HIMS: Q2 Earnings Review

Terrible quarter or the beginning of a new era of success. Let’s see

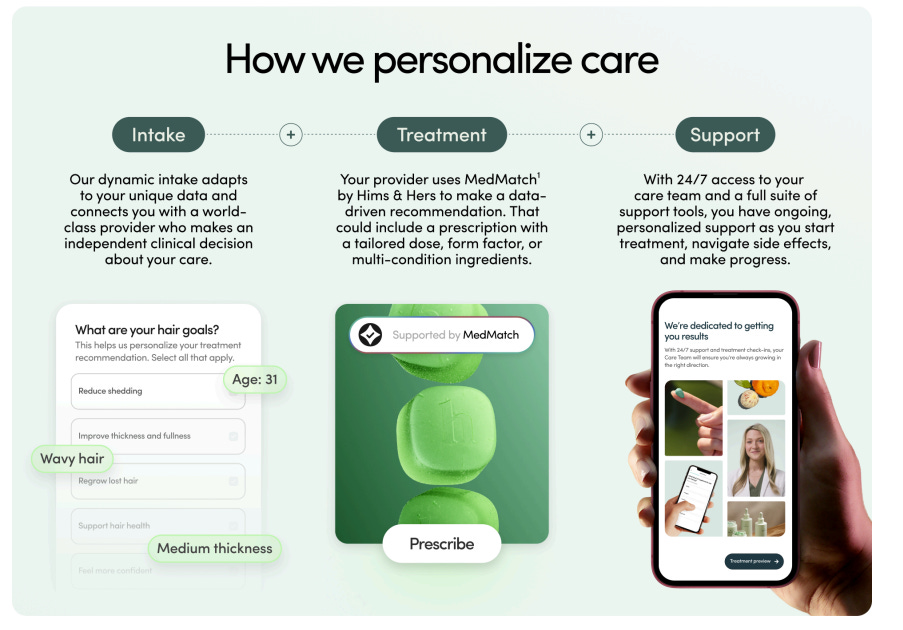

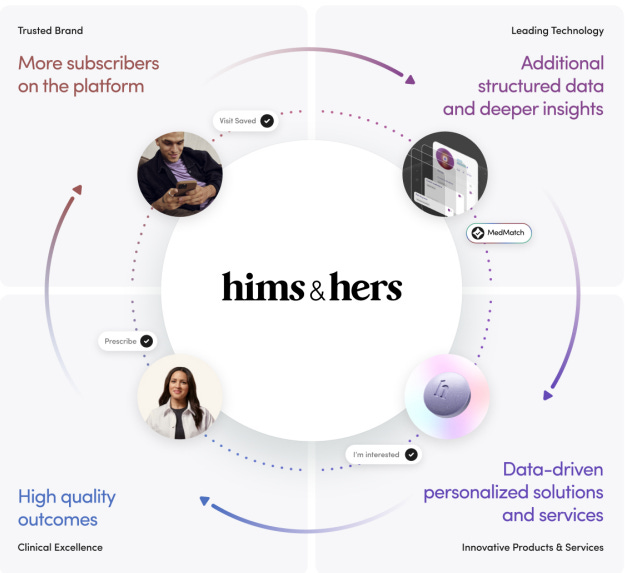

Hims has reached an inflection point. The company is no longer defined solely by compounded GLP‑1 scripts. Management spent this quarter emphasizing a transformation into a personalized health platform, a place where diagnostics, hormone therapy, telemedicine, and AI-driven recommendations converge.

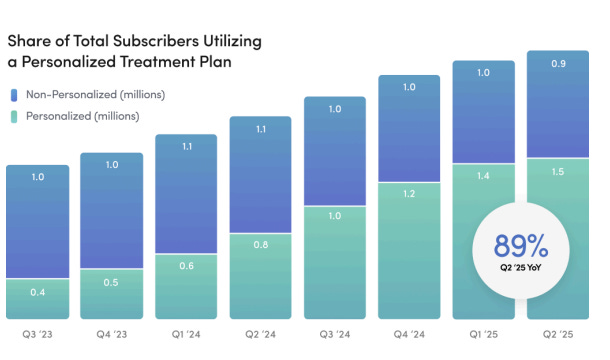

Nearly 70% of new subscribers now opt into personalized treatment plans rather than single-condition refills, showing the brand is moving well beyond being just a prescription provider.

Snapshot of the Quarter

Beat / In‑Line

GAAP Gross Margin 76.4 % (+60 bps vs. Street)

Adj. EBITDA $82.0 M (+14 % vs. est.; +17 % vs. guide) → 15.1 % margin

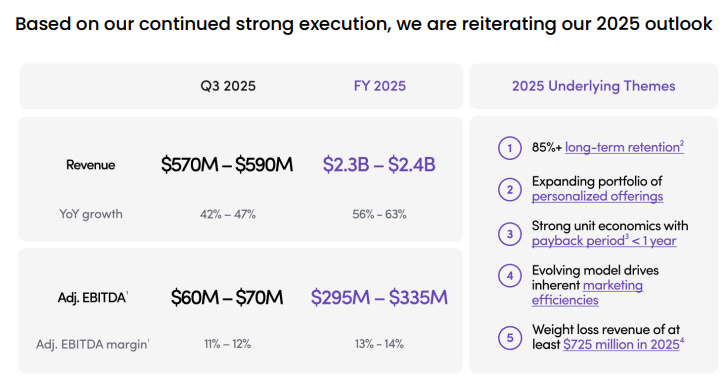

FY‑25 outlook reiterated: Revenue $2.3–2.4 B, Adj. EBITDA $295–335 M

Mixed

Revenue $544.8 M (−1.3 % vs. est.; +0.9 % vs. guide)

Miss

Subscribers 2.439 M (−2.5 % vs. est.)

First sequential revenue decline (−7 % Q/Q) as compounded GLP‑1 demand rolled off

Q3 revenue & EBITDA guide came in a touch below the Street’s expectations

KPIs & Growth Trajectory

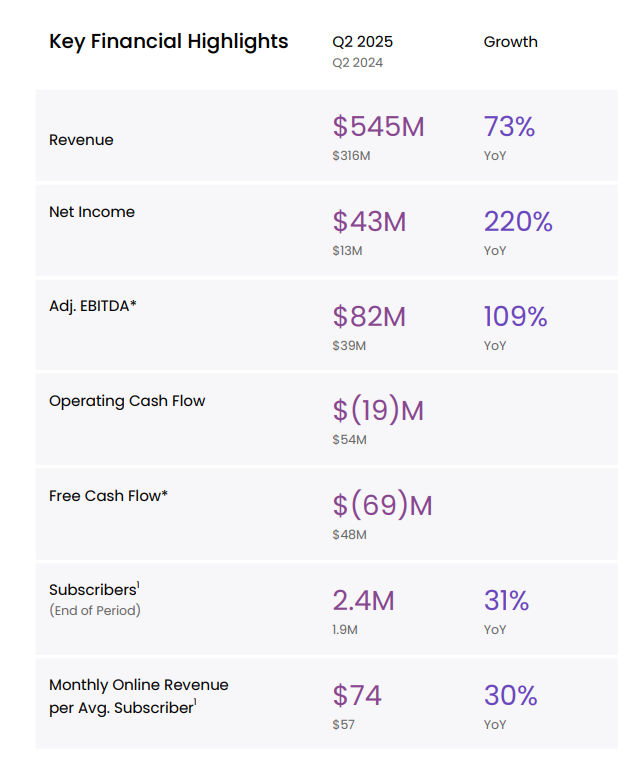

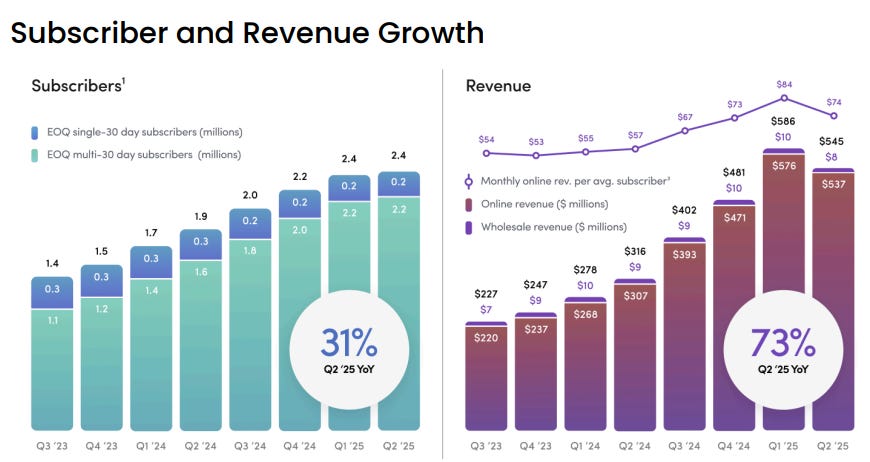

Revenue $544.8 M (‑7 % Q/Q, +72.6 % Y/Y)

Subscribers 2.44 M (+31 % Y/Y)

Monthly Rev / Sub $74 (+30 % Y/Y)

Adj. EBITDA Margin 15.1 % (‑0.4 ppt Q/Q, +2.6 ppt Y/Y)

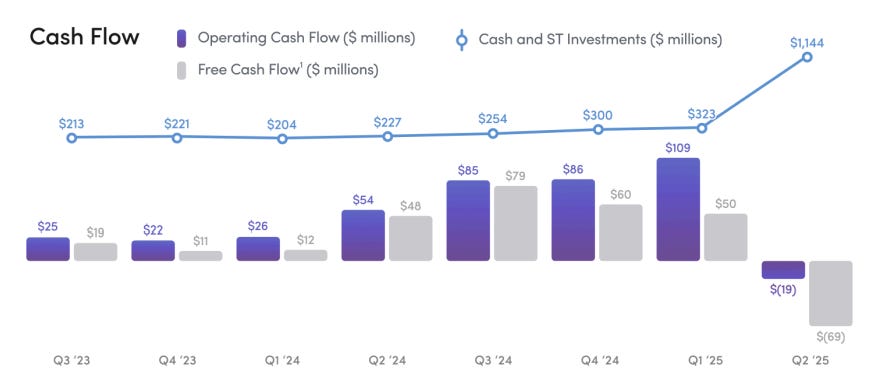

Free Cash Flow ‑$69 M due to heavy CapEx in pharmacy automation and hormone capacity

Quarter Overview

Hims didn’t have a bad quarter, but it wasn’t the type of report we were used to. Year‑over‑year growth was still strong at 73%, with revenue hitting $545M, but this was down roughly 7% from Q1, marking the first sequential revenue decline since the company went public. Management had already guided for this in Q1, so it wasn’t a surprise, but it does raise some questions about how growth looks over the next few quarters.

GLP‑1s remain a big part of the story, but the mix is sliding. They accounted for 39.2% of revenue in Q1, 34.9% in Q2, and 37.7% for the first half. Core revenue, excluding GLP‑1s, slowed from around 30% YoY in Q1 to nearly 20% in Q2, which shows some deceleration across the base business.

Profitability on paper was fine, but cash generation took a hit. Operating cash flow was –$19M, and free cash flow came in at –$69M, driven by temporary working capital investments and a spike in capex to expand pharmacy automation and sterile‑injectable capacity. Management expects operating cash flow to normalize in the second half as the new infrastructure ramps.

Overall, Q2 was the transition quarter they warned about. GLP‑1 mix rolled off, core growth slowed, and cash went out the door to build the next stage of the platform. The big question is whether testing, hormones, and early European contributions can bring growth back to the pace investors have come to expect.

Platform Transition

This quarter marks a clear transition phase. Hims is positioning itself as the Amazon of health optimization, a service that people check proactively, not just when something goes wrong. The vision is powered by three pillars:

Lab testing and diagnostics that give providers longitudinal data.

Vertical integration in compounding, peptides, and sterile injectables.

AI‑driven personalization through MedMatch, increasing retention and ARPU.

The company openly acknowledges that this transition creates a temporary slowdown. The word “headwinds” was mentioned a few times in the call.

However, the weaker-than-usual results are due to other factors too. We saw that the Q2 job numbers were revised down by over 90%, and that a weaker economic environment will obviously affect consumer-facing companies.

I think this situation may be similar to what Netflix faced in 2022, a couple of weaker quarters because of a worse economic environment, followed by a sharp recovery once the transition period ends.

Moat‑Building CapEx

Free cash flow turned negative this quarter because the company invested aggressively in its infrastructure. Roughly $101 M went toward new pharmacy automation, sterile-injectable lines, and the C S Bio peptide facility.

This level of vertical integration serves three purposes:

Reduces long-term unit costs as volumes scale.

Protects margins even as the product mix evolves.

Builds regulatory barriers that make it harder for competitors to replicate the model.

Management is clearly prioritizing scale and defensibility over near-term margins, signaling they are building for decades, not quarters.

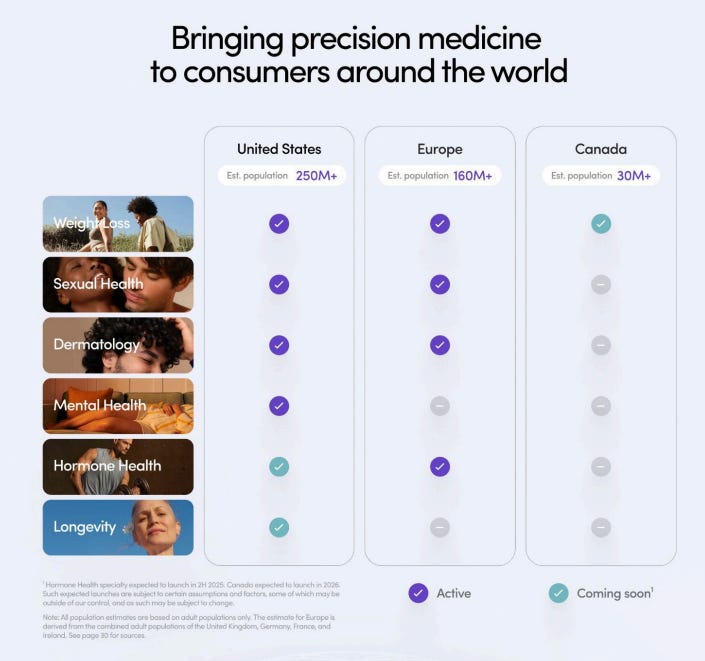

International Expansion: Europe & Canada

A critical step in this global strategy is the acquisition of Zava Global GmbH for €225 M ($265.7 M), with €125 M ($147.6 M) paid upfront.

Zava operates in the UK, Germany, France, and Ireland, markets representing about 160 million addressable adults. Management expects at least $50 M in incremental revenue in H2 2025, and importantly, Zava is already EBITDA-positive.

Canada is next in line for 2026. Leveraging the new sterile-injectable line, Hims will introduce hormone and weight-loss therapies in another large English-speaking market.

Together, Europe and Canada have the long-term potential to double the company’s total addressable market in a matter of a couple of years.

Although this is further down the line, management also signaled expansion into Latin America and Asia. I doubt this is in the near term, it’s probably coming after 2026. And while it’s fine to have big plans, I’d rather see them focus on the massive challenge they currently face with the European expansion, instead of talking about such different markets like those two.

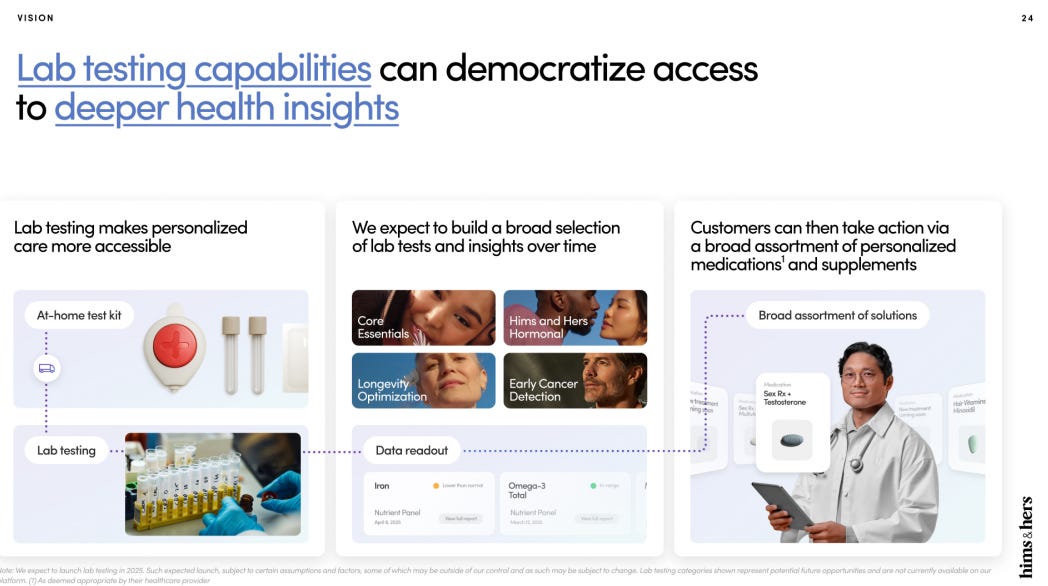

Lab Testing: Hims“ChatGPT Moment”

Testing is the breakthrough that could define Hims’ next era.

Management is clear: you cannot optimize health without diagnostics.

Starting in 2026, users will be able to order lab panels directly in the app. These results will feed into MedMatch, guiding personalized treatment adjustments for hormones, weight management, and beyond. Doctor calls are useful, but true health optimization comes from structured, ongoing data.

This flywheel: tests leading to AI recommendations, which lead to higher engagement and more prescriptions, can expand ARPU and reduce churn. Hims already reports $74 in monthly revenue per subscriber, up 30% year over year, and lab integration could push this even higher.

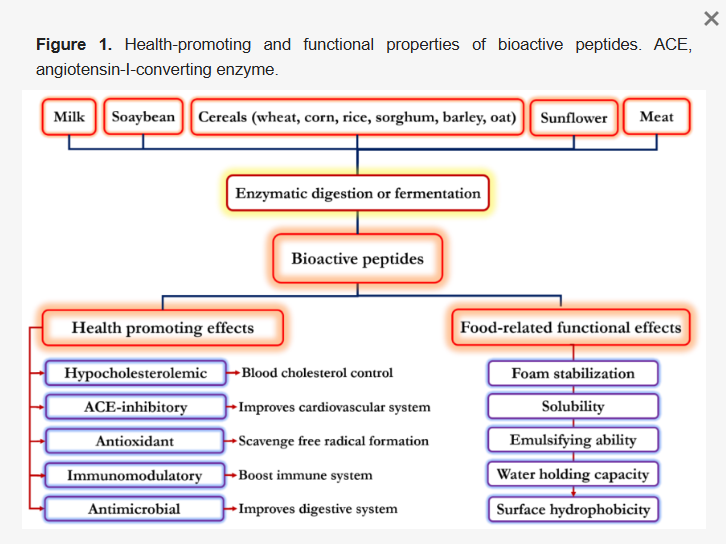

Peptides & Longevity

Hims is preparing for its 2026 entry into longevity care, and peptides are at the core of that strategy. Management highlights a surge in innovative treatments that target immunity, recovery, and improved metabolic function, and the company believes it is now positioned to go beyond reactive prescriptions into truly proactive, preventive health.

By combining access to comprehensive lab work with a growing network of compounding and peptide facilities, Hims can create thoughtful interventions designed to help members live longer, healthier lives. This is not about reacting to a single condition; it’s about building programs that continuously optimize health. The company sees a future where a Hims membership can address the majority of conditions impacting daily life, from metabolic and hormonal imbalances to recovery and preventive care.

Management’s vision is clear: over time, the platform will shift from a place people visit to treat an issue to one they trust to prevent it. With lab data feeding directly into MedMatch and in‑house peptide production enabling rapid dosage adjustments, the company can deliver a seamless loop of testing, treatment, and optimization.

If executed, this approach transforms Hims from a simple telehealth player into a full‑spectrum health optimization platform, one that keeps members engaged for years and builds a moat that few competitors can replicate.

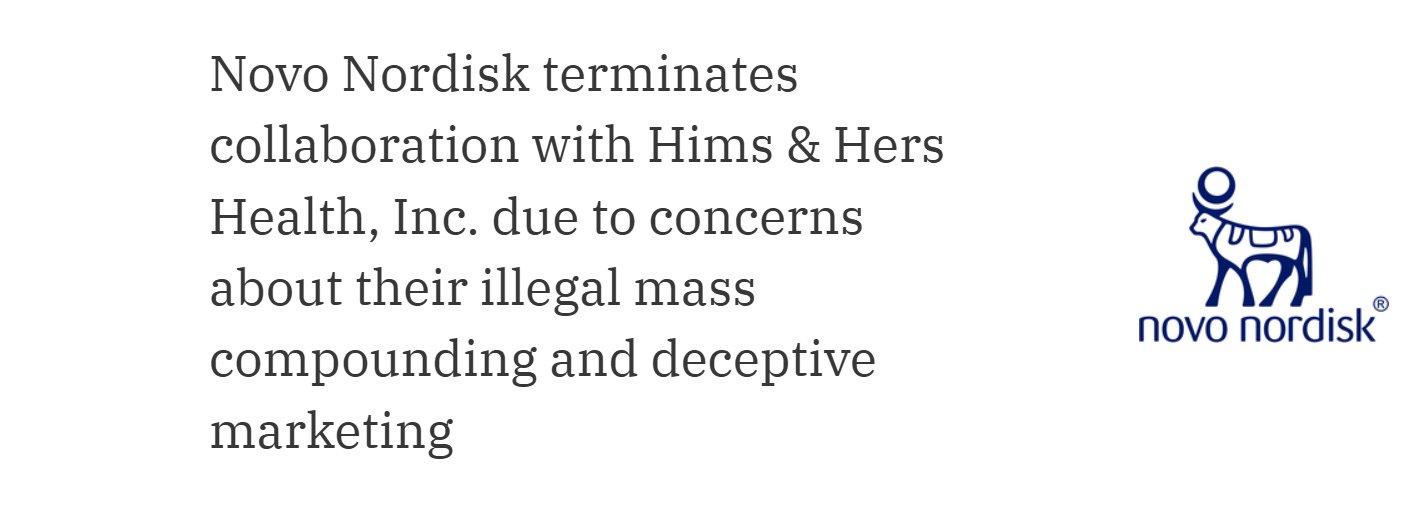

Short‑Term Headwinds

The first sequential revenue decline since the SPAC listing sent a clear signal: the hypergrowth phase is on pause. The market is rarely patient with transitions, especially after a year of 100%+ growth.

Key factors behind the softness:

Normalization of compounded GLP‑1 demand after FDA shortages ended

Integration costs from three acquisitions, including Zava

Broader macro pressure on discretionary cash‑pay products

Beyond this quarter, there are other risks to keep in mind:

Potential legal actions regarding their GLP‑1 offerings

Competition from important companies in the space like Ro and Amazon

Medicare, Medicaid plan to experiment with covering weight loss drugs

Management guided Q3 slightly below Street, framing this as a transition period. Wall Street may remain sceptical until new growth vectors as hormones, testing, and international start to materially show up in the numbers.

Full‑Year Guidance

FY-25 guidance was reaffirmed:

Revenue: $2.3–2.4 B

Adj. EBITDA: $295–335 M (12–14 % margin)

H2 is expected to re‑accelerate modestly with new hormone products, early European contribution, and testing pilots.

The company also ended the quarter with $1.12 B in cash, providing flexibility for continued infrastructure buildout and potential M&A.

Looking Forward

Hims is in the middle of a transitional period. Short‑term growth is slowing, but the building blocks for the future are clear:

Zava integration and Canada expansion for global reach

Moat‑building CapEx to control costs and secure compliance

Lab testing and AI to transform episodic care into continuous optimization

Peptides to revolutionize health optimization and prevention

If management executes, 2026 could reignite growth and reposition Hims from a GLP‑1 and ED‑pill company into a vertically integrated international health optimization platform.

At roughly 6x forward sales and 45x 2025 Adj. EBITDA, with such high YoY growth and clear tailwinds for 2026, much of the risk seems priced in. The market won’t wait forever, but if Hims delivers on its 2026 vision, patience could be well rewarded.

What I’m doing

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.