HIMS Acquiring Zava: A Big Opportunity?

HIMS takes a big step forward in Europe by acquiring a provider with 1.3 million active customers. How much growth could this unlock?

HIMS is one of my favourite opportunities in the market. Although I’m a long-term investor, I sold a significant portion of my stake after it crossed $60, just as I did during the previous bull run, and later bought back in after the price dropped. Trading HIMS has been relatively easy.

Even though I take a long-term approach, I use valuation models, sometimes a company can skyrocket and still be deeply undervalued, while other times it can run too far ahead of its fundamentals.

I’ve still kept a substantial position. I can adjust to market sentiment, but HIMS remains one of my core holdings. I discussed the company’s potential in a previous article, but with the recent announcement of its plan to acquire ZAVA, I need to reassess my thesis to understand what’s changed and how this may impact its long-term outlook.

Overview

First of all, a move like this wasn’t unexpected. HIMS had already made clear their plans to expand internationally, and investors knew that to sustain hypergrowth, the company would need to expand its total addressable market. Expanding into other countries is often easier than branching into entirely new verticals.

Replicating their success in a hypercompetitive market like the US across other countries is a logical step. This acquisition significantly accelerates that process.

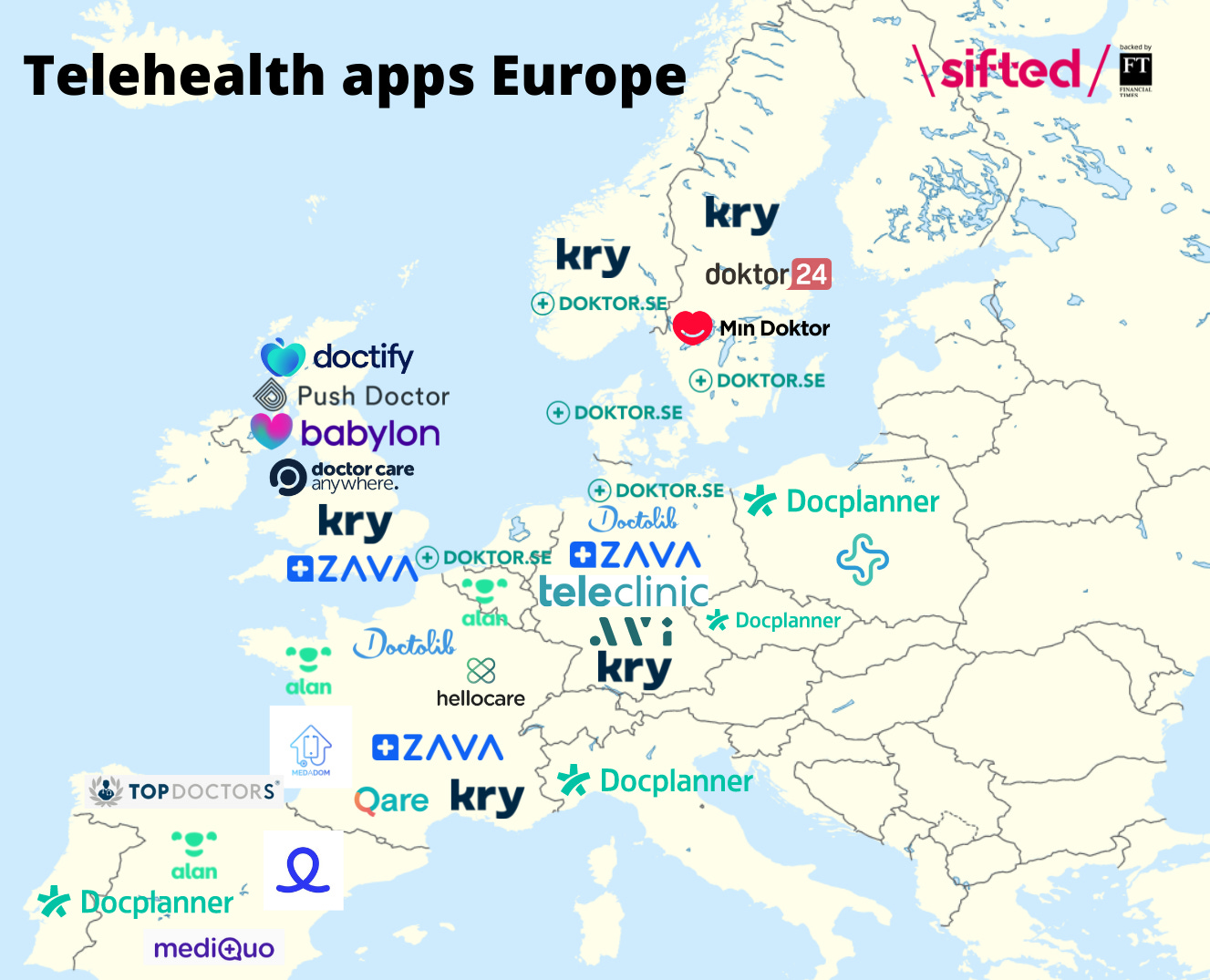

ZAVA is a European online doctor and pharmacy service, a telemedicine platform based in London that allows users to receive medical consultations and prescriptions digitally. Founded in 2010 and operated by Health Bridge Limited, ZAVA brings with it 1.3 million active customers across the UK, Germany, France, and Ireland. Through this acquisition, HIMS not only gains direct access to these users but also bypasses lengthy regulatory approval processes typically required for new market entrants.

In fact, the acquisition offers much more than entry into just four countries. Thanks to European Directive 2011/24/EC on cross-border healthcare, prescriptions written by a doctor registered in one EU member state are recognized across all EU countries. That means HIMS gains potential access to the entire European Union market.

To put things into perspective:

HIMS will automatically increase their active customers by 54%

Their potential customer base grows by 66% based on population, just from the four countries ZAVA currently serves

With EU-wide expansion, the potential customer base could increase by 132%

Of course, US consumers have more disposable income than their European counterparts, but even so, these are compelling initial figures that help frame the significance of the opportunity.

The Business

HIMS plans to acquire ZAVA in an all-cash transaction, though the exact amount remains undisclosed. Because of the lack of financial detail, it's difficult to assess how favorable the deal truly is. As a privately held company, ZAVA’s revenue is also hard to pin down. The only public estimate comes from Growjo, which puts ZAVA’s revenue at approximately $45 million. That’s modest compared to HIMS’ revenue, but the real value lies not in what ZAVA is today, but in what it could become under HIMS’ leadership.

The synergies are crystal clear. ZAVA offers diagnoses and treatments for weight loss, sexual health, testosterone therapy, mental health, dermatology, essentially, everything HIMS already provides. What ZAVA lacks is HIMS’ elite marketing, brand strength, and world-class management. That’s exactly where HIMS will supercharge their operations, starting from an already solid customer base and established local trust.

The user experience is remarkably similar to HIMS: fast, convenient, affordable. You answer a medical questionnaire, a doctor reviews and approves the prescription, and your medication is shipped directly to your home.

ZAVA also offers at-home testing kits. Customers receive a kit, send back their sample, and access the results online. This combination of convenience and autonomy is exactly what much of European healthcare lacks. While the US has made strides in healthcare digitalization, many Europeans still need to visit a doctor in person for even basic prescriptions. It’s inefficient, time-consuming, and frustrating. There’s real demand for a better alternative, and HIMS is positioning itself as the brand to break the mold.

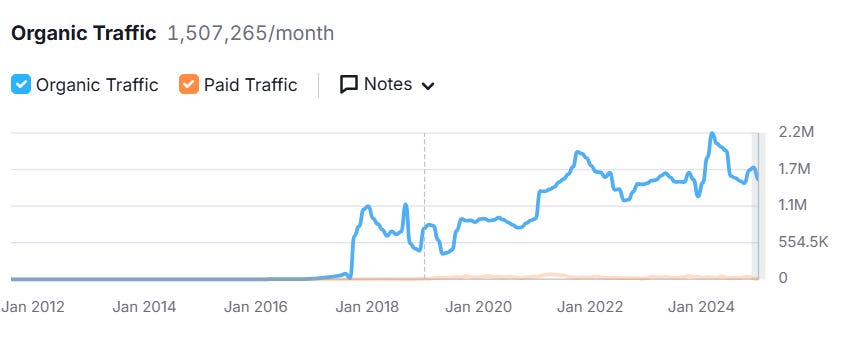

ZAVA has always been a solid business, but recent trends show signs of stagnation.

That likely played a role in their decision to sell. While growth surged in 2021, website traffic peaked in 2022, saw another high in August 2023, and has since returned to 2021 levels. Macroeconomic conditions appear to affect the business significantly, and with momentum cooling, this was a perfect time to sell to a larger, well-capitalized company like HIMS, one with the talent and resources to fully unlock the upside.

But here's the most compelling insight:

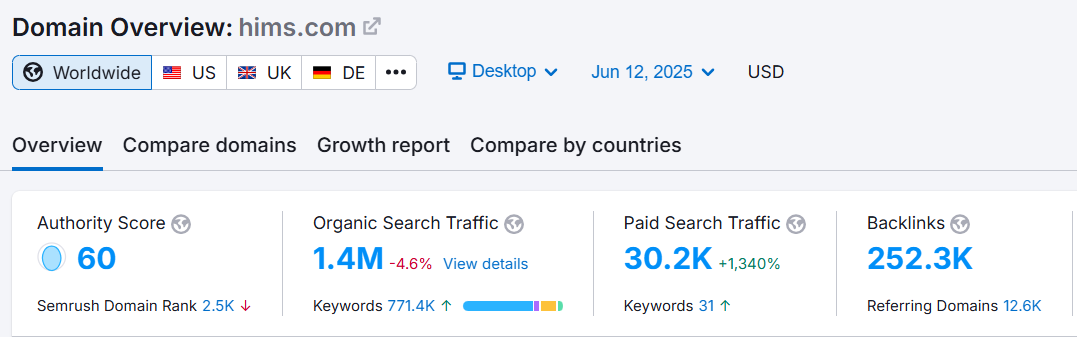

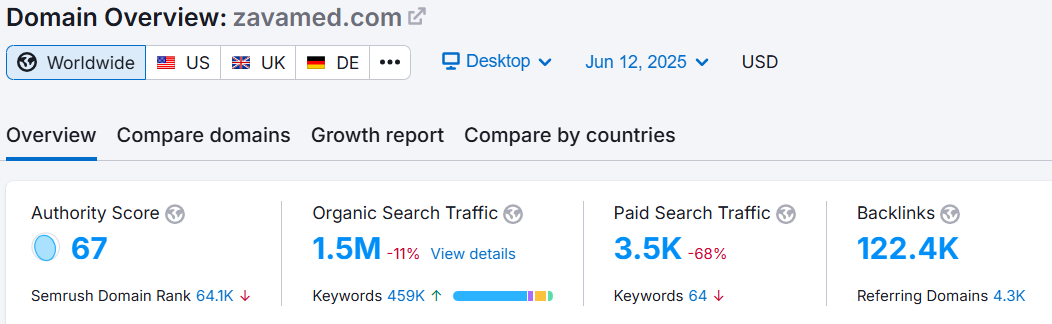

ZAVA’s website receives more organic search traffic than Hims.com.

Even with half the backlinks.

That’s remarkable. Even when you include Hers.com, HIMS’ two websites only surpass ZAVA’s traffic by 40%. So while ZAVA doesn’t generate as much revenue, and its 1.3 million users will boost HIMS’ subscriber base by 54%, the real hidden value lies in visibility: this acquisition will increase HIMS’ organic traffic by 71%.

That’s 71% more eyes on their products, without spending a single extra dollar. In a company where marketing is one of the largest expenses, this is a massive operational win. Gaining this kind of traffic typically requires millions in ad spend. Now, HIMS can simply upsell and cross-sell to ZAVA’s audience, which is already interested and engaged, at zero additional cost.

This deal isn’t just about customers, revenue, or regulatory shortcuts. It’s a strategic expansion with immediate impact on reach, efficiency, and long-term growth potential.

Competition

HIMS will have a very easy time popularizing their brand and products in Europe. For starters, competitors are too focused on essential medicine. They don’t offer a direct-to-consumer model, where users choose what they think they need, get reviewed by a doctor, receive advice, and simply pay.

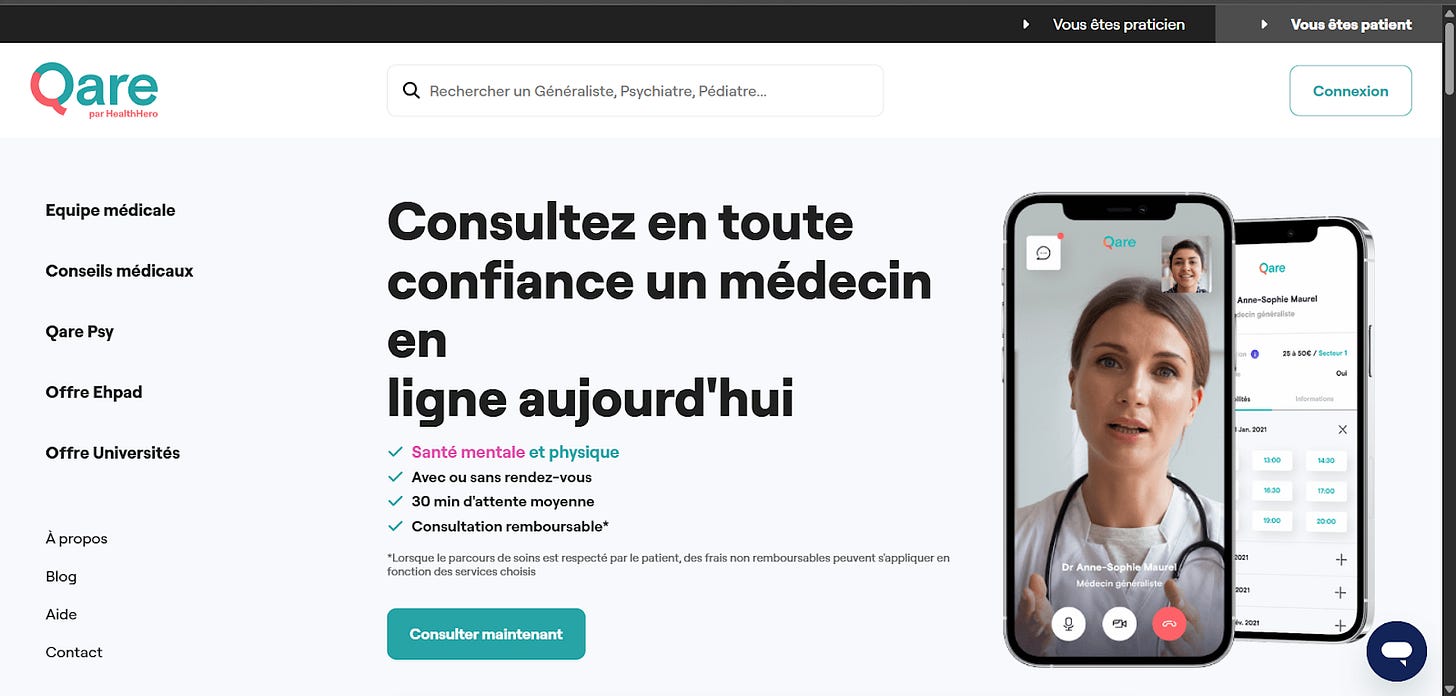

Take one of the largest telehealth platforms in France, Qare, for example. The website is unattractive and poorly designed.

It's a boring site meant to book an expensive consultation with a doctor. No product info, no compelling marketing, no message about how your life could improve, just the same outdated experience that HIMS is disrupting.

Just compare the websites.

Healthcare has long been treated differently from other markets. It wasn't supposed to be appealing, optimistic, or well-branded. It had to be dry and clinical.

So why has HIMS succeeded where others failed? Because they’ve mastered the art of marketing a great product.

On their website, HIMS focuses on the benefits, the transformation you get from using their treatments. The vibe is encouraging. It actually makes you want to try a product that could improve your health and life.

Now look at another competitor, Doctolib, and you’ll see exactly what I mean.

In terms of branding and customer experience, HIMS will have a field day.

I also believe HIMS won’t face much trouble on pricing. Consultations are priced similarly, even considering higher US healthcare wages. For example, psychiatric consultations cost $58 at Qare, compared to $59 for HIMS' initial consultation. But unlike Qare, HIMS offers unlimited free follow-ups as long as you're subscribed to treatment. It’s a complete care experience, not just a pricey, one-time consult.

HIMS CEO Andrew Dudum said it best:

"The demand for simpler, more personalized healthcare is universal,"

"By leveraging ZAVA's established European presence, cutting-edge technology, and deep customer understanding, we're poised to fundamentally transform access to care for millions across Europe. Whether in rural towns, vibrant cities, or remote communities, people battling widespread, often silent chronic conditions like obesity, depression, and more will have access to the personalized, high-quality care they deserve.”

Personalized, simpler, high-quality, that’s exactly what Europe needs. Even though it’s a relatively rich continent, innovation in healthcare delivery is lacking. Europeans want to feel that their provider actually cares about them. With a monthly subscription like HIMS offers, you can actually address your needs, improve your overall well-being, and receive ongoing, customized treatment, instead of a one-off consultation, limited follow-up, and the uncertainty of whether you’ll ever feel better.

I think personal experiences are an important lens to analyze stocks. In the end, investing is about meeting needs, human needs. Let me give an example.

In Spain, we have public healthcare. But I use private insurance because public care is extremely slow. If I want to see a dermatologist, I can’t just book a visit, I’d have to see a primary care doctor first and wait months for a referral, even when I clearly have a skin condition. The system just doesn’t work efficiently.

My mother is older and has serious nutritional problems. She uses public care. To get a recurring prescription, she has to drive 20 minutes to her doctor, get the script, go to the pharmacy, find parking, wait in line, buy the treatment, and then return home. That’s at least 1.5 hours of effort just to refill medication. If she feels unwell during treatment and wants to consult the doctor? There's no digital support. She must book an appointment and go in person.

So what's the end result? A poor treatment plan, no proper follow-up, and a feeling that no one’s really helping. If she were using HIMS, she could have had a personalized compounded treatment, delivered to her door, with ongoing digital consultations. Simple. Efficient. Humane.

Would private insurance help? Maybe, she could see a nutritionist. But she'd still need to go in person for everything. And the tech? Sure, I use an app. It barely works. It's buggy, slow, and unreliable, and I have to end up calling for half the appointments.

HIMS could enter Spain and immediately capture a meaningful share of the market. Higher-income consumers would jump at the chance to finally be treated properly. And this pattern repeats across Europe. Even in markets with more competition, there’s nothing like HIMS here.

David Meinertz, co-founder and CEO of ZAVA, captured the message clearly:

"Wherever you live, the need is the same: healthcare that’s personal, trustworthy, and fast. By joining forces with Hims & Hers, we can put that standard within reach of millions more people across Europe,"

"Together we’ll pair ZAVA’s trusted clinical services, established footprint, and deep understanding of the European healthcare landscape with the Hims & Hers experience to make affordable access to high-quality, personalized care the rule, not the exception. I’m thrilled to be working with Andrew and his team. It’s still day one for digital healthcare, and I can’t wait to see what we’ll achieve for patients in the years ahead."

The opportunity

Putting specific numbers here is difficult. But one thing is clear, HIMS' total addressable market is about to expand significantly. They’ll scale operations in the UK, expand into Germany, France, and Ireland, and have already signaled plans to enter additional markets soon.

Currently, HIMS earns about $1,000 per customer annually on average. Replicating this in Europe will be challenging unless they focus on higher-income segments. The GDP per capita of the countries where ZAVA operates is 37% lower than in the US. Disposable income is also roughly 37% lower.

So let’s assume HIMS earns exactly 37% less per customer in these countries over the long term. And let’s apply the same market penetration rate they’ve achieved in the US. While this assumption isn’t perfect, since HIMS already has some presence in the UK, albeit limited compared to what the ZAVA acquisition enables, it’s still a conservative long-term estimate.

HIMS’ current US market penetration is 0.71%. Applying the same rate to the four countries ZAVA currently operates in, HIMS could add around 1.6 million subscribers, which aligns closely with ZAVA’s 1.3 million existing customers.

Assuming they reach 37% less revenue per customer than in the US, HIMS could generate an additional $1 billion in annual revenue, representing about a 50% increase over current levels. Obviously, this won't happen on day one, but it illustrates the potential.

Now let’s assume HIMS expands into additional European countries in the coming years: Netherlands, Sweden, Switzerland, Austria, Belgium, Spain, Italy, Portugal, and Denmark. Based on their GDP and HIMS' current market penetration, this expansion could add another $700 million in revenue.

Combined, HIMS could nearly double its total revenue over time.

We’ll eventually find out the exact figures behind the ZAVA acquisition, but in hindsight, it could look like a bargain just a few years from now.

And the opportunity doesn’t end there. Just like in the US, Europe has a rapidly growing market where HIMS has a strong competitive edge: weight loss treatments.

The market is projected to reach $220 billion by 2033, and HIMS now has a chance to claim a share of it. ZAVA already offers treatments from Novo Nordisk and Eli Lilly, and through this acquisition, HIMS is likely to deepen its relationship with Novo, and possibly forge a stronger partnership with Eli Lilly as well.

Conclusion

This acquisition seems like a perfect fit for HIMS. ZAVA shares the same focus on products and commitment to improving subscriber outcomes, but lacks the marketing strength, premium quality, and personalization that define HIMS. Now, with HIMS’ culture and management, ZAVA will be able to realize the full potential of what it set out to offer.

By avoiding the usual regulatory hurdles, HIMS saves both time and capital, and by gaining access to ZAVA’s subscriber base and organic traffic, the company will put millions of new eyes on its highly engaging and personalized product ecosystem.

The European era begins for HIMS, and it looks like a prosperous one.