Is AMD a Buy Right Now?

Why did AMD have a bad quarter? Is it an opportunity?

AMD just reported earnings, and the market didn’t take it well. Now investors are asking: What do I do with this one?

Should I ditch it and rotate into NVIDIA? Or stick with it?

Is the best still to come?

In this article, I break down the quarter, what it means for the AMD thesis, and whether this could be a buy-the-dip opportunity.

Q2 Earnings Snapshot

Beat

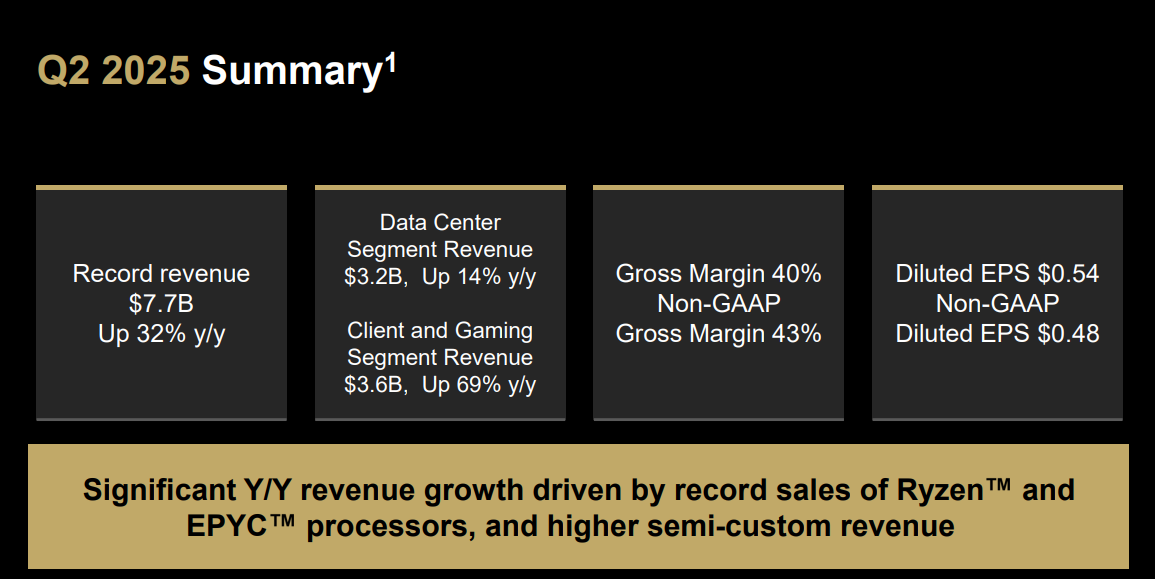

🟢 Revenue: $7.69B, +32% YoY (roughly 4% above the $7.41B consensus)

🟢 Revenue guide midpoint: $8.7 B (Street $8.3 B) ≈ 5 % surprise

In Line

🟡 $0.48 EPS, in line with expectations

Miss

🔴 Gross margin: 43% vs. 53% Street average, weighed down by a $800M MI308 export-related charge. Adjusted GM would’ve been ~54%

Segment Breakdown

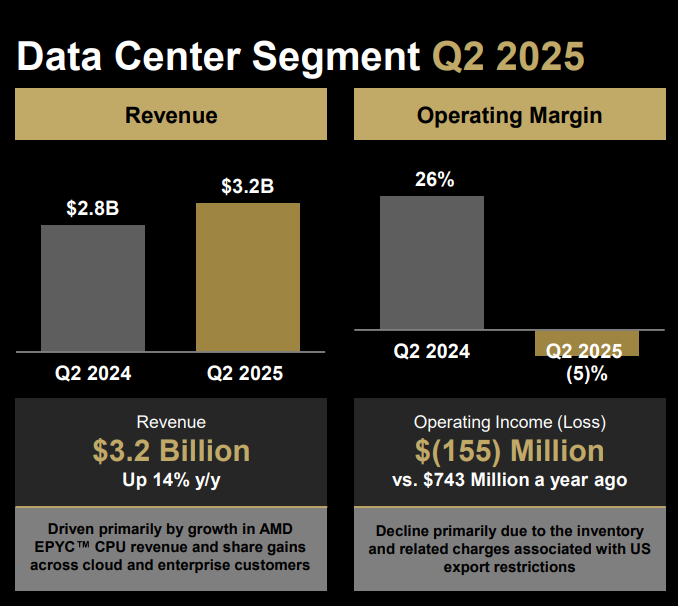

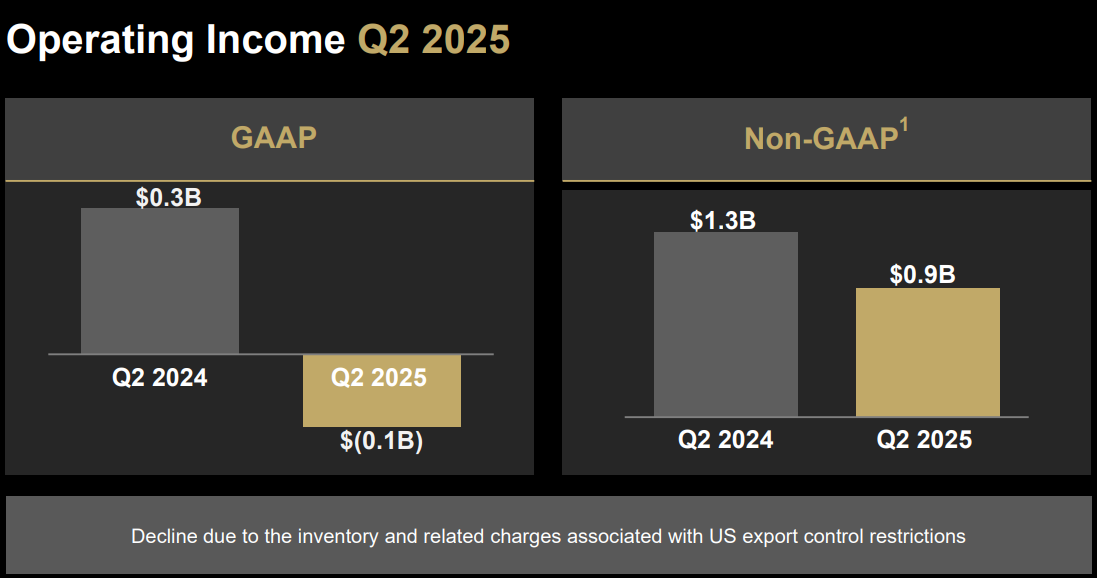

Data Center: $3.24B revenue, +14% YoY. Operating income swung to a $(155)M loss due to the MI308 charge.

Strong EPYC CPU sales offset GPU weakness. Without the charge, the segment would've delivered a high-teens margin.

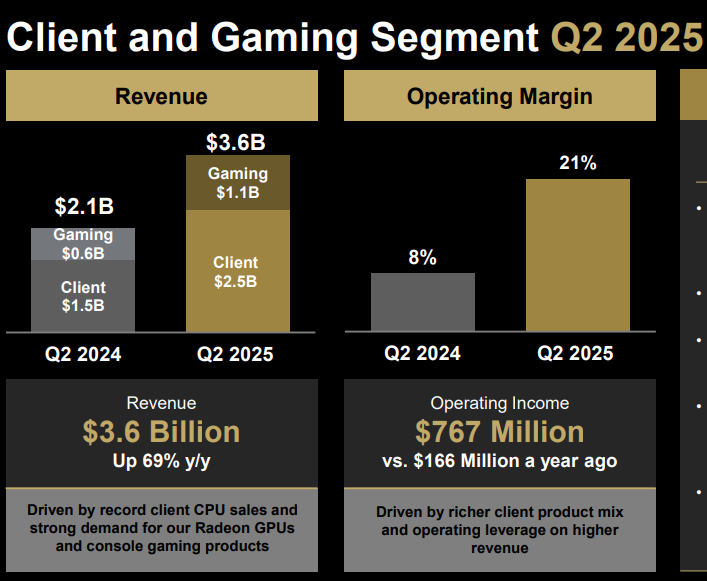

Client + Gaming: $3.62B, +69% YoY. Record quarter for Ryzen desktop at $2.5B and Radeon-driven Gaming at $1.1B. Operating income reached $767M, supported by a better product mix and strong leverage.

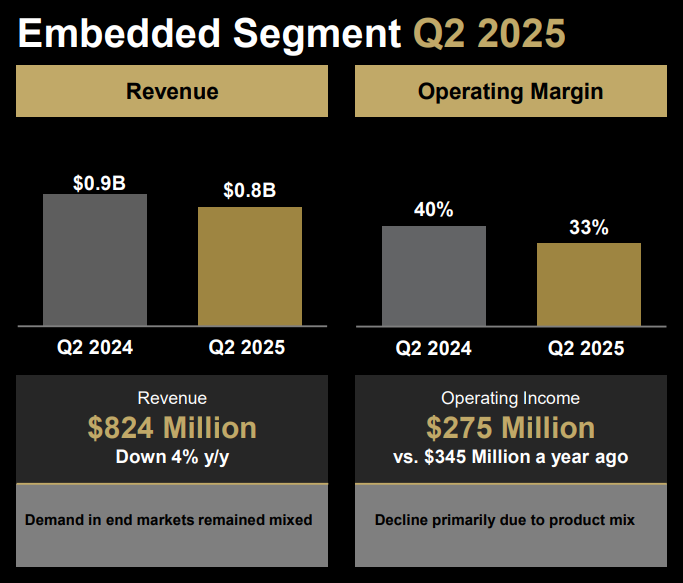

Embedded: $824M, –4% YoY. Auto and industrial demand remained soft, but still delivered $275M profit.

Operating Expenses

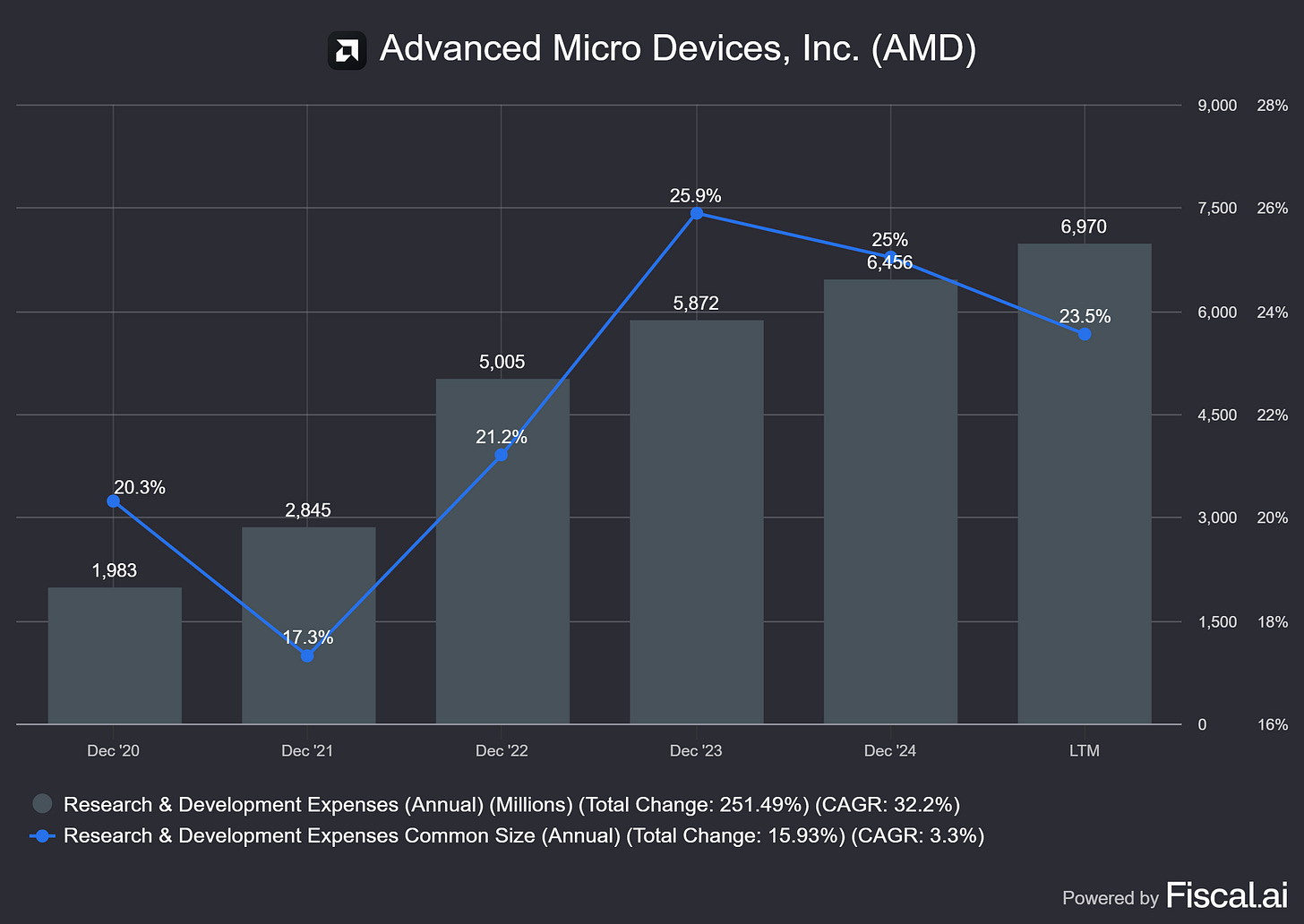

Opex: $3.19B, +23% YoY, driven by higher R&D spend on MI350, MI400, and Turin CPUs, plus the first full quarter of ZT Systems costs

Management guided a near 19% R&D run-rate as the “new normal” to maintain a yearly GPU release cycle

Cash Flow

Operating cash flow: $1.46B, but $330M came from receivables factoring and $836M from stretched payables. True underlying cash generation was closer to flat.

Free cash flow: $1.18B, after $282M in capex, mostly related to MI350/MI400 test capacity.

Balance Sheet

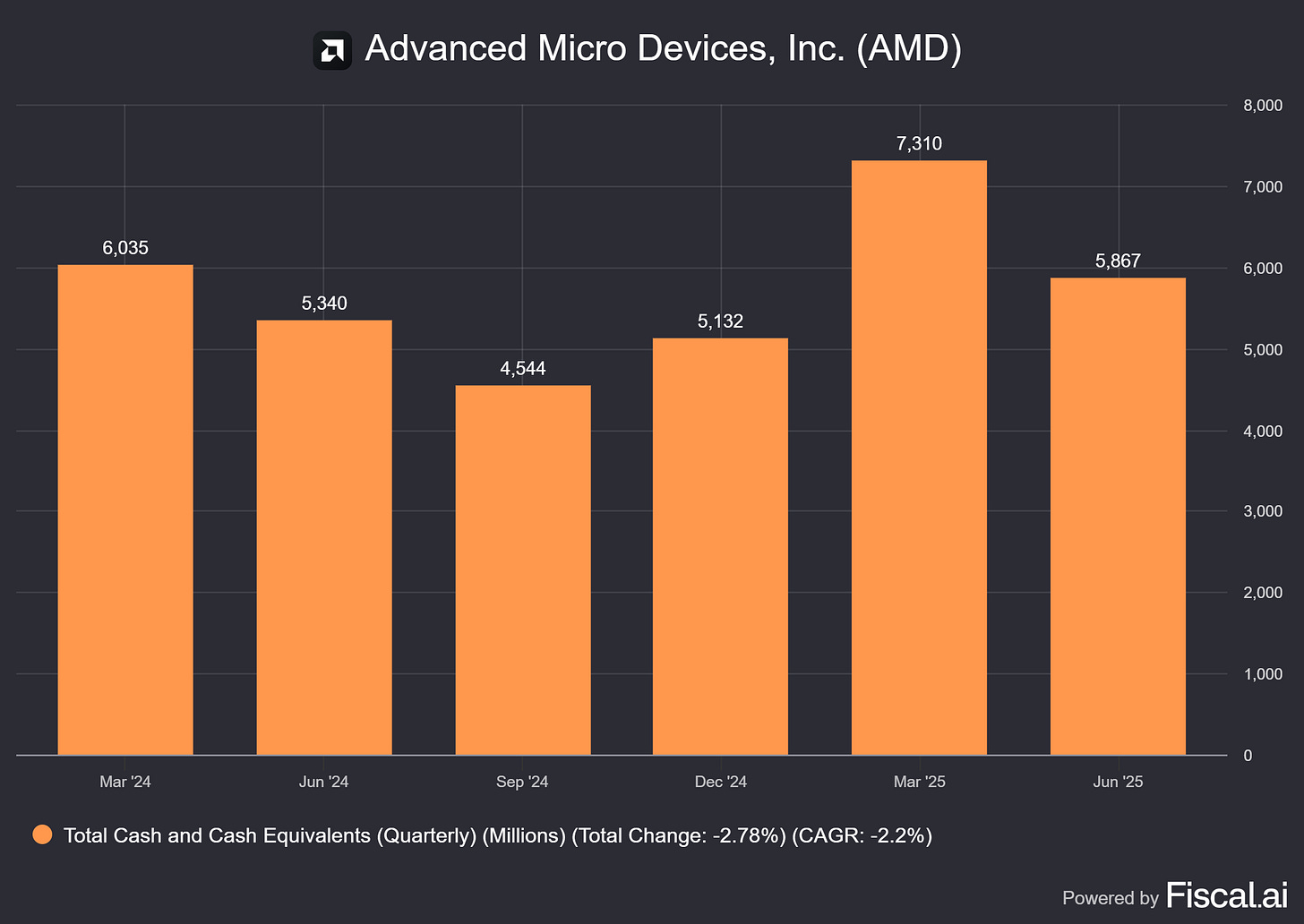

Cash + short-term investments: Fell 20% QoQ to $5.87B due to $478M in share buybacks and the ZT acquisition.

Accounts receivable: Down 6% QoQ (reflecting factoring activity)

Inventories: Up 4% QoQ as MI350 ramps

Total debt: Reduced to $3.22B after retiring $950M in commercial paper linked to ZT

One-Time Charges

The $800M MI308 write-down dragged gross margin from an adjusted 54% to the reported 43%. Management confirmed the charge is behind them.

ZT Systems amortization: Drove $568M in non-cash expense. This amortization will continue for years and should be excluded from EBITDA comparisons.

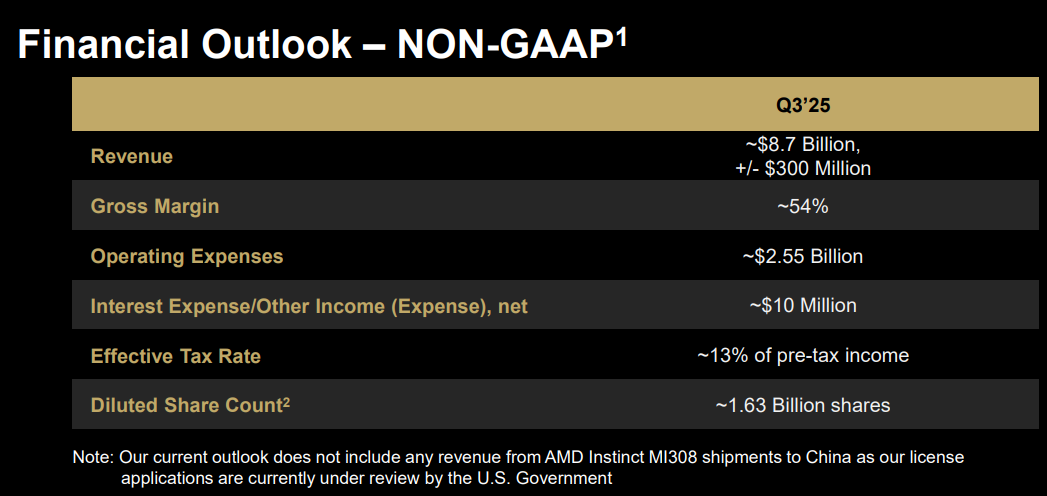

Q3 Outlook

Revenue guidance: Approximately $8.7 billion, plus or minus $300 million

At the midpoint, this implies ~28% YoY growth and ~13% sequential growth

Non-GAAP gross margin: Expected to be around 54%

IMPORTANT: Guidance does not include any revenue from MI308 shipments to China, as export licenses are still under review by the U.S. Government

Quarter Overview

AMD posted 32% revenue growth in what was a weak quarter for Data Center GPU demand.

Ryzen desktops and EPYC server CPUs held up the business, while MI308 units bound for China sat unused.

Management is guiding for 13% sequential growth in Q3 as MI350 ramps and Zen 5 sales increase.

Profitability

GAAP net income was $872M, although there’s an asterisk to this.

The 10-Q shows:

An $834M one-time tax reserve release

A $104M gain from discontinued operations

These two items flipped what would’ve been a pre-tax loss into a headline profit.

What’s a tax reserve release?

Companies set aside cash when there’s uncertainty around a tax deduction. If the deduction is later approved, that reserve is reversed; it’s not new profit, just an accounting adjustment from a risk that didn’t materialize.

As for the $104M gain, it’s tied to AMD’s plan to sell its low-margin ZT Systems unit. That gain came mostly from fair-value adjustments and currency moves, not real business performance.

Core operations actually lost $74M pre-tax. The entire $872M net profit came from accounting tailwinds.

Cash flow looked solid at $1.5B from operations and $1.2B in free cash flow, but there’s more to it:

$330M boost from receivables factoring

$836M in delayed vendor payments

Bottom Line

This was a tough quarter for AMD, not just in terms of data center revenue, but also in profitability. That said, there’s a clear explanation, and none of it looks structural.

The company faced two major headwinds at once:

China export restrictions on MI308 accelerators

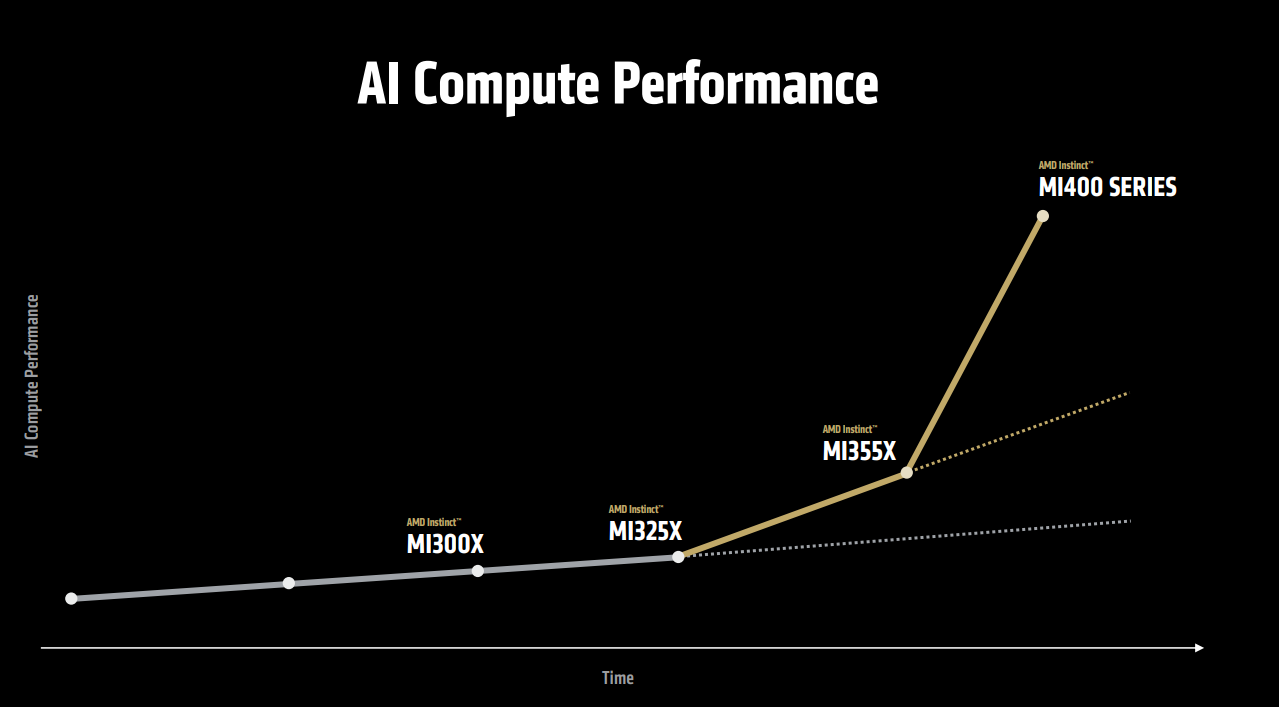

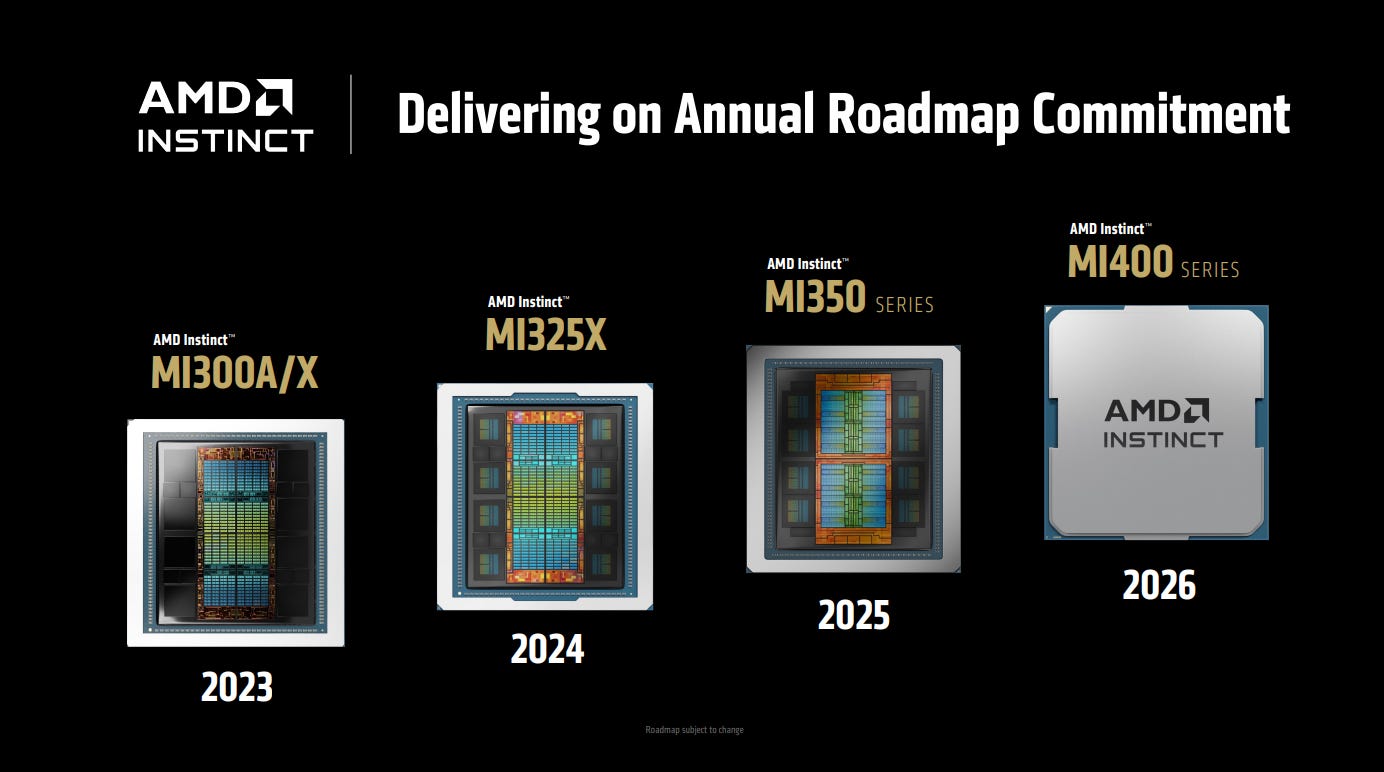

A transition phase from the MI325X(a weak offering to fill a gap) to the new MI350 series

The underlying story hasn’t changed. This was just a bad window in an otherwise solid long-term trajectory.

Growth reacceleration

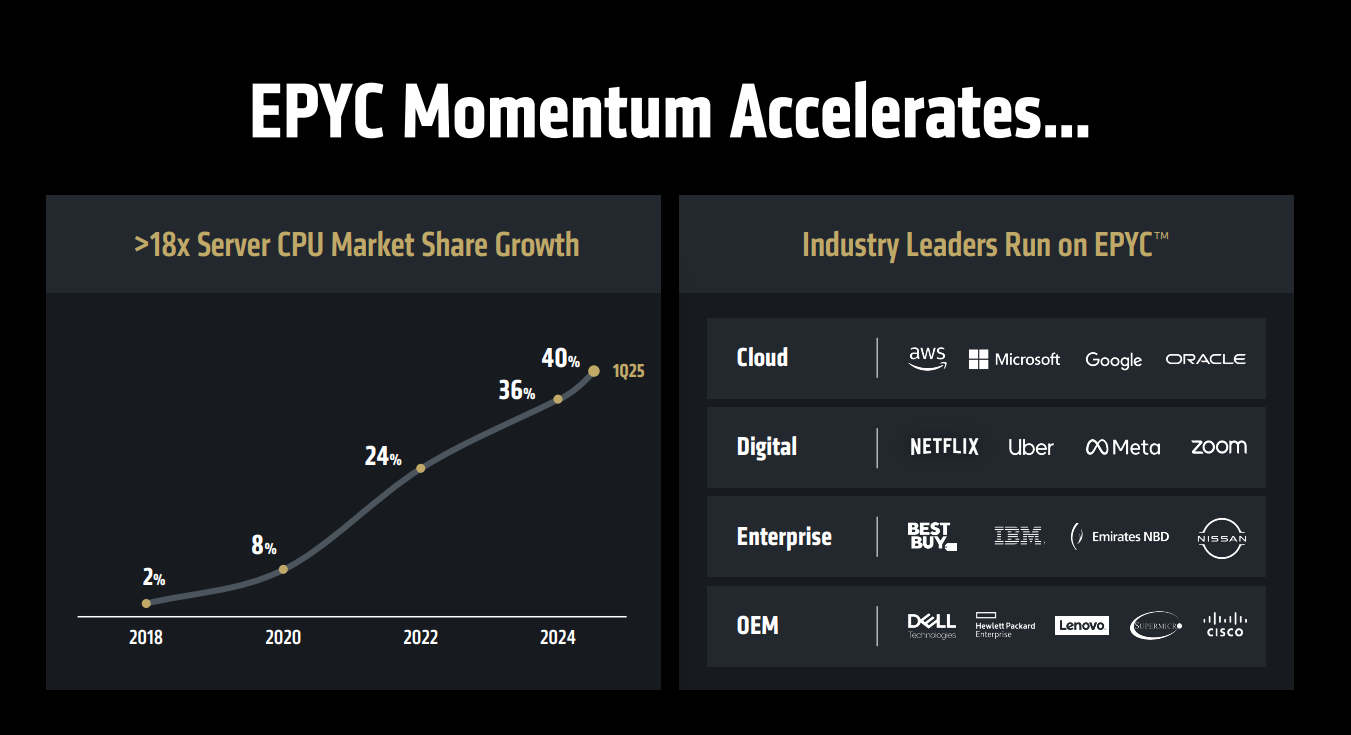

Despite MI308 being sidelined, AMD still posted 14% data center growth, which shows EPYC CPUs are winning sockets. But this is just the beginning. The real upside starts now, with the launch of the MI350 series this quarter.

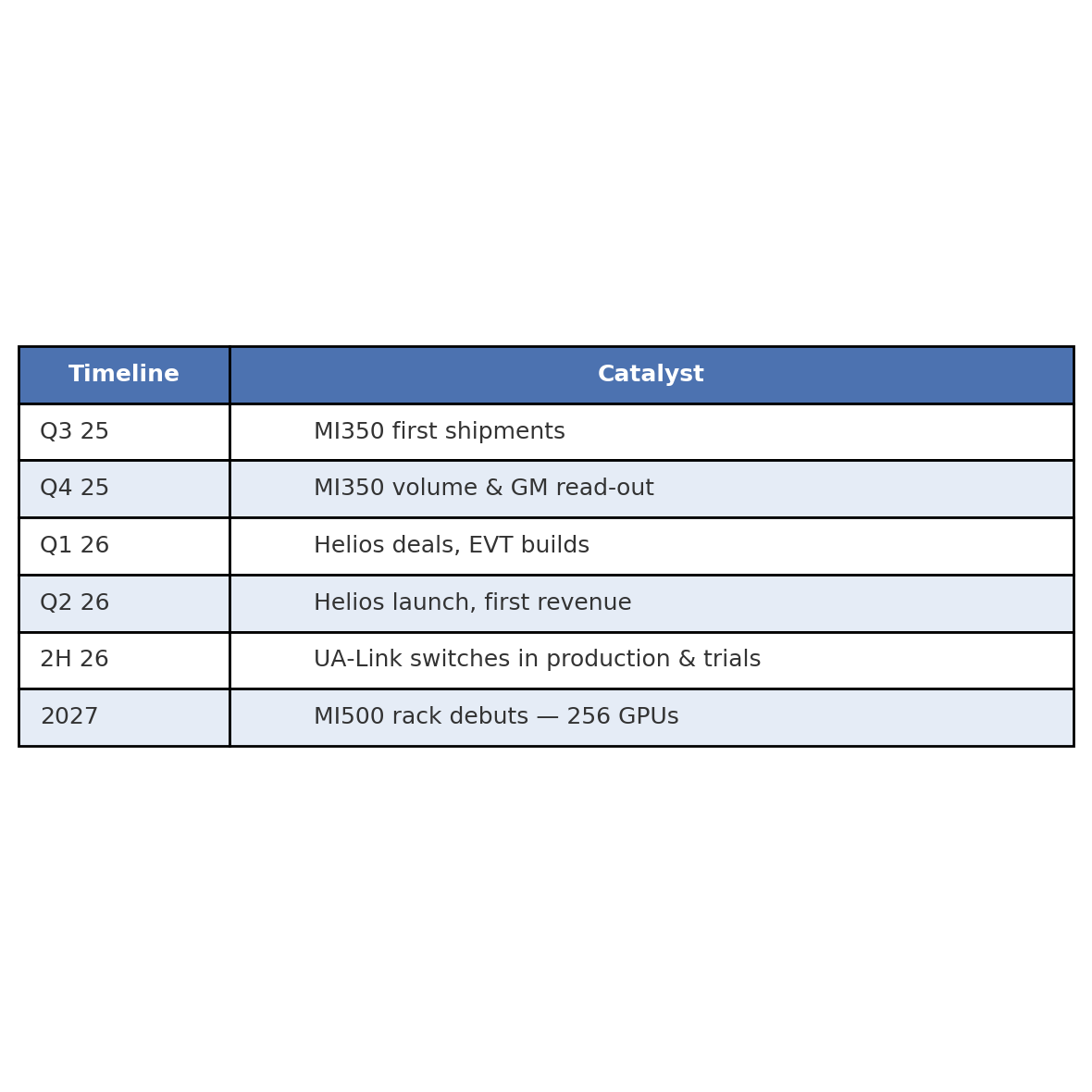

The demand isn’t just speculation. Microsoft has already shown strong interest, xAI announced a purchase, and Meta and Microsoft are expected to follow. Meanwhile, Oracle revealed plans to build zetascale clusters using AMD systems, with over 100,000 GPUs.

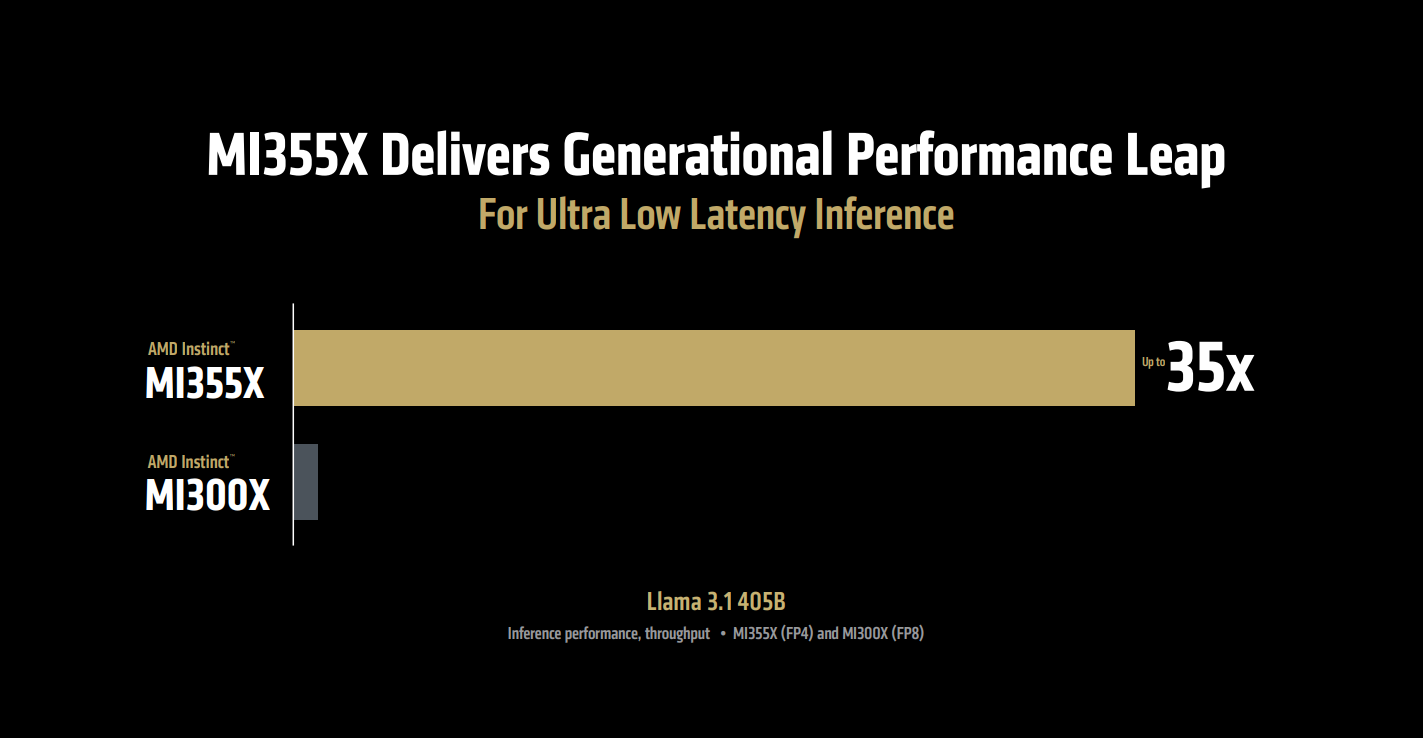

The MI355X is already attracting serious orders. In addition to Oracle, Crusoe placed a $400 million order, and other neocloud providers like TensorWave, Vultr, and Hot Aisle are preparing to deploy the system. AMD is clearly gaining ground.

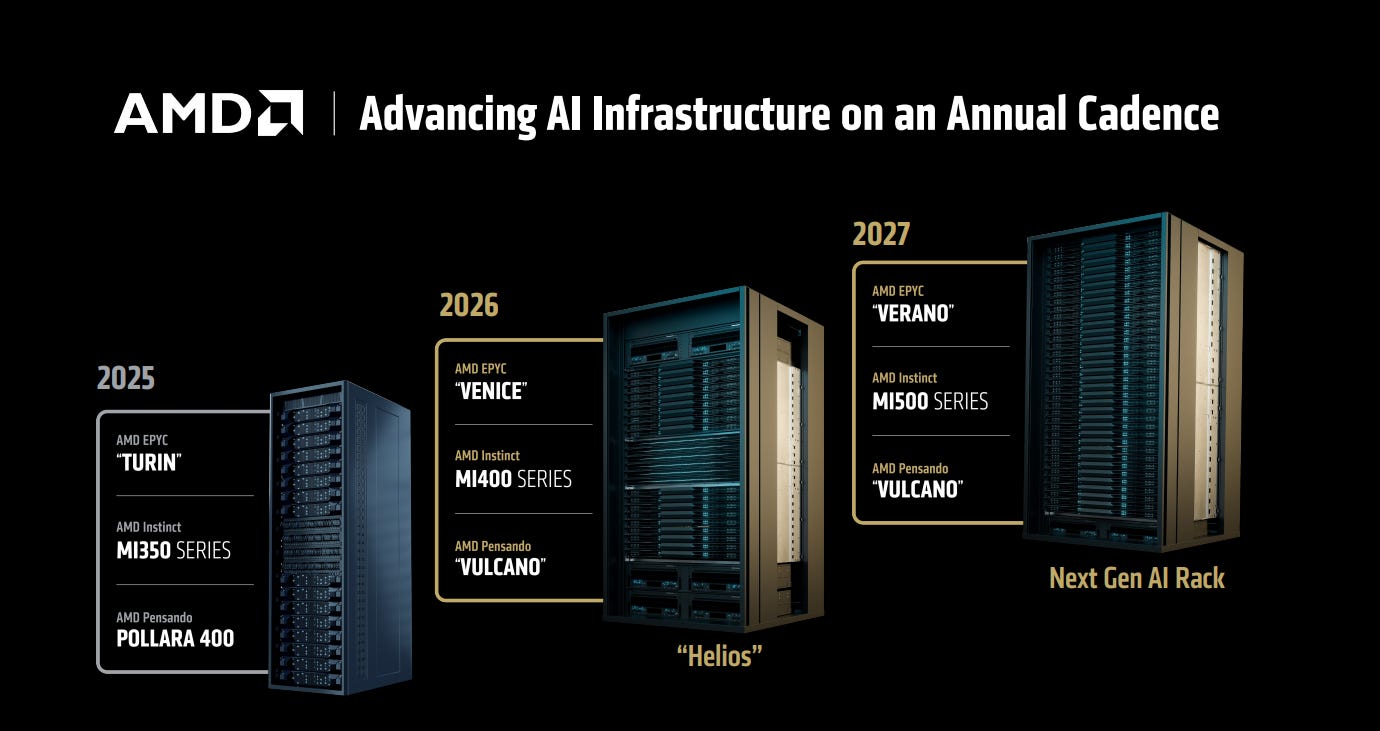

Next up is MI400, expected in Q2 2026. AMD will launch Helios, its first rack-scale system, featuring 72 fully interconnected GPUs, powered by the MI400 series accelerator, a next-gen EPYC CPU, and a Pensando NIC. It’s built to rival NVIDIA’s Vera Rubin, and with AMD’s memory bandwidth advantage and impressive inference performance, it could go beyond just competing, it could signal a shift in leadership.

That interest is already showing. Sam Altman personally announced OpenAI is collaborating with AMD on the MI400. If AMD delivers, this could be the moment that pushes it into trillion-dollar territory. And OpenAI won’t be the only one. The entire industry is watching closely.

AMD’s approach has been step by step. First, build the best chips. Then, design the servers and racks. Now, they’re aiming to deliver the best solutions across every level, from hyperscale data centers to enterprise, desktops, and laptops.

And they’re not stopping. At the Advancing AI event, AMD also introduced the upcoming MI500 series, set to debut with a rack system featuring 256 interconnected GPUs, well above NVIDIA’s Rubin Ultra, which is designed for 144.

Outscaling NVIDIA by this margin would be a first. Now it’s all about execution. But one thing is clear: the future looks exciting for AMD.

You can dig deeper in these two pieces:

• AMD: The next AI giant?

• $AMD: The Next 10-Bagger?

Market opportunity

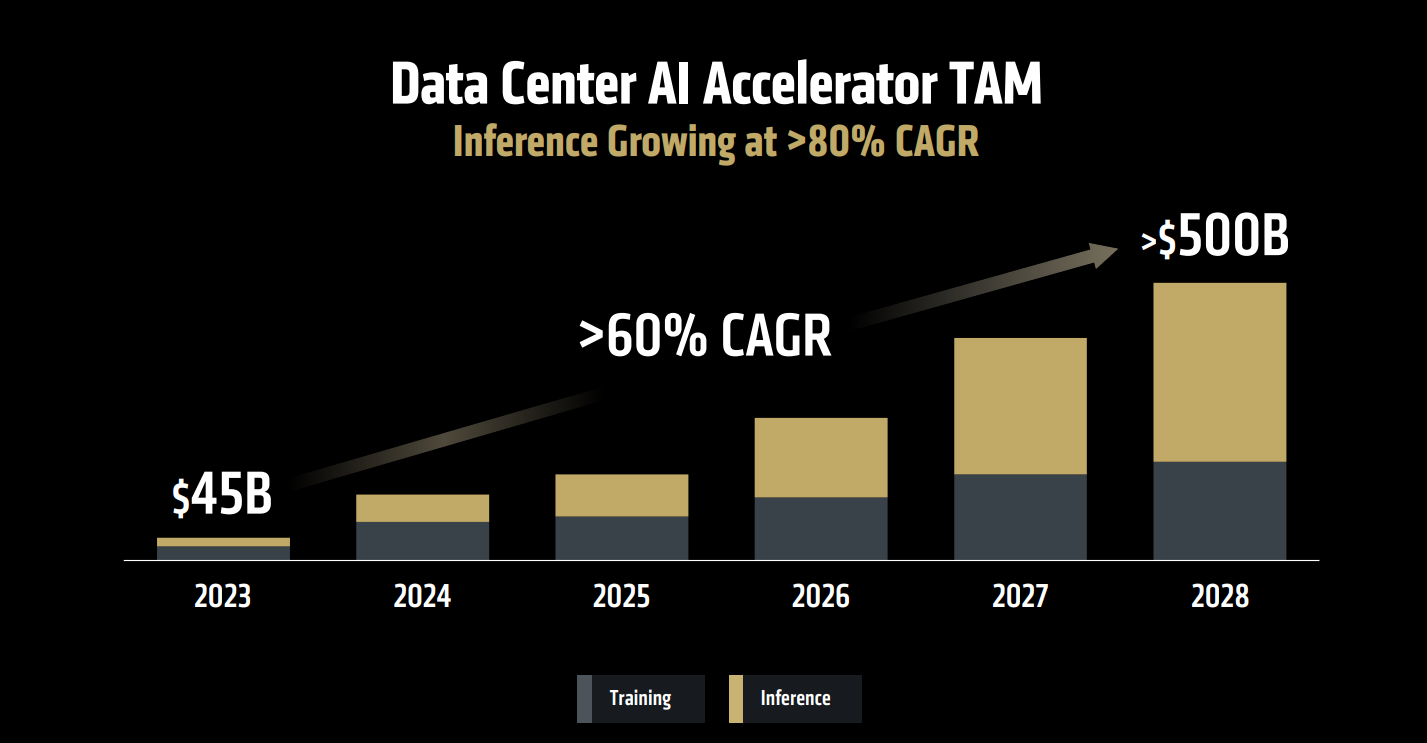

At Advancing AI 2025, AMD shared a slide projecting the AI accelerator TAM to hit $500B by 2029, growing at a 60% CAGR. Even applying a conservative 10× sales multiple, the long-term opportunity in silicon and systems could easily stretch into multi-trillion-dollar territory.

And this isn’t just AMD talking. NVIDIA is also pivoting heavily toward inference. Their CEO, Jensen Huang, recently stated that agentic AI as an inference workload could drive GPU demand through the roof.

“The amount of computation we have to do for inference is dramatically higher than it used to be,” Huang said. “The amount of computation we have to do is 100 times more, easily.”

AMD already holds over 40% share in server CPUs, up 18× since 2018. Management is now betting that GPUs will follow a similar curve as the ecosystem continues to mature.

Key Catalysts

Short term

• Export-license relief. U.S. and China continue negotiating updated restrictions. Even a partial reopening of the MI308 sales channel could instantly restore ~200 basis points of gross margin.

• MI350 volume shipments. Oracle, Meta, and Microsoft are first in line. Internal benchmarks show clear training throughput gains over MI300X, and memory capacity more than 67% higher than NVIDIA’s H200.

Mid term

• MI400 rack-scale adoption. OpenAI is already collaborating with AMD, a clear sign that hyperscalers are seeking alternatives to Blackwell.

Long term

Owning AMD right now is like owning picks and shovels during a gold rush. Their business is riding a structural tailwind, the growing need for compute, driven not only by AI training, but even more so by inference.

LLMs, AI agents, and automation at scale will all require huge compute capacity, and AMD, through its full-stack ecosystem, is in a prime position to capture this demand and lead the next era of AI infrastructure.

Timeline

Risks

Export controls

U.S.–China tensions remain a major risk. Any tightening could limit AMD’s ability to sell accelerators like the MI308 in China.Execution risk

AMD still needs to deliver ROCm parity with CUDA and drive adoption of UA-Link. NVIDIA’s software and ecosystem moat is still very real.Competitive response

NVIDIA’s Blackwell GB200 and Rubin Ultra are expected to launch in the same window as MI400 and MI500. These platforms will be tough to compete with in both performance and adoption.

Broader competition

The real long-term risk isn’t just NVIDIA, it’s the entire industry moving fast:

Amazon, Microsoft, and Meta are building their own AI ASICs, with partners like Alchip, Marvell, and Broadcom.

Google TPUs are a mature alternative to GPUs for large-scale inference and training.

ARM CPUs are gaining ground in data centers, with better efficiency in some workloads.

Startups like Groq and Cerebras have cutting-edge inference chips with interesting potential.

Huawei, Intel, and other Chinese designers are pushing hard to grab share.

There’s no doubt demand will be there. But the question is: who will capture it? AMD is ramping up R&D, now targeting one new generation per year, but until that execution turns into real-world results, its fate will be uncertain.

Valuation and What I’m Doing

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.