Is Nebius Still a Buy?

Nebius (NBIS) is up nearly 200% in 4 months. Is there still room to run?

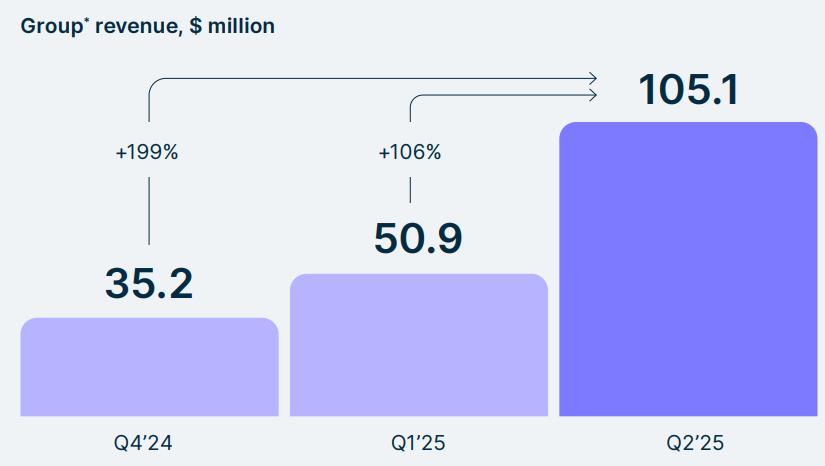

Q2 Earnings Snapshot

Q2 Revenue: $105.1M vs. $101.2M consensus (raised from $94.7M pre-release)

ARR Guidance Raised: From $750M–$1B → $900M–$1.1B

Core Business Adjusted EBITDA: Positive, ahead of plan (vs. estimated loss)

EPS: -38 cents vs. -42 cents (estimated)

YoY Revenue Growth: +625%

QoQ Revenue Growth: +106%

Power Capacity Buildout: On track to secure over 1 GW by the end of 2026

Overview

Nebius earnings are even more impressive than they appear. They didn’t just beat across the board, they did so while excluding Toloka, a divested unit, from their consolidated results.

They also achieved core EBITDA profitability earlier than expected, supported by a massive gross margin expansion, from 47% to 71% in a single quarter.

Another key highlight: Nebius grew significantly while reducing their SG&A expenses year over year. They now require less marketing to meet overwhelming demand.

This sharp profitability improvement is explained by the timing of their contracts. When new capacity is added, GPUs are not instantly utilized. Some are pre-contracted, while others sit idle for a time.

But in Q2, they achieved full capacity utilization, as management explained in the earnings call:

"We could grow faster, but we were oversold on all of our supply of previous-generation Hoppers, and we decided to wait for the new generation of GPUs to come."

"By the end of Q2, we were at peak utilization. The demand environment is very strong. As we brought on more capacity, we sold through it. If we had more capacity, we probably would have sold more as well."

This is an extremely bullish signal. Nebius is not demand-constrained, but supply-constrained. The market is absorbing new capacity almost instantly.

The need for compute driven by AI far exceeds expectations. Companies satisfying that demand, whether AI accelerator providers like AMD and NVIDIA, memory manufacturers like Micron, or retailers of infrastructure like Nebius, are perfectly positioned to become giants in an economy where FLOPs, not karats, are the most valuable resource.

Following this surge in demand, Nebius raised its ARR guidance for 2025 to a $1B midpoint.

Additionally, the company stated:

"Pricing trends remain relatively stable for the Hoppers."

This is another bullish signal, as price stability helps mitigate concerns about depreciation, a critical issue for capital-intensive AI infrastructure businesses.

Enterprise Customers

Nebius’ client strategy follows a clear progression:

Started with small and mid-sized AI labs

Next, targeting larger AI labs (potentially Perplexity, OpenAI, or Anthropic) now that their data center capacity has grown

Ultimate focus: enterprise customers

Enterprise has always been the core target, as it represents the largest total addressable market for Nebius, and the strategy is progressing exceptionally well.

They’ve already secured two major enterprise clients: Shopify and Cloudflare.

The Enterprise Opportunity

Building highly intelligent AI models is essential. But once those models are trained, the much larger opportunity lies in fine-tuning and running inference.

Think of it like building a car. It takes a lot of energy to manufacture it, but once it hits the road, the energy used during its lifetime far exceeds the energy used to build it.

The same applies to AI. Training is just the start. Running inference at scale, especially with company-specific models and AI agents, is where the bulk of compute demand lies.

And every enterprise on the planet will need AI compute to stay competitive.

That’s the market Nebius is targeting, and so far, they’re executing with precision.

Data Center Expansion

Nebius now operates across seven data centers, with rapid expansion underway:

Europe

Finland (Wholly Owned):

Their only fully owned data center, with a 75 MW capacity. Expected to generate $1B in ARR starting next year.France (Paris - Equinix Colocation):

A smaller deployment, likely aimed at addressing local demand.Iceland:

Currently running with 10 MW of capacity.United Kingdom & Israel:

Each will host 4,000 Blackwell GPUs.UK goes live in Q4 2025

Israel is scheduled for early 2026

United States

Kansas City:

Operational since Q1 2025 with an initial 5 MW, now being expanded with Blackwell GPUs.New Jersey (Major Catalyst):

25 MW coming online in a matter of weeks

100 MW operational by year-end

Two New Greenfield Sites (Coming 2026):

Nebius announced that they are close to securing two massive greenfield locations in the U.S.

Each is expected to deliver hundreds of megawatts of power in 2026. A formal announcement is expected soon.

The Full-Stack Advantage

Nebius chooses greenfield builds over colocated or retrofitted data centers due to strategic and financial advantages:

Full control over design, construction, hardware, and deployment.

Custom design down to the motherboards, servers, racks, and entire building layout.

In-house integration of fiber, power, and infrastructure, optimizing every layer of the stack.

20% lower total cost of ownership compared to market average, according to the company.

Offers greater flexibility and efficiency for AI-specific workloads.

Nebius is not just a cloud provider. It controls both the hardware and software stack, enabling a level of integration and performance far beyond traditional players.

The Nebius Group

Nebius goes far beyond just data centers and GPUs.

The company also operates two additional business units and holds strategic investments in the revolutionary database ClickHouse and the AI training platform Toloka.

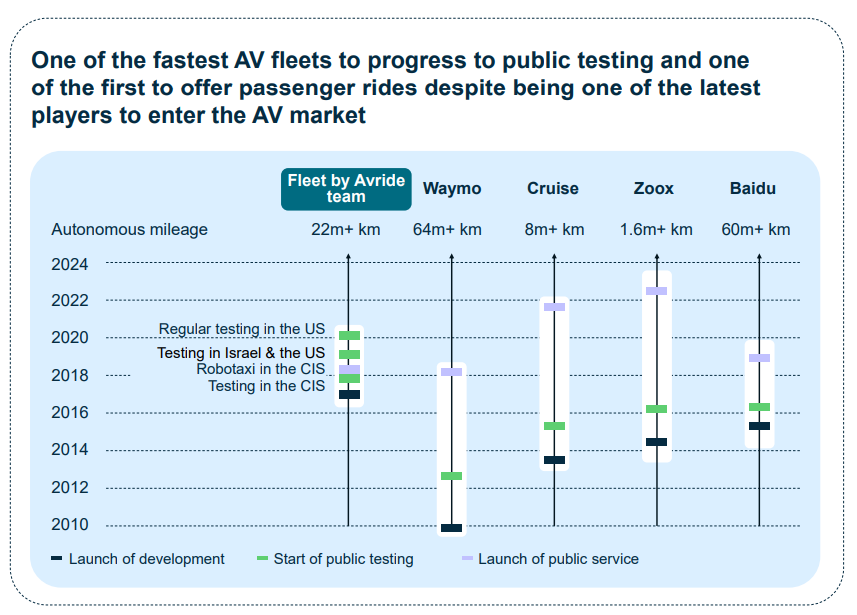

Avride

One of Nebius' most promising business lines is Avride, an automation technology company focused on robotaxis and autonomous delivery robots. Its self-driving stack is among the most advanced in the world, and unlike most competitors, it even designs its LiDAR systems in-house.

They were the first company to launch robotaxis in Europe and now operate in Moscow under Yandex. Their robotaxis have driven over 22 million kilometers, compared to:

64 million for Waymo

8 million for Cruise

1.6 million for Zoox

Avride has also been aggressively expanding its robotic delivery operations across several geographies.

In the US, its robots delivered Uber Eats orders from restaurants in Jersey City, Dallas, and Austin. It also piloted a grocery delivery program with H-E-B, one of Texas’s largest supermarket chains. In Ohio, delivery operations at The Ohio State University continued via a partnership with Grubhub, launched in early 2025.

In Japan, Avride partnered with Mitsui Fudosan to deploy robots at the country’s largest outlet mall. These robots manage warehouse-to-store logistics, delivering packing materials and transporting items to centralized pickup points.

Meanwhile, the team is finalizing preparations for the autonomous ride-hailing launch in Dallas. In Q2, Avride continued testing its fleet in real-world conditions to ensure safety and performance. The cars include Ioniq autonomous vehicles, developed in partnership with Hyundai, with Avride handling all software development and systems integration.

Avride already has a partnership with Hyundai and plans to scale to fully driverless cars this year.

What’s surprising is how under the radar this company still is. Before discovering Nebius, I had never even heard of it, yet it appears to be more advanced than Cruise or Zoox.

Cruise’s last funding round valued it at $30 billion, though that has since dropped to around $15 billion due to disappointing progress.

Zoox, now valued at $6 billion, has logged far fewer testing kilometers than Avride and has a less proven track record. Although Zoox also plans to begin commercial operations this year, it is not expected to reach the 100 vehicles that Avride has planned.

Zoox does benefit from a stronger cool factor thanks to its custom-built vehicle and Amazon’s backing, but given Avride’s extensively tested technology, its valuation should not be far behind.

Perhaps the closest competitor to Avride is Motional.

Like Avride, Motional has a partnership with Hyundai and is working toward launching robotaxis, though its target is 2026. It has been testing in five U.S. cities, but its technology is not as mature. Motional has yet to test its cars on highways, and it has not disclosed total test mileage. It remains uncertain whether the company will meet its 2026 goal.

Motional was last valued at $4.1 billion.

Considering the valuations of Cruise, Zoox, and Motional, it is difficult to justify Avride being valued at anything less than $6 to $7 billion. Zoox is probably undervalued, while Cruise and Motional appear to be overvalued.

Waymo, of course, still deserves its $45 billion valuation as the undisputed leader in the space, but Avride has the chance to become a good second this year if the deployment works as expected.

TripleTen

TripleTen is an online coding bootcamp designed to help individuals transition into tech careers, even without prior experience.

The platform continued to show strong growth in Q2, supported by a quarter-over-quarter enrollment increase of approximately 6,000 new learners and a rise in average revenue per student. These trends highlight sustained demand across key regions, particularly the U.S. and Latin America.

Nebius also holds two highly strategic investments that complement its core infrastructure and AI stack.

Toloka

Previously a Nebius business unit, Toloka became an independent entity following an investment from Bezos Expeditions. It is a data generation platform that provides high-quality labeled data for AI labs through a global network of contributors.

Toloka plays a critical role within the Nebius ecosystem, and its tools are trusted by some of the largest AI players in the world, including Anthropic, Microsoft, Hugging Face, and Amazon.

ClickHouse

ClickHouse is a cloud-native data management and analytics platform, widely recognized as one of the best in the world at what it does. Its ultra-fast performance and scalability make it the database of choice for major global companies, including Meta, Block, Anthropic, eBay, Lyft, HubSpot, Didi, and Spotify.

As of its most recent funding round in May 2025, ClickHouse was valued at $6.35 billion. With Nebius holding an estimated ~25% stake, that investment alone is now worth approximately $1.6 billion.

Catalysts

Several major events could drive Nebius higher in the near and medium term:

New Jersey data center going online, along with the announcement of additional large enterprise clients

Formal announcement of new U.S. greenfield data center sites, each expected to support hundreds of megawatts in 2026

Launch of Avride's robotaxi service in Dallas, marking its first autonomous ride-hailing deployment in the U.S.

A strategic partner taking equity in Avride, potentially Uber, given their existing collaboration

ClickHouse valuation boost through either a new funding round (short term) or a potential IPO (long term)

New analyst coverage. Currently, the only large institution covering the stock is Goldman Sachs. It's still not covered by JPMorgan, Morgan Stanley, or Bank of America, among others.

Risks

I could outline plenty of risks here, from depreciation to uncertainty around future margins, but I believe that would be a waste of time. I don’t see those as real concerns. In fact, I believe Nebius is the AWS of the 2020s.

There is, however, one legitimate risk that I do see. It is not significant in the short term, or even in the mid term, but going forward, it is definitely something to consider.

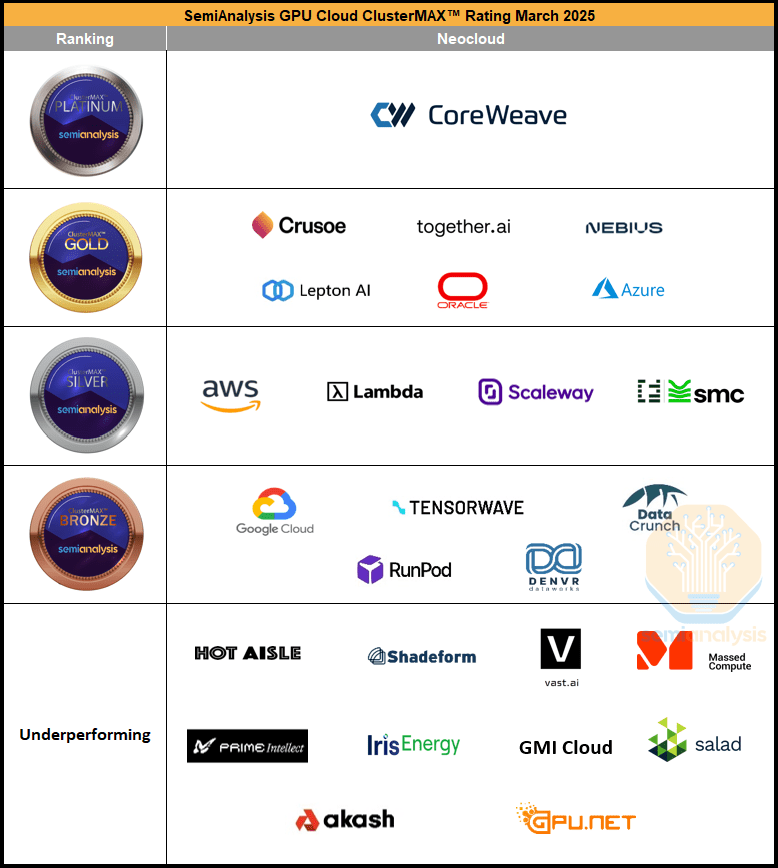

This risk is NVIDIA Lepton. Lepton is NVIDIA’s attempt to create a one-cloud-for-all experience. The idea is to offer a consistent and seamless user interface across all AI cloud providers, under the NVIDIA brand. In this model, providers like Nebius, CoreWeave, or Crusoe would simply offer their GPUs through NVIDIA’s unified platform.

This model could eliminate Nebius' biggest moat, which is its software stack. AI labs didn’t choose Nebius because of pricing or marketing. What attracted them was the great usability, smooth onboarding, and world-class support.

If NVIDIA delivers a state-of-the-art software layer that gives every provider the same high-quality user experience, what remains to differentiate Nebius?

Can Nebius avoid that? I believe so.

They can continue their partnership with NVIDIA and offer part of their capacity through Lepton, but they can also maintain their own platform in parallel. And given how good their current stack already is, it is entirely possible that they remain competitive even if Lepton succeeds.

Another layer of protection comes from enterprise contracts. If Nebius continues to secure deals and build trust with large caps like Cloudflare and Shopify, they lock in long-term revenue. Why would these companies access Nebius through NVIDIA if they are already getting what they need directly from Nebius?

Still, the underlying risk remains. No one wants to compete with NVIDIA. If NVIDIA provides a first-class user experience at a commission, even bare-metal providers can suddenly become strong competitors. What used to be a weak rival could now be supercharged by NVIDIA’s software layer, and that changes the game.

Not everything is perfect. Even a company as strong as Nebius has risks, and this one should not be ignored. It is important to stay focused on NVIDIA’s moves, and not underestimate how fast Lepton could shift the landscape.

Valuation

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.