New Microcap Energy and U.S. Manufacturing Position

A $700M manufacturer building a vertically integrated U.S. energy business to profit from AI demand

In this article, I’ll cover an energy and manufacturing microcap play focused on solar energy and storage, with a state-of-the-art facility and another under construction to double manufacturing capacity and achieve high vertical integration. The company aims to reach a 70% US supply chain and has key partners such as Corning, Palantir, and Nextracker.

It is fully sold out for this year and, after ramping up production in H2 at its modern factory completed a year ago, it expects to break even in EBITDA for the year.

This isn’t surprising.

The AI Era

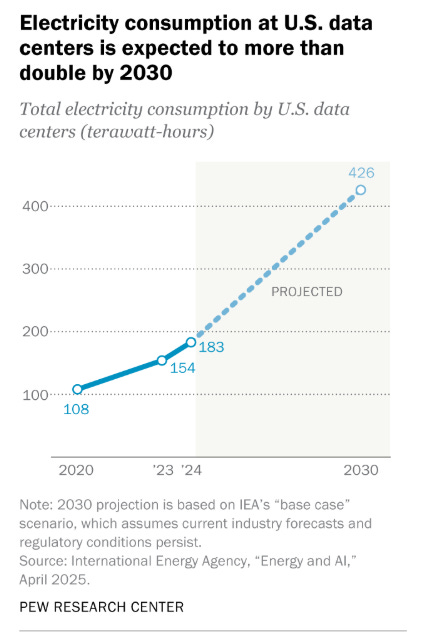

AI is creating a massive energy deficit in the US. Just check the latest DOE report.

100 GW of new peak hour supply will be needed by 2030, with 50 GW directly attributable to data centers.

It takes three times longer to build the generation capacity required for a data center than to complete the data center buildout itself.

The rest of the DOE document focuses more on oil, gas, coal, and nuclear than on renewables or batteries, but the administration still recognizes that all energy sources are necessary, serving complementary roles.

IRA 45X Credits

Although the current administration isn’t rhetorically supportive of renewable energy, the IRA 45X manufacturing credits for clean energy production introduced by the Joe Biden administration were preserved by the One Big Beautiful Bill Act, with some modifications.

Here are the requirements and credit amounts for the IRA 45X manufacturing credits, which provide great incentives for U.S. clean energy production and help boost the profitability of domestic manufacturers:

Covered U.S. Production

Solar components (polysilicon, wafers, cells, modules), wind components, inverters, battery cells, battery modules, electrode-active materials, and critical minerals.

Credit Amounts

Battery cells: $35/kWh

Battery modules: $10/kWh (or $45/kWh if no cells)

Solar cells: $0.04/Wdc

Solar modules: $0.07/Wdc

Electrode-active materials: 10% of production cost

Inverters: fixed $/Wac rates

Monetization

Direct pay in cash or a one-time annual transfer or sale of the credit.

Phaseout

75% in 2030

50% in 2031

25% in 2032

Ends after 2032

Wind components end after 2027

Critical minerals follow the 2030–2032 phase-down.

Key Rules

Manufacturing must take place in the United States, and the product must be sold to an unrelated buyer.

US Manufacturing: A powerful trend

This administration is also focused on U.S.-based manufacturing. To achieve that, it is implementing an aggressive import restriction plan, particularly on Chinese goods. Here are some of the key restrictions currently in place:

China solar tariffs (AD/CVD): The U.S. has long-running extra import taxes on Chinese solar cells and panels, and they were kept in 2024, so China-made panels stay expensive at the border. (USTIC)

Southeast Asia tariffs (AD/CVD): As of Apr 21, 2025, the U.S. set company-specific tariffs on cells/panels from Cambodia, Malaysia, Thailand, and Vietnam when they rely on Chinese inputs—meaning many SEA-made panels now face new duties. (Trade.gov)

2022–2024 “tariff holiday” status: The two-year pause on collecting some SEA solar duties expired Jun 6, 2024; a court later vacated that pause but put the ruling on hold while the government appeals, so retroactive collection risk is paused for now. (Trade.gov)

Section 301 on China—finished panels/cells: The U.S. raised tariffs on Chinese solar cells (whether or not in modules) to 50%—a big price hit on any direct China-origin cells/panels. (United States Trade Representative)

Section 301 on China—wafers & polysilicon: Chinese wafers and polysilicon now face 50% tariffs (effective Jan 1, 2025), making upstream China inputs far costlier. (United States Trade Representative)

Section 201 solar safeguard: A separate safeguard runs through early 2026. It allows about 5 GW of cells/year duty-free (tariff-rate quota), while modules remain under safeguard; bifacial modules are exempt. (White & Case)

UFLPA forced-labor ban: If any part of a panel’s supply chain ties to Xinjiang or a listed entity (e.g., in the polysilicon chain), U.S. Customs can block the shipment unless the importer proves it’s clean. The entity list expanded in 2025. (Department of Homeland Security)

And what about demand?

In March 2025, U.S. solar power generation increased by 37% (+8.3 TWh) compared to March 2024.

Wind and solar combined produced a record 17% of U.S. electricity in 2024, surpassing coal at 15% for the first time.

Solar remains the fastest-growing renewable source thanks to larger capacity additions and favorable tax credit policies. Planned projects are expected to boost capacity operated by the electric power sector 38%, from 95 GW at the end of 2023 to 131 GW by the end of 2024.

Solar and storage represented 84% of new U.S. power added in 2024.

Macro Tailwinds

Another key factor is that solar is sensitive to interest rates, as most projects rely on financing. The FED started cutting rates a year ago, and now the cuts are expected to accelerate. Along with the transition from quantitative tightening to quantitative easing signaled in recent meetings, this points to liquidity relief for solar projects, boosting the industry and panel prices.

There are two strong themes emerging in the U.S.: energy and U.S. manufacturing. Solar is a crucial part of solving the massive energy demand driven by AI, especially to reach superintelligence.

For that reason, I believe this company presents a compelling opportunity to scale from a microcap to a mid-cap and deliver multibagger returns in the process.

Let’s start.

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.