Nebius Group: A Potential 10x in the Making

Nebius Group is an emerging leader in AI cloud, data centers, robotaxis, and AI data infrastructure. It is building the foundation to become the AWS of AI.

1. Nebius Group: Structure and Scope

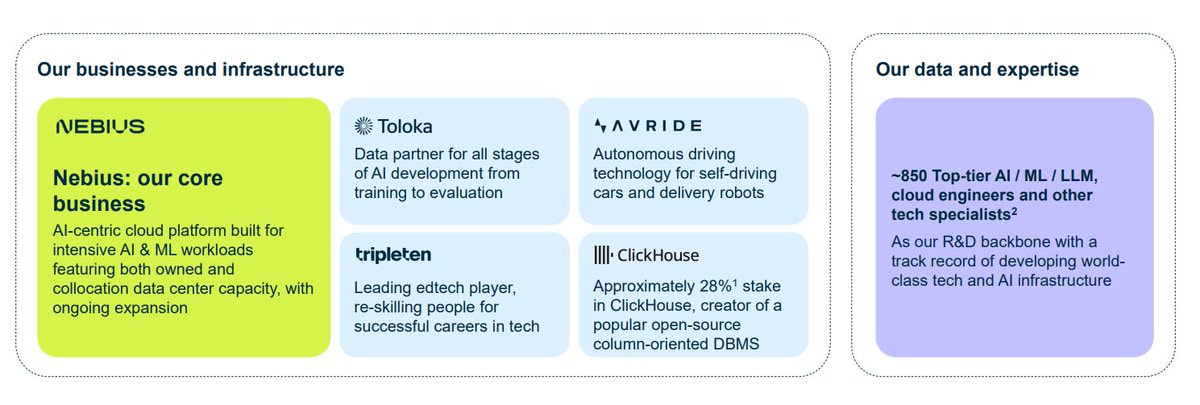

Nebius Group comprises the core business, Nebius, and three additional primary business units: Toloka, Avride, and TripleTen.

Nebius, the core business, operates a proprietary data center in Finland and uses colocation arrangements in Paris, Iceland, and Missouri. Only the Finland facility is owned outright, and the other locations are rented from third-party data center providers.

Let’s first explore the technology and business model of Nebius, followed by its financials.

2. Nebius AI Cloud

Nebius offers two core services: Nebius AI Cloud and Nebius AI Studio.

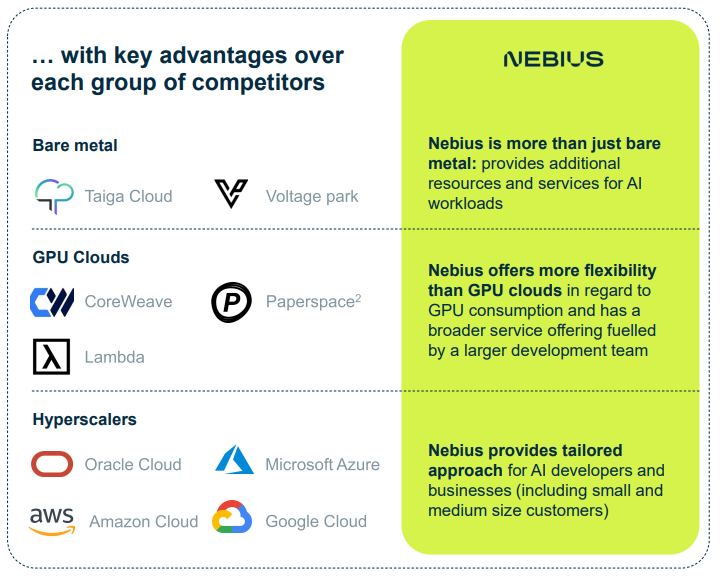

The flagship product, Nebius AI Cloud, is a full-stack platform purpose-built for AI training, inference, and data-heavy processing. It competes directly with Lambda, CoreWeave, Paperspace, Vultr, TogetherAI, DeepInfra, and hyperscalers like AWS, GCP, Azure, and Oracle.

Trusted by Top AI Companies

Mistral, JetBrains, Brave, Behavox, Converge, and others already rely on Nebius to power their AI infrastructure.

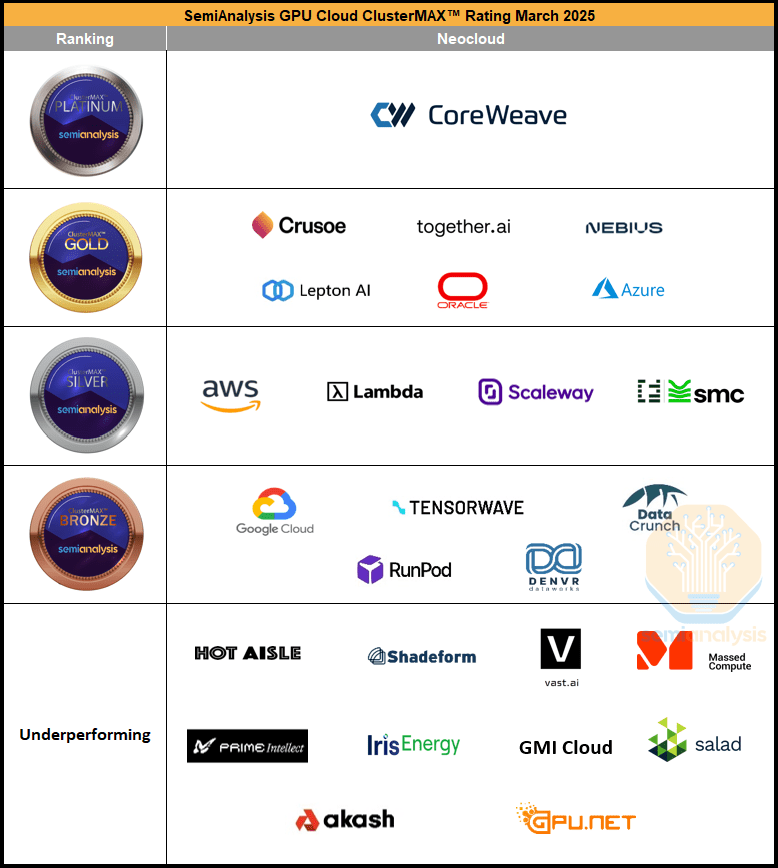

Recognized by SemiAnalysis

Nebius was placed in the Gold tier of Dylan Patel’s AI Neocloud report at SemiAnalysis, one of the most respected deep tech research firms in the AI infrastructure space.

That puts it on par with Oracle and Microsoft, and ranked above AWS and Google Cloud.

The report evaluated GPU-native clouds based on:

Real performance

Cost structure

Service flexibility

Alignment with modern AI development demands

Why Nebius Reached This Position

Nebius has emerged as a leader in AI infrastructure by offering the lowest absolute prices and the most favorable terms for short- to medium-term GPU rentals. This makes it an ideal choice for startups and mid-sized teams that need flexibility without being locked into long-term hyperscaler contracts.

This edge comes from a combination of strategic choices:

Deep vertical integration across hardware and software

ODM-based infrastructure that avoids costly OEMs like Dell and Supermicro

Pay-as-you-go pricing with no upfront lock-ins

A relentless focus on availability and speed, not just raw compute

Unlike traditional clouds that retrofit AI capabilities onto outdated systems, Nebius was built for AI from day one. Every layer, from custom hardware to developer experience, is optimized for real-world AI workflows.

The result is tangible:

On-demand access to NVIDIA H100s at around $1.50 per hour

128-GPU clusters deployable in under 48 hours

Startup-friendly pricing with gross margins as low as 2 to 3 percent, made possible by custom ODM hardware

What Developers Are Saying

You don’t have to take Nebius’s word for it. Engineers from some of the most innovative AI startups are publicly sharing why they’ve moved their workloads to Nebius.

Real-world users include:

Higsfield AI – a global leader in AI video generation

Lynx Analytics – an AI and analytics company specializing in graph analytics and AI solutions for industries like life sciences, retail, telecommunications, and financial services

Captions – an AI-powered platform for video editing and content generation

With all this information, we can clearly identify the core competitive advantages that form Nebius’s moat and set it apart from other players in the AI cloud space.

What’s the competitive advantage of Nebius?

Here’s a summary of it:

Lowest absolute GPU pricing on the market

AI-first infrastructure, built for demanding workloads

Streamlined cloud console for intuitive cluster deployment

Fully integrated software stack, optimized for AI

End-to-end control over hardware and operations

20–25% lower GPU TCO, thanks to design and vertical integration

Direct NVIDIA partnership, with early access to next-gen Blackwell GPUs

15+ years of infrastructure expertise

Best short- and mid-term rental terms

Aggressive ODM strategy, with massive cost savings

Focus on developer convenience over bureaucracy

Fast, easy setup of multi-GPU clusters

Seamless horizontal scaling

Transparent, startup-friendly pricing

Clean, intuitive UI

Responsive support that actually answers

No lock-in games or surprise fees

Better experience than AWS for AI workflows

Tools built for real AI teams, not enterprise IT checkboxes

In summary, the moat of Nebius lies in its aggressive pricing, made possible by the efficiency of its in-house hardware developments. This is reinforced by the strength of its massive engineering team, a transparent and intuitive UI, and the versatility and convenience of a full software stack built specifically for developers.

NVIDIA Backing

Nebius is a member of the NVIDIA Cloud Partner Program and one of the few GPU-native clouds NVIDIA has directly invested in.

This backing gives Nebius:

Early access to next-gen GPUs like Blackwell

Tight integration with NVIDIA’s architecture roadmap

Strategic alignment with the company setting the pace in AI hardware

NVIDIA doesn’t hand out that kind of access lightly. Their backing is a clear signal that Nebius is being viewed as a serious long-term infrastructure partner.

What’s Next

Right now, Nebius is probably the best AI cloud for startups and mid-sized developers. But it’s just the beginning.

Once its Finland site and 300 MW colocation facility in New Jersey come online, Nebius will be one of the few platforms with the scale, pricing, and tech stack to go head-to-head with the hyperscalers in enterprise-grade AI compute.

3. Nebius AI Studio

Nebius AI Studio is a managed platform designed for AI model development, providing tools, environments, and resources specifically for building, training, and deploying machine learning models. It offers preconfigured environments, AI frameworks, and integrated tools for model training and testing.

This platform is ideal for AI researchers, data scientists, and developers focused on developing and fine-tuning algorithms, allowing them to experiment and innovate without worrying about infrastructure management.

Nebius AI Studio provides a playground with access to popular pre-trained models.

They offer two alternatives: base and fast, depending on how quickly you want the model to perform.

Using these pre-trained models, you can fine-tune them to adapt to your specific domain or task without needing to build and train them from scratch.

With Nebius AI Studio, you could, for example:

Create a customer support chatbot that answers questions 24/7

Generate blog content automatically

Summarize long documents

Build a product recommendation system based on customer behavior

Perform sentiment analysis on social media mentions

Craft personalized email campaigns for marketing

The possibilities are endless. And here’s a key point: Nebius AI Studio offers some of the best prices available, along with a comprehensive stack of tools that support a wide variety of use cases, a combination that’s attracting many AI startups.

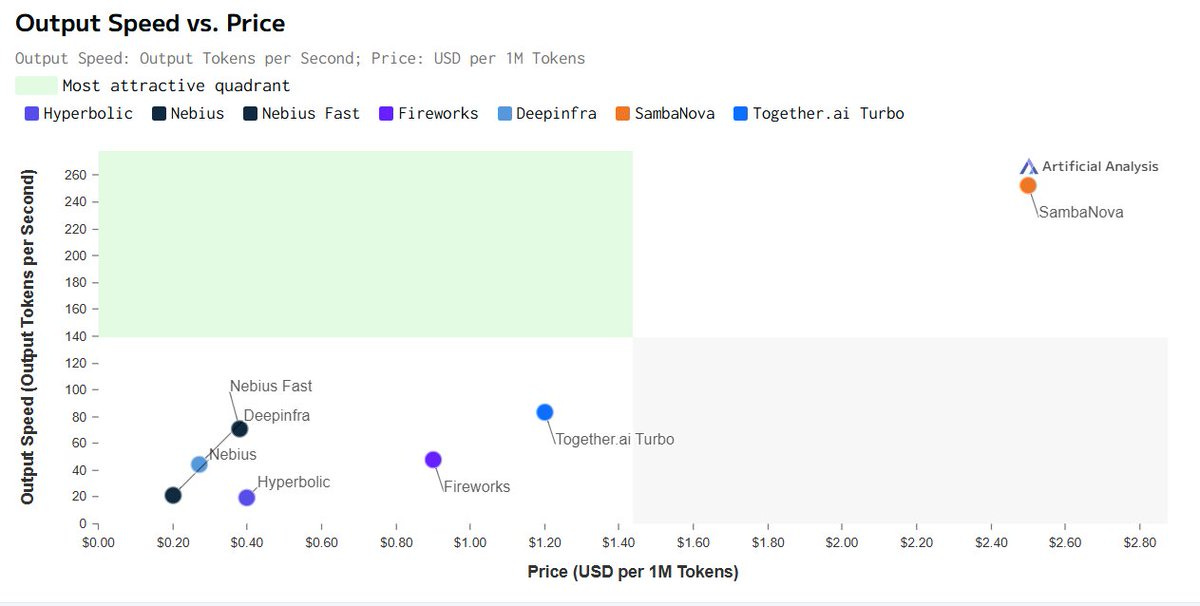

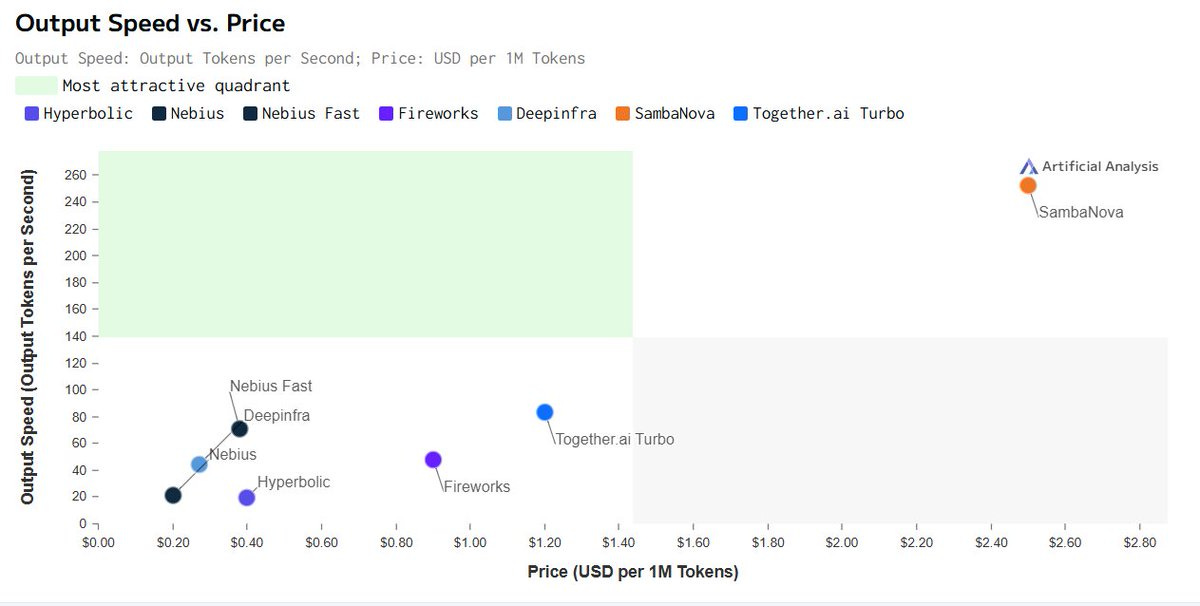

Here are the prices per token and speed of some popular open-source models:

DeepSeek R1

Qwen2.5 72B

Llama 3.3 70B

Nebius AI Studio is among the best performers in the 3 most popular open-source models.

4. TractoAI

Nebius also provides AI cloud services through their newest venture, TractoAI.

TractoAI is a serverless neocloud platform designed to facilitate the deployment, scaling, and monitoring of AI and big data workloads.

Companies like JetBrains, Unrealme, Synthlabs, and Pleias already trust and use the platform.

Tracto is built to be a more convenient and user-friendly option for developers, offering a value stack that is both more intuitive and robust compared to public clouds, Lambda, RunPod, and similar providers.

Tracto is particularly convenient because, in the Tracto cloud, users don’t pay for GPU cluster usage, but rather for the amount of workload processed. This pricing model allows TractoAI users to achieve faster project results without the burden of learning Slurm, Kubernetes, or other DevOps tools.

5. What makes Nebius more successful than others?

5.1 Their expertise and connections

Nebius offers a premium AI service, distinct from traditional data centers. It requires state-of-the-art NVIDIA GPUs, making its hardware far more valuable than that of a standard general-purpose data center.

Nebius holds a key advantage in this regard, as they are a preferred partner of NVIDIA. This partnership gives Nebius priority access to NVIDIA GPUs, making their business model more resilient and allowing them to offer a truly premium service.

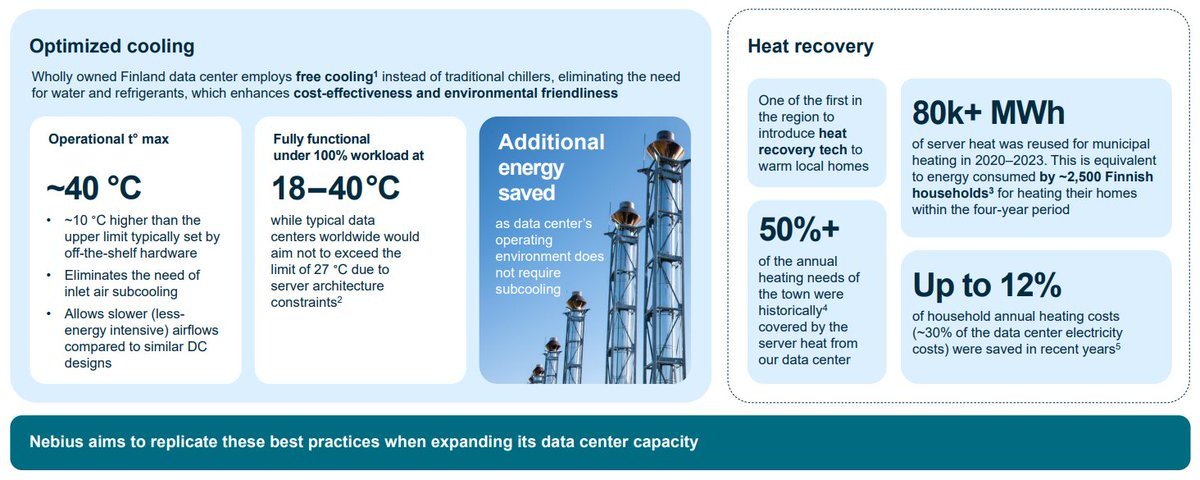

These data centers are highly complex, as their energy and cooling requirements far exceed those of standard general-purpose facilities. This presents an engineering challenge that only a highly skilled team of experts can tackle.

Fortunately for Nebius, they have a large team of engineers with a long history of data center operations and in-house technology development, setting them apart from the rest.

5.2 In-house R&D and developments

Nebius not only designs their data centers, but also designs their own servers, racks, and even motherboards, ensuring that every component is optimized to the highest level.

Additionally, this approach allows Nebius to cut costs, reduce delays, and gain the flexibility to pursue R&D developments. It’s the result of more than 10 years of experience in data center operations.

Nebius has also introduced heat recovery technology in its Finland data center, which helps warm 2,500 local households.

This is reflected in the efficiency of their data centers. Their Finland data center is the 19th most powerful supercomputer in the world and is only surpassed by Google Cloud and Microsoft Azure in power usage effectiveness.

Their new Paris data center will also use waste heat to warm an urban farm established on the facility’s roof, while their new Iceland data center will not require subcooling due to the naturally cold climate.

6. Financials and Specifications

The Finland data center is expected to triple its power by the end of 2025, reaching 75 MW. Once operating at full capacity, Nebius expects it to generate $1 billion in annual recurring revenue.

The Missouri data center began operations this quarter with an initial capacity of 5 MW. This will be expanded by Q2 of this year and further increased to 40 MW with Blackwell GPUs. Assuming a proportional relationship, this data center could generate up to $533 million.

The Paris data center has an undisclosed capacity.

Nebius expects to invest more than $1 billion in European data centers by mid-2025, including the expansion of the Finland data center, the deployment of GPUs at the Paris site, and other investments in build-to-suit data centers at greenfield sites, primarily in Europe.

This program is well-funded by the $2.5 billion in cash that Nebius Group holds on its balance sheet.

On top of that, Nebius has highly ambitious plans.

They have secured a New Jersey site with a capacity of up to 300 MW and have partnered with DataOne to build a custom data center in just 20 weeks.

By the end of 2025, Nebius will have 100 MW of installed capacity in the US.

They are also deploying a 10 MW compute cluster in Iceland, which will not require subcooling and will be powered entirely by renewable energy. It is expected to launch operations by late March.

7. Putting It All Together

Assuming a linear relationship with their Finland data center and considering the time necessary to acquire clients, they could generate an ARR by mid-2026 of:

$1 billion from their Finland data center

$1.3 billion from their US data centers

$130 million from their Iceland data center

An undisclosed amount from the Paris data center

Bringing the total to ~$2.5 billion.

Even if they diluted 10% of shares over the next two years, it would still be a massively profitable investment, as their current valuation is just $6 billion for the whole company.

In fact, the opportunity could be even bigger. CEO Arkady Volozh expects the company to reach more than 1 GW of data center capacity by 2026. Today, they have just 25 MW. That’s a 40x increase in capacity in less than two years.

With 1 GW of capacity, assuming the same linear relationship as before, Nebius could generate $13.3 billion in ARR.

And this is just one business unit.

8. Avride

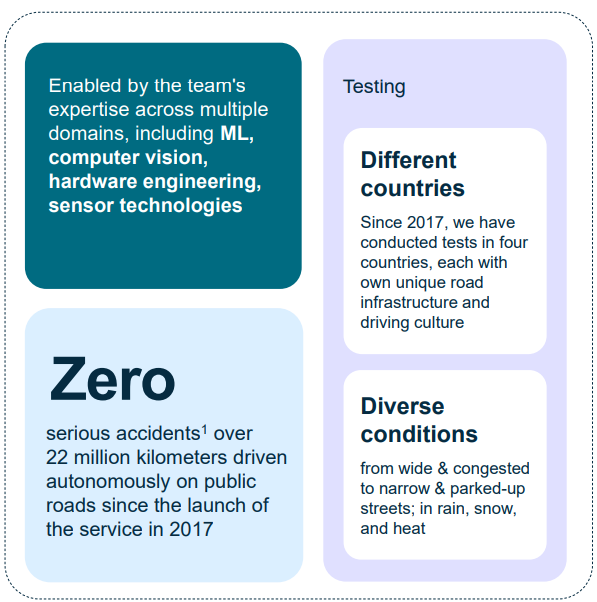

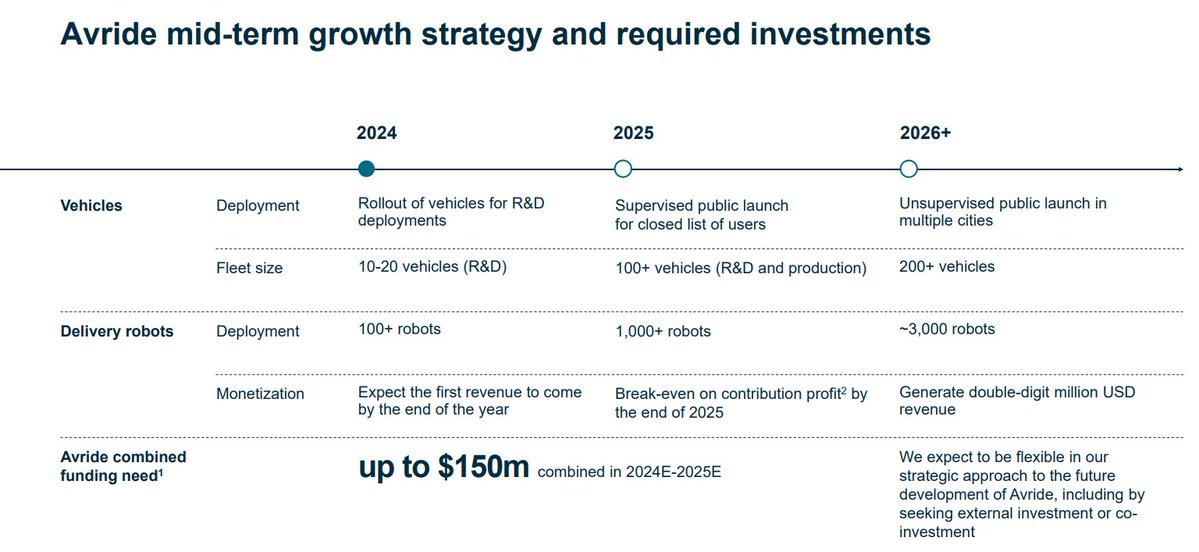

Avride is an automation technology company with two development lines: robotaxis and autonomous delivery robots.

Their self-driving technology is among the most advanced in the world, and they also design their LiDAR in-house.

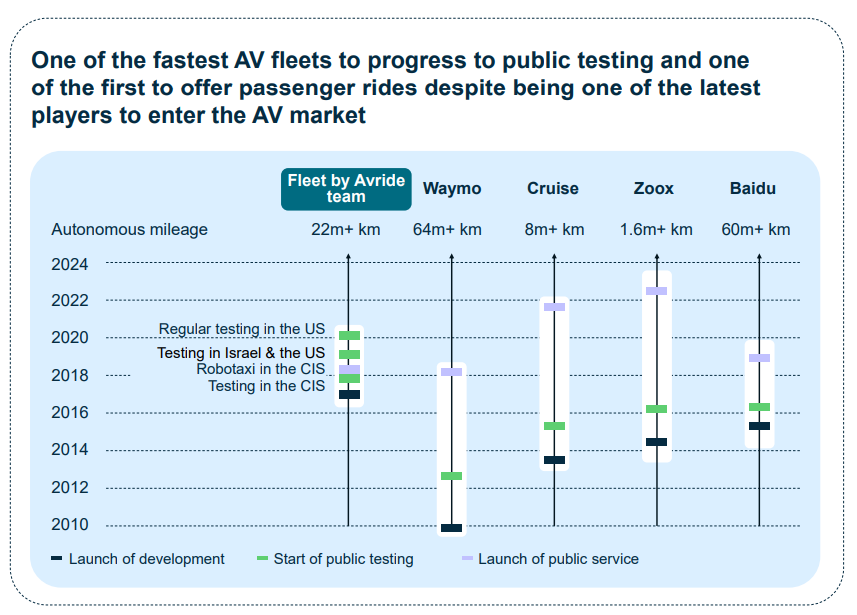

They were the first company to launch robotaxis in Europe and now operate in Moscow under Yandex. Their robotaxis have driven over 22 million kilometers, compared to:

64 million for Waymo

8 million for Cruise

1.6 million for Zoox

These cars have never had a single accident, and they’ve already been tested in the US and South Korea. They’re starting autonomous ride operations with Uber this year in Dallas, and given their success in Russia, it wouldn’t be surprising to see them expanding to other cities soon.

Avride already has a partnership with Hyundai and plans to scale to fully driverless cars this year.

What’s surprising is how under the radar this company still is. Before discovering $NBIS, I had never even heard of it, yet it appears to be more advanced than Cruise or Zoox.

Cruise’s last funding round valued it at $30 billion, though that has since dropped to around $15 billion due to disappointing progress. Zoox, now valued at $6 billion, has logged far fewer testing kilometers than Avride and has a less proven track record. Although Zoox also plans to begin commercial operations this year, it is not expected to reach the 100 vehicles that Avride has planned.

Zoox does benefit from a stronger cool factor thanks to its custom-built vehicle and Amazon’s backing, but given Avride’s extensively tested technology, its valuation should not be far behind.

Perhaps the closest competitor to Avride is Motional. Like Avride, Motional has a partnership with Hyundai and is working toward launching robotaxis, though its target is 2026. It has been testing in five U.S. cities, but its technology is not as mature. Motional has yet to test its cars on highways, and it has not disclosed total test mileage. It remains uncertain whether the company will meet its 2026 goal.

Motional was last valued at $4.1 billion.

Considering the valuations of Cruise, Zoox, and Motional, it is difficult to justify Avride being valued at anything less than $6 to $7 billion. Zoox is probably undervalued, while Cruise and Motional appear to be overvalued.

Waymo, of course, still deserves its $45 billion valuation as the undisputed leader in the space, but Avride has the chance to become a good second this year if the deployment works as expected.

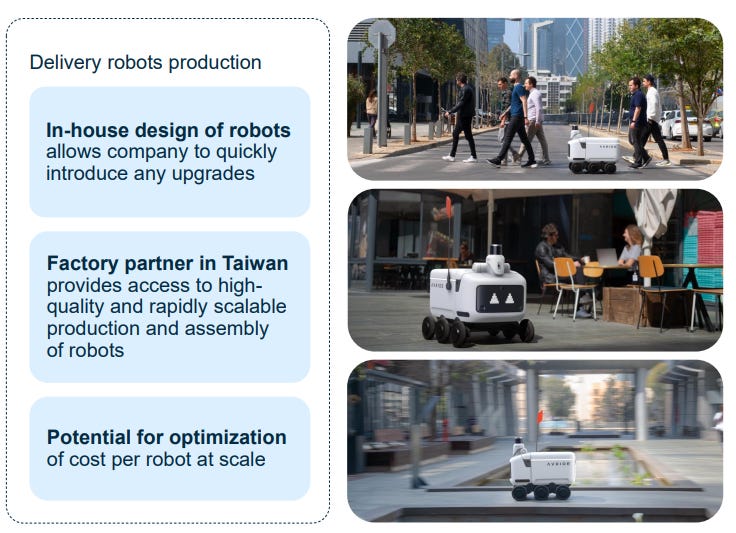

8.1 Autonomous Delivery Robots

Avride’s autonomous delivery robots are designed for food, grocery, and small-scale logistics deliveries. These are designed entirely in-house, using the same proprietary LiDAR tech as their robotaxis.

They’ve already deployed over 100 robots in the USA, UAE, and South Korea and expect to surpass 1,000 deployments this year, with plans to expand into Tokyo.

So far, they’ve completed over 200,000 deliveries, and US customers can already select them as a delivery option through Uber Eats.

Compare this with Serve Robotics:

Only 57 robots deployed

Plans to scale to 2,000 in 2025

Their robots require remote control intervention 20% of the time

Serve is currently valued at $500 million, and I don’t believe Avride’s delivery division should be valued much lower, if at all.

9. Toloka

Toloka is a crowdsourcing platform for data labeling and AI training services. It pays users for completing tasks that help train neural models.

Toloka is already working with top-tier clients like Microsoft, Amazon, ServiceNow, Hugging Face, AMD, and more.

In today’s AI race, high-quality data is the new gold, and Toloka is a 100 km² mine.

They can generate both expert-level and synthetic datasets using LLMs. Think of Toloka as the Uber of AI data sourcing.

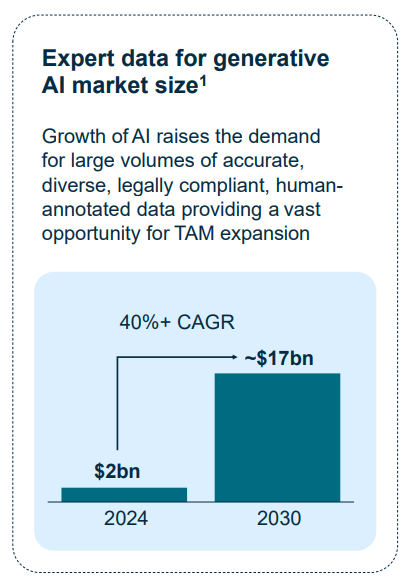

Their total addressable market is expected to grow at a 40%+ CAGR, and they’re projected to generate $60 million in revenue this year.

Assuming a 40% CAGR through 2030, Toloka could reach $322 million in revenue, which at 5x sales would imply a $1.6 billion valuation.

This company has the potential to become a behemoth in the AI world. AI experts like Ilya Sutskever have already pointed out that the biggest bottleneck for AI improvement right now is high-quality data. At some point in the future, additional data may no longer be necessary, but until that point, which is still far away, data will remain a key driver of improvement for new models.

10. TripleTen

Nebius Group also owns TripleTen, an online tech bootcamp that offers training programs in fields such as:

Data science

Software engineering

QA engineering

Business intelligence analytics

TripleTen is primarily a B2C bootcamp that targets individuals from diverse backgrounds looking to break into tech roles, with over 1,000 people enrolling in its programs each month. It operates mainly in the US, Latin America, and Israel, offering remote and accessible programs across these regions.

TripleTen has recently launched a B2B offering to help companies close IT skills gaps, embrace AI, and retain talent by upskilling employees in high-demand areas.

With TripleTen, Nebius is leveraging their brand recognition, strong reviews, and proven track record of successful job placements to play a key role in one of the most important aspects of AI adoption in companies, the reskilling of employees to adapt to new technologies.

TripleTen is experiencing massive growth, with a 149% increase in students from 2023 to 2024, and 2025 revenue is expected to reach approximately $50 million.

The global digital education market is projected to grow at a 26%+ CAGR from 2024 to 2030.

Using this CAGR, TripleTen could reach $160 million in sales by 2030. Using a similar multiple to Coursera or Udemy implies a valuation of ~$320 million.

11. ClickHouse

ClickHouse is a high-performance, open-source columnar database designed for real-time analytics on massive datasets. Nebius Group holds a 28% stake.

Unlike traditional row-based databases like MySQL or PostgreSQL, ClickHouse stores data in columns, enabling much faster queries—ideal for log processing, BI, fraud detection, and web analytics.

ClickHouse was valued at $2 billion in 2021, and since then, it hasn’t stopped growing.

Its software is revolutionary and is used by some of the largest companies in the world, including Microsoft, Spotify, Meta, Sony, Block, Lyft, HubSpot, Instacart, Shopee, IBM, and practically any major enterprise you can think of.

Valuing ClickHouse is challenging since its last funding round took place in a bubbly market, but the company has continued expanding since.

Even if we just use the $2 billion valuation as a reference, Nebius' stake would be worth approximately $560 million.

12. Final Valuation

The core Nebius business is planning to scale to 400 MW of capacity, targeting $3 billion in revenue by FY2028. At a 9x sales multiple, that puts it at $27 billion.

If they manage to hit their ambitious 1 GW target and generate $13.3 billion in revenue, that would imply a $120 billion valuation using the same multiple.

Yes, it would require a massive financing round, but if that growth is achieved, the shareholder returns would vastly offset the possible dilution.

Valuation Summary by Business Unit

Nebius Cloud Core (2026–28): $27B to $120B

Avride: $6B+ (with upside toward $10B+)

Toloka: ~$1.6B

TripleTen: ~$320M

ClickHouse stake: ~$560M

13. Looking Ahead

I believe Nebius Group could reach a $10 billion+ valuation this year, given their $1 billion ARR target and projection of breaking even in adjusted EBITDA.

Looking further out, Nebius Core and Avride alone could be worth multi-dozens of billions each, depending on overall AI compute demand and execution in the autonomous driving segment.

If Nebius achieves its ambitious goal of scaling to 1 GW of data center capacity by 2026, the upside could be significantly higher. Based on the same linear ARR assumptions and a 9x sales multiple, this scenario would imply a $120 billion valuation for Nebius Core alone. It’s a bold target and would require flawless execution and major capex, but if they pull it off, shareholders stand to possibly gain tremendously.

Financing Pressure in a Bearish Market

I think Nebius management must be concerned about the current market bearishment. The company has repeatedly made clear that the main reason for going public was to gain access to easy financing, given that they operate in a capex-intensive business.

Of course, they’re not just relying on ATM offerings. They’ve historically pursued private placements, with notable investment from NVIDIA. The issue is that their leverage in negotiating valuation during these rounds depends heavily on overall market conditions and NVIDIA’s capacity to deploy capital.

If the market declines or a recession weakens compute demand, it could create a serious bump in the road for Nebius’ scaling plans.

Still Strong if Conditions Stay Conservative

That said, it wouldn’t be the end of the world. With their current cash balance, Nebius can still successfully scale both their data center core business and their Avride segment.

But the difference between becoming a $20 billion company and a $100 billion company in the next couple of years will ultimately come down to macro conditions.

Even in a conservative case, just with the Finland expansion, Paris and Iceland colocation, Missouri, and additional capacity in New Jersey, plus Avride and the other business units, you’re still looking at a company that can deliver strong shareholder returns.

So I’d call the conservative scenario good, and the bull scenario magnificent.

The Bear Case

Of course, there’s a bearish scenario worth thinking about. What if there’s a global recession, AI compute demand stagnates or declines, and the trade war ends up slowing AI progress by a decade?

It would be catastrophic, no doubt.

Still, given the rapid pace of development in AI, AI agents, autonomous vehicles, robotics, and next-gen startups, it’s hard to believe that demand for compute won’t continue to rise dramatically year after year. All projections and research point in that direction, and the demand for AI accelerators clearly reflects this ongoing trend.

Will shareholders fully benefit?

Probably not entirely.

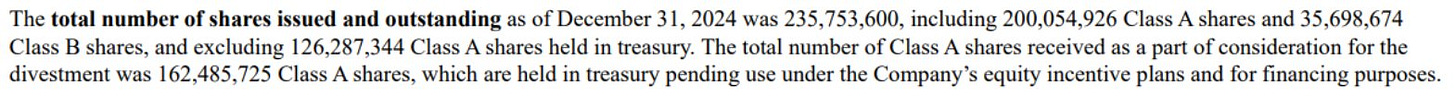

After their December financing round, which raised $700 million, Nebius now has 235 million shares outstanding and 126 million shares held in treasury, which will likely be used for employee incentives and future fundraising.

Nebius still has significant funding requirements. Their cloud business is capex-intensive, and they are preparing for the Blackwell generation, with Rubin already on the roadmap. Avride also still requires funding before becoming self-sustaining.

So yes, some dilution is inevitable. But if total dilution tops out at 53%, and market conditions remain stable or improve, I don’t see this as a major concern at the current ~$6 billion valuation.

At this level, $NBIS could 10x in 5 to 7 years, so some dilution shouldn’t be a big concern for investors.

And honestly, I’ll go even further. If AI compute demand accelerates and Nebius scales to 1 GW while Avride executes well, I might actually be underestimating the upside.

As wild as it may sound, this could become a 10x in just 5 years, even after accounting for dilution.

Conclusion

Nebius is on the right path to becoming an AI cloud leader. Just as we’ve seen giants like AWS, Azure, Google Cloud, Oracle, and Salesforce arise in the traditional cloud space, Nebius is set to reach a similar status among AI cloud providers in the coming years.

As good as Nebius’ current offerings are, what will truly differentiate them over time is the massive talent within the company. Nebius was originally part of Yandex, the Google of Russia, and it has a large team of some of the best AI and machine learning engineers and scientists in the world.

They’re already standing out in the data center and cloud space through in-house development and R&D, but they also have some of the best autonomous software in the world. You can’t achieve that without elite talent.

At the end of the day, Google, Tesla, and Nvidia are where they are because they have world-class professionals. Nebius also has that level of talent, better than what we see at other AI cloud providers.

Their autonomous software could even be redesigned for robotics in the future through the right partnerships. When you have this kind of talent, the potential is enormous.

I wouldn’t be surprised to see this company become a major tech giant. Great companies tend to surprise to the upside, and I think Nebius will deliver more than a few positive surprises in the years ahead.

Thank you for your deep dive on Nebius. I have entered a bullish setup on NBIS based on your analysis (and a few others), and have added a link to your deep dive in my recent post describing the trade. It will be great to get your feedback on my NBIS trade setup. Thank you.

https://walkerrauschenberg.substack.com/p/nyse-four?r=5rdmrq