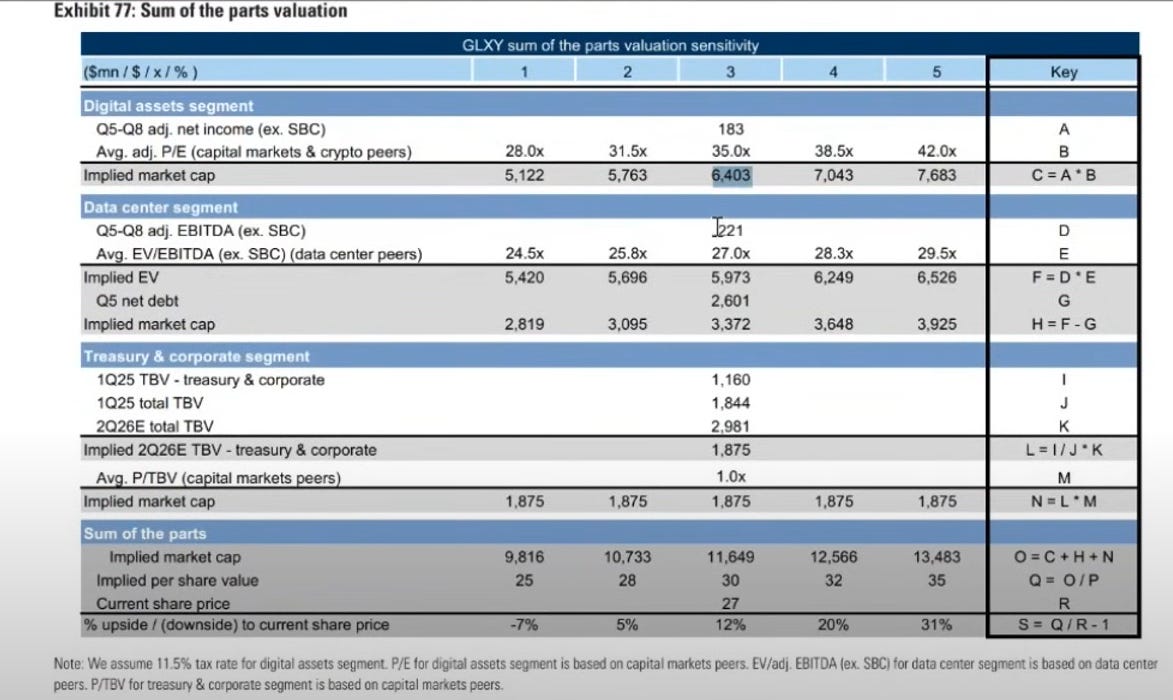

Goldman released a report on Galaxy, and it’s worth breaking down:

Goldman Sachs Valuation Model

Goldman splits Galaxy into three distinct engines:

The crypto flow business

The Helios data center buildout

The balance sheet

They assign valuations to each separately.

1. Digital Assets Segment

Uses $183M of adjusted net income over Q5–Q8 (excluding SBC)

Applies a P/E multiple of 28–42x

Results in a valuation range of $5.1B to $7.7B

Anchored on capital markets and crypto comps

Represents core earnings: OTC, derivatives, trading, and lending

2. Data Center Segment

Uses $221M of adjusted EBITDA (Q5–Q8)

Applies an EV/EBITDA multiple of 24.5–29.5x

Implies an enterprise value of $5.4B to $6.5B

After subtracting $2.6B of net debt, results in $2.8B to $3.9B equity value

Does not yet include the CoreWeave expansion (~200MW), making this estimate conservative

3. Treasury + Corporate Assets

Valued using a 1.0x P/TBV multiple

Arrives at a valuation of $1.875B

Includes the crypto treasury, cash, venture investments, and other corporate-level assets

Sum-of-the-Parts Implied Valuation

Total market cap range: $9.8B to $13.5B

Equivalent to $25 to $35 per share

Based on assumptions of:

11.5% tax rate on digital business

Flat crypto prices

Revenue CAGR of 11% for trading and 15% for asset management

At the time of writing, shares were trading around $27.

According to Goldman, Galaxy would be slightly undervalued.

I’d personally call their P/E multiple very optimistic. Apart from that, the structure and logic seem broadly in line with my own assumptions.

Their numbers look larger because they discounted forward-looking figures to the present one year ahead, while I calculated the digital business by assigning a reasonable P/E and then discounted the full value of the three Helios phases, adding treasury on top, but the conclusion is similar.

Conclusion

I think Galaxy is an interesting opportunity for a crypto bull looking to gain exposure to the broader crypto ecosystem.

I also believe that if they secure approval for the remaining 2.7 GW Helios project, the company instantly becomes more compelling and the multibagger potential becomes clear.

Companies are fighting for energy and well-suited AI data centers. Having that much power concentrated in a single campus, especially considering that in a year and a half NVIDIA Rubin Ultra and MI500 will require rack densities three times larger than today’s most powerful racks, would give Galaxy the perfect opportunity to build state-of-the-art data centers and launch a massive project with partners like hyperscalers, CoreWeave, or even OpenAI.

I’ll be doing a dedicated article explaining the data center segment in more depth, with a refined valuation model, but not in isolation. I want to compare all the major data center plays to see which offers the best opportunity.

I already published a piece on IREN, which was a simpler company to analyze, but the outcome was quite bullish. Now I plan to compare IREN, APLD, HUT, WULF, and others in a comprehensive way, factoring in not just IT load capacity, but also the resources and strategic advantages that make each stand out.

So far, from a pure data center play perspective, I come away more bullish on Nebius and Iren. They not only trade at much cheaper valuations than Galaxy, but also have deeper experience in HPC and AI-focused infrastructure.

That said, there are still solid reasons to be bullish on Galaxy, but more so as a crypto disruptor in financial markets rather than a leading-edge data center builder.

I’ll be researching the rest of the sector to deliver a full comparison, which sounds as laborious as it does interesting.

And let’s not forget, data centers go far beyond just operators. You also have companies that:

Supply key cooling infrastructure

Build and manage the electrical network

Ensure fluid integrity in cooling systems

And cover many other mission-critical layers

If you look at the returns of some of these suppliers, it might surprise you. Sometimes, the best returns are hidden beyond the headline names.

As always, have a great end of the week, and until next time,

Daniel