Hims: My Take

Hims is one of the most popular stocks among retail investors. Some say it has no moat, while others call it the Amazon of healthcare. So who is right?

Hims is laying the foundation for what could become the next healthcare giant. While many argue the company lacks a moat, Hims has shown that this level of execution is not easy to replicate.

With more than 2.4 million subscribers, an expanding business, important growth vectors, and a loyal subscriber base, Hims is taking on the retail healthcare market with a simple motto: high quality, customer satisfaction, and convenience.

The Business

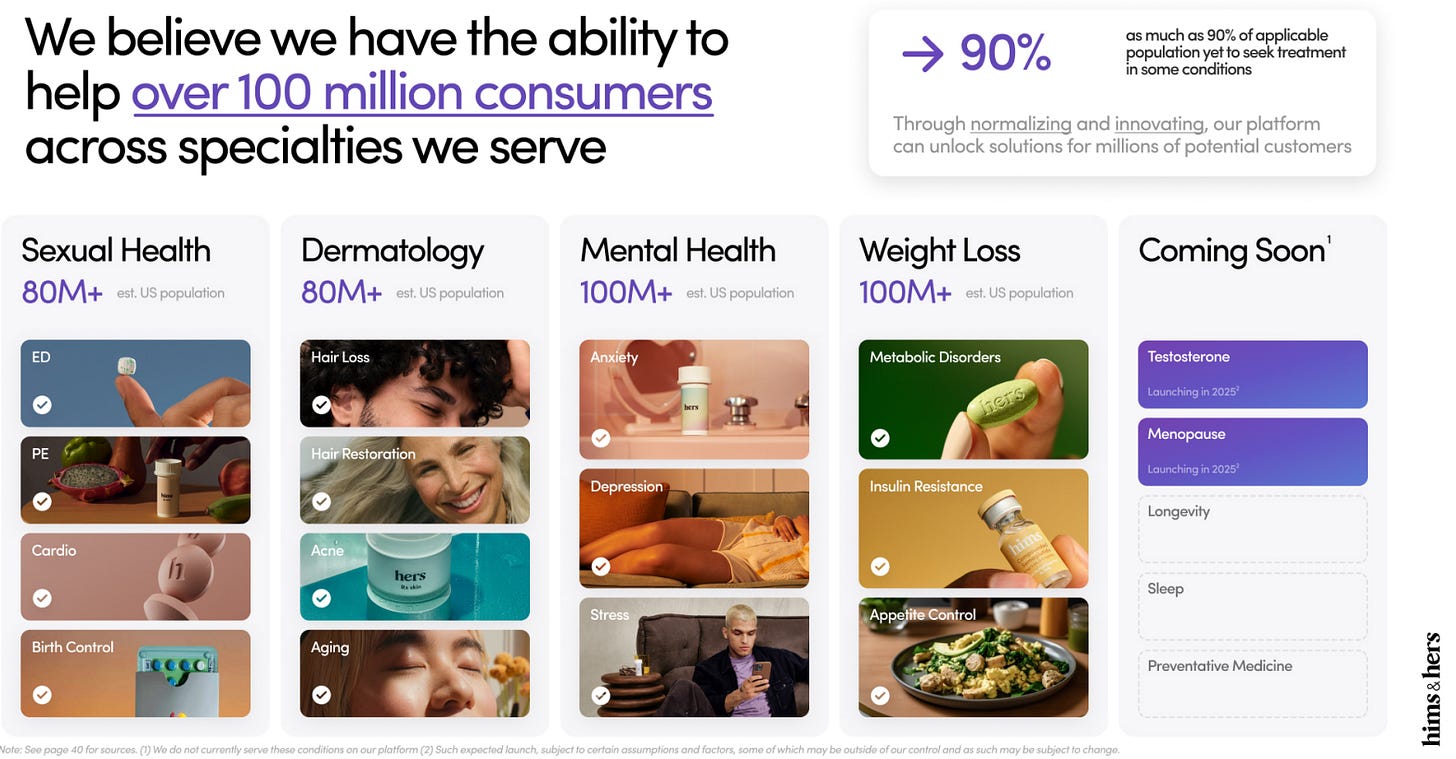

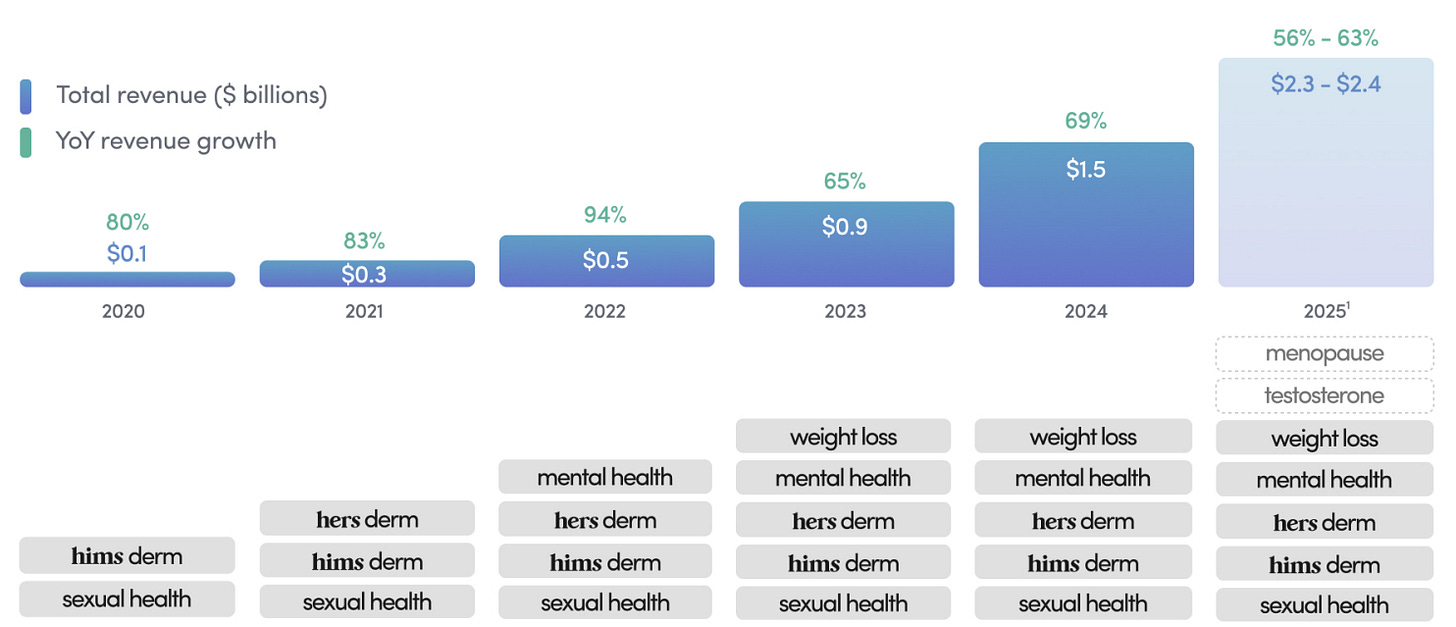

Hims is a diversified telehealth company with its own online pharmacy. It offers a broad range of products, and its clinical professionals treat a wide set of conditions. It has now expanded into four major markets:

Sexual Health

Dermatology

Mental Health

Weight Loss

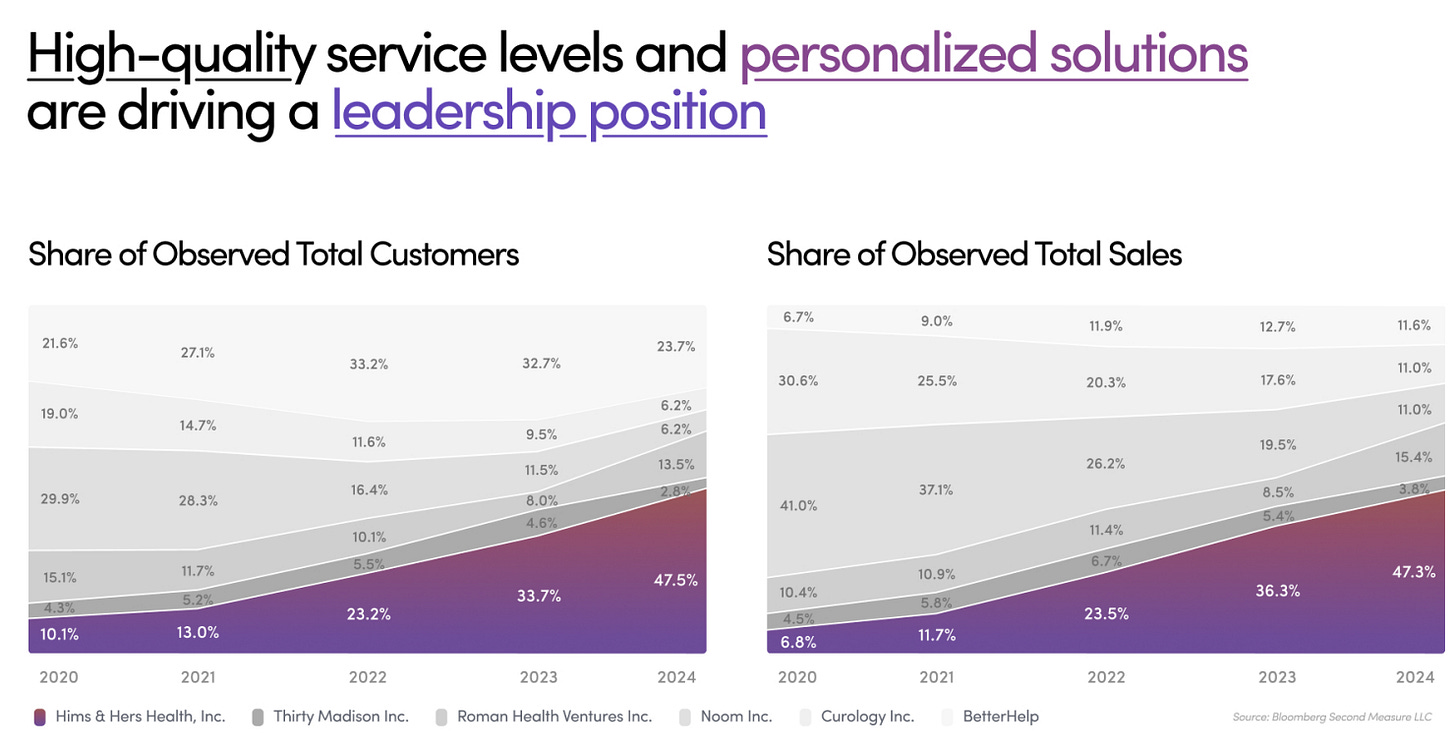

Each of these markets is massive, and Hims already holds a strong position. In direct-to-consumer digital health services across these categories, Hims has an impressive 47% market share.

You do not reach this level of market share through luck, or with what some describe as a missing moat. High-quality products, strong marketing, highly rated care from professionals, and a convenient telehealth experience are not easy to replicate. The growth and market position Hims is delivering make that clear.

While Hims is widely associated with GLP-1, the business is much broader.

Its GLP-1 offering is a clear example of management’s speed and execution quality. The team moved quickly, captured an unexpected opportunity, and turned it into a major profit driver. The capital generated there has helped Hims invest in new high-growth segments that can support long-term expansion.

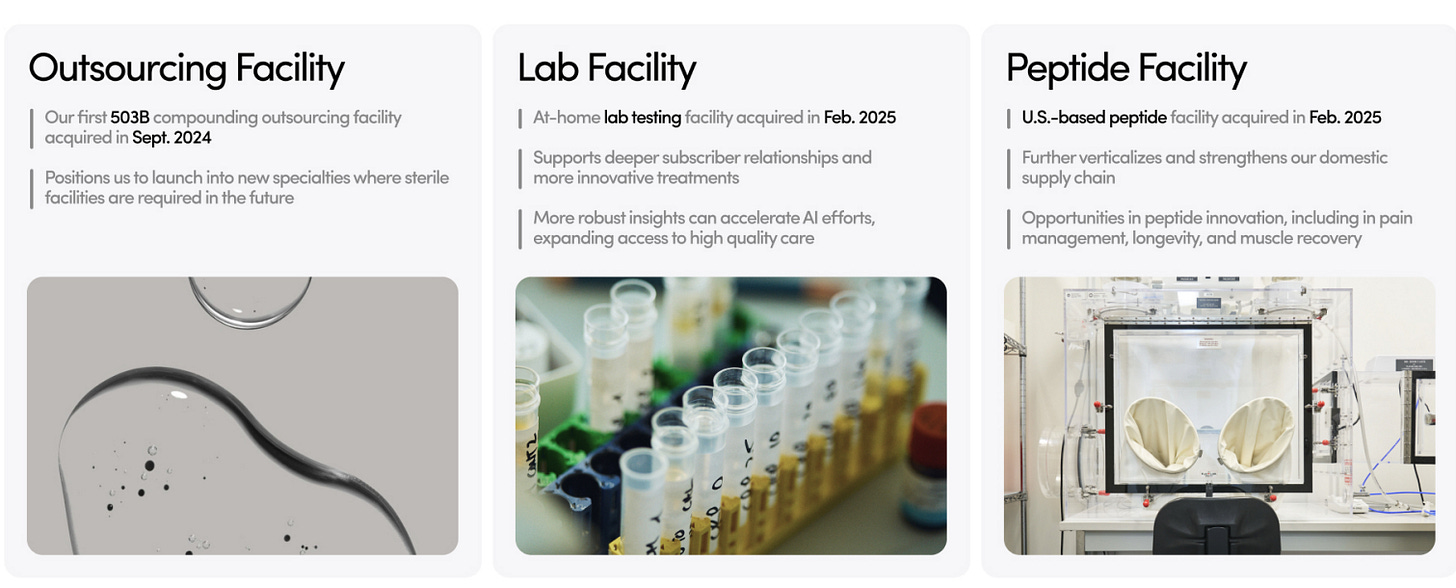

Vertical Integration

Its total nationwide internal fulfillment footprint is approximately 700,000 square feet, including:

Three compounding pharmacies in Ohio, California, and Arizona

A peptide facility

An at-home lab testing facility in New Jersey

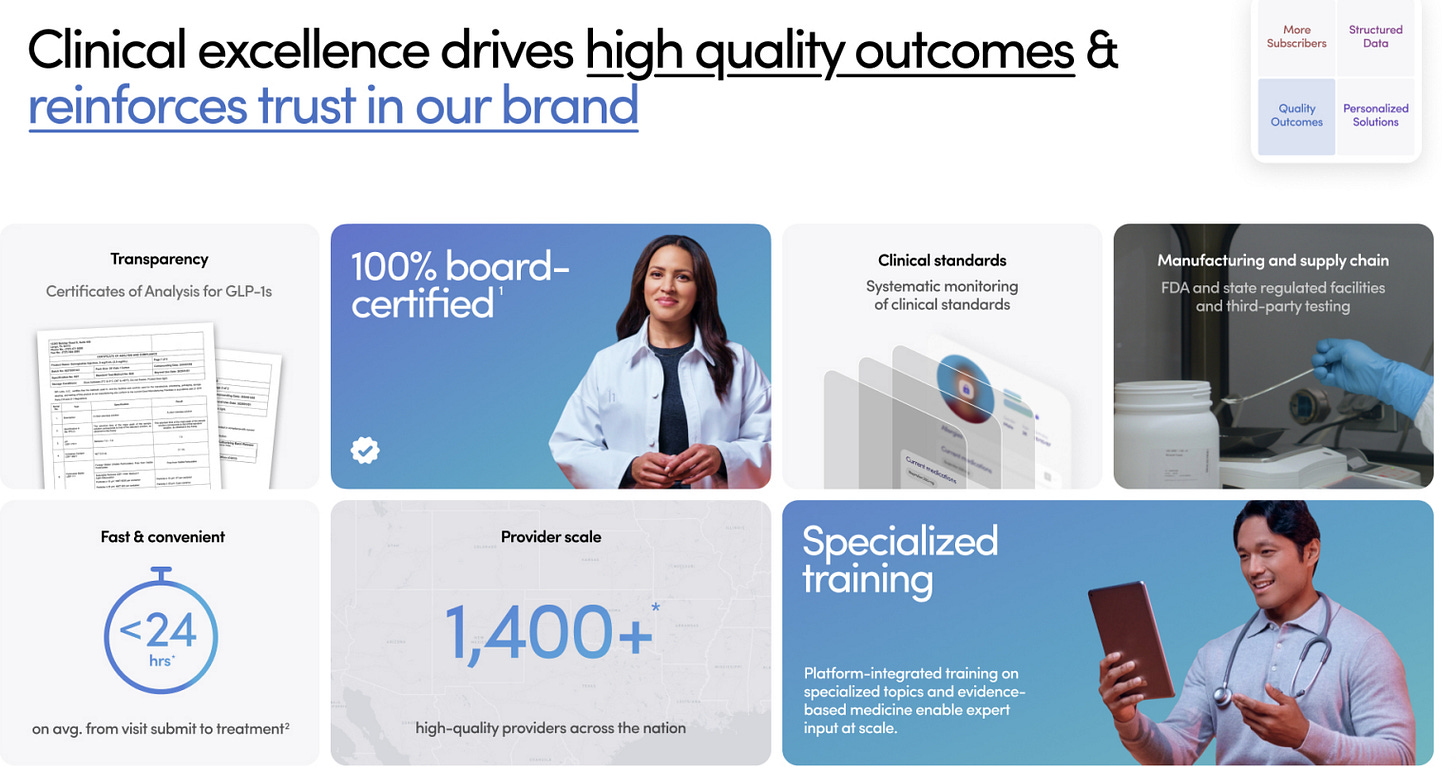

The strength of Hims comes from being one of the first companies to deliver this level of telehealth service. Through strong strategic positioning, it has embedded itself in the market through both subscriber scale and brand recognition.

That positioning, combined with a strong brand, creates a moat in itself.

The cash flow generated by this model allows Hims to reinvest in compounding capacity, testing infrastructure, and stronger marketing. That reinforces the moat and creates a positive feedback loop, supporting a fast-growing long-term compounder.

Financials

This leadership and market position are clearly reflected in the numbers.

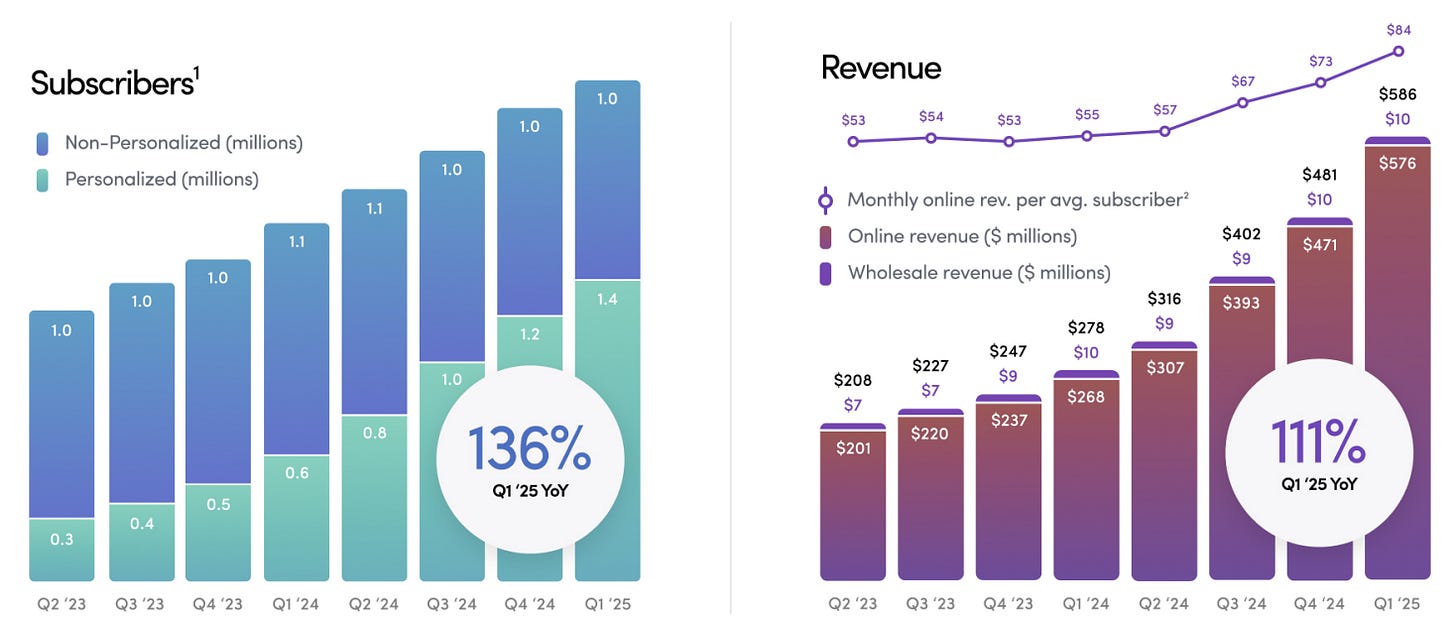

Hims delivered 38% year-over-year subscriber growth and 136% growth in personalized subscribers, reaching 2.4 million subscribers.

This growth is already impressive, but what makes it even stronger is that monthly online revenue per average subscriber increased 52% over the same period, helping drive total revenue growth to 111%.

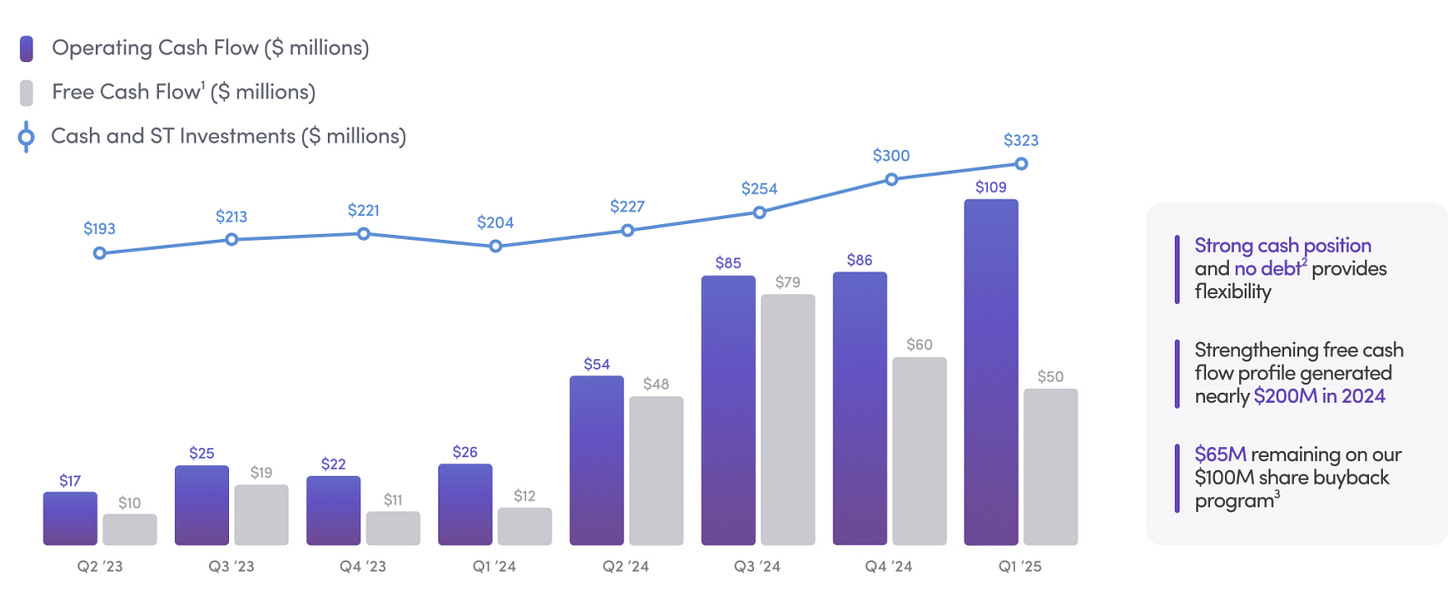

This is not unprofitable revenue. Hims has been free cash flow positive for two consecutive years, and its operating cash flow reached 109 million dollars in the last quarter.

With strong fundamentals and a 323 million dollar cash balance, Hims has more than enough firepower to continue expanding.

For full-year 2025, the company expects to generate 2.35 billion dollars in revenue and 315 million dollars in adjusted EBITDA.

Based on the current enterprise value, that implies a valuation of about 5x sales and 37x EBITDA, which does not look demanding given the business’s growth trajectory.

2030 Goal

Demonstrating confidence in the business, Hims has provided guidance for 2030.

The company expects revenue to reach at least 6.5 billion dollars, implying a compound annual growth rate above 23%.

Adjusted EBITDA is expected to reach at least 1.3 billion dollars, implying a CAGR above 33%.

These targets will be important for long-term valuation.

New Segments

Hims is expanding into new areas, including testosterone, menopause, longevity, and preventive medicine.

Testosterone is a large and fragmented market. Today, care is often provided by small clinics, and in some cases treatment is covered by insurance when the condition is severe.

But for people who want a more convenient, high-quality experience, Hims is well positioned.

Through its existing subscriber base, Hims can distribute these treatments efficiently. Its brand and market leadership should help attract demand directly.

Instead of relying on small clinics or navigating insurer friction, users can access more personalized, digital care through Hims.

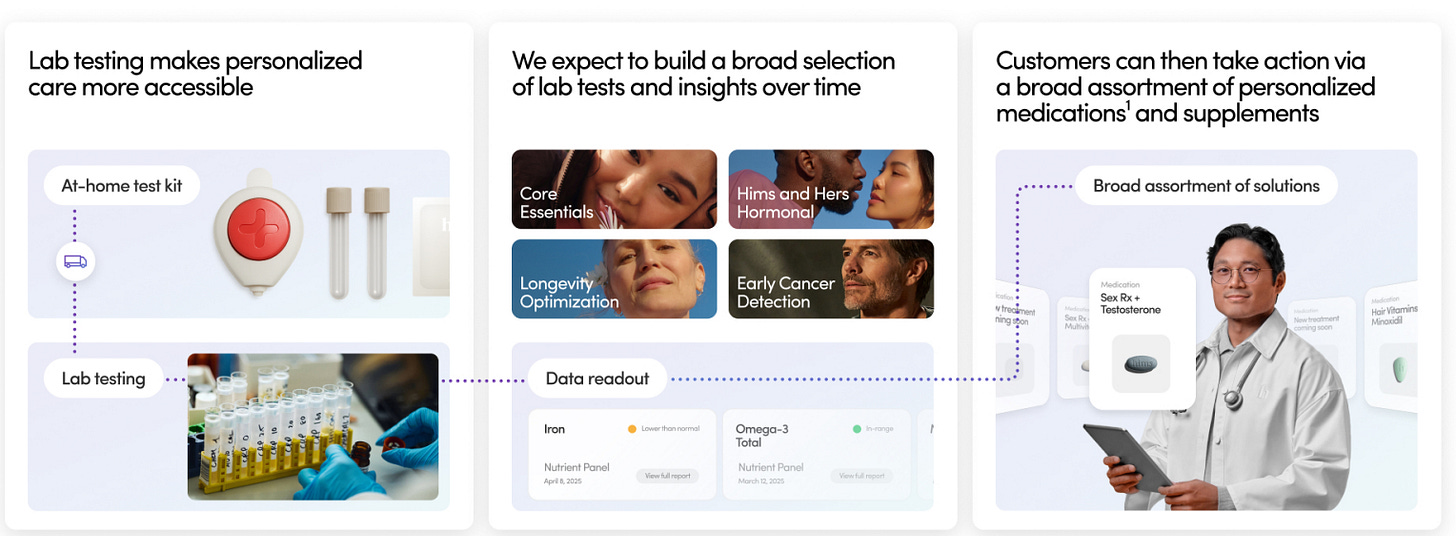

If you are wondering how testing works in this model, that is where the new facility becomes critical:

Hims recently acquired a testing lab in New Jersey, which allows it to enter markets that were previously harder to serve.

Patients can now receive an at-home test kit, send in a sample, and get results from a Hims lab. Based on those results, Hims can identify deficiencies in vitamins, minerals, and hormones, then prescribe personalized supplements or medications through an integrated workflow.

This pushes Hims further toward becoming a fully vertically integrated healthcare provider.

The same testing infrastructure also supports menopause treatments and the broader health optimization strategy.

The goal is not only to treat illness, but also to prevent it by helping patients monitor and improve their health over time.

Its peptide facility strengthens that vision. Interest in peptide research has grown quickly, with many reported potential benefits, and consumers are increasingly looking for ways peptides may support overall well-being.

With its new facility in California, Hims can offer a broader set of solutions. Given the brand’s reputation and scale, customer retention should remain strong.

This is no longer just a single-category provider. Hims is now a more integrated telehealth platform with internal testing and manufacturing capacity.

Weight Loss

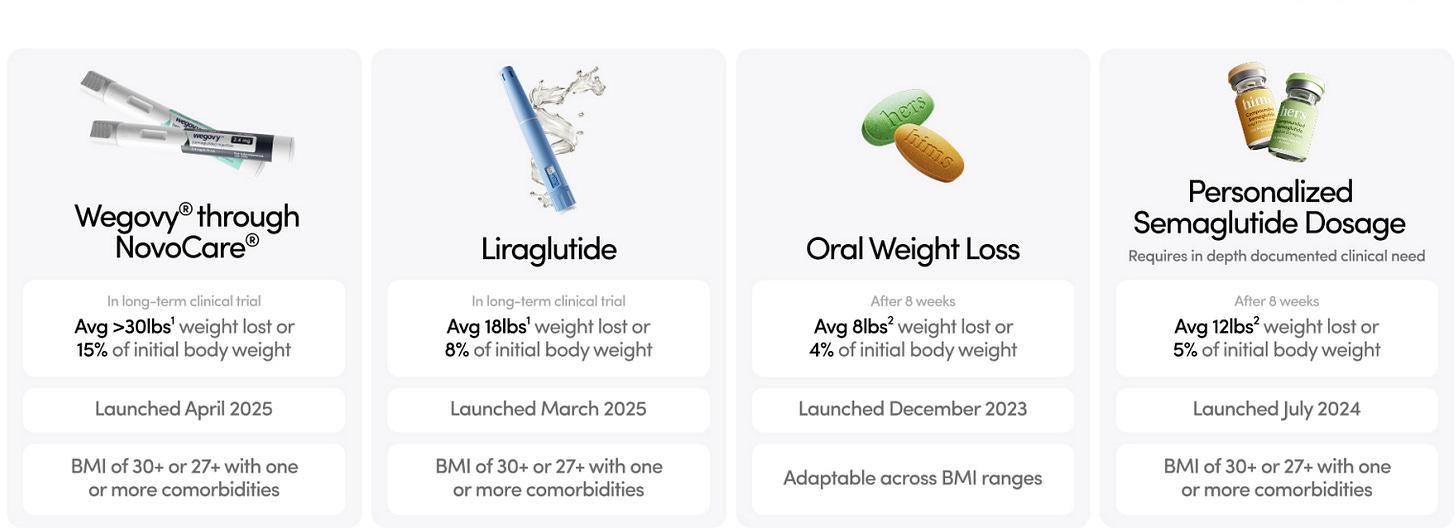

GLP-1 was a major profit driver for Hims, but after the shortage ended, the company could no longer offer the same generic treatments as before. It now has to lean more on branded, higher-cost alternatives.

At the moment, the only generic option is liraglutide, which is generally less effective than newer injectable alternatives. Hims can still provide semaglutide to existing patients, but only through the allowed transition window, expected to run until the second quarter of this year.

Even so, Hims continues to capitalize on strong weight-loss demand.

They offer popular oral weight-loss solutions, including personalized formulas, allowing patients to avoid injectables entirely. In the first quarter of 2025, subscriber growth from these oral offerings increased by more than 300% year over year.

They have also partnered with Novo Nordisk to offer a more affordable injectable option.

Patients in the United States can now access NovoCare Pharmacy directly through Hims, bundled with a membership that includes 24/7 care, clinical support, and nutritional guidance, starting at 599 dollars per month.

The two companies are also developing a long-term plan that combines Novo Nordisk’s innovation with Hims’ ability to scale access to care, with the goal of improving outcomes at a more affordable cost.

International Expansion

Hims has also indicated that international expansion will accelerate as part of its growth strategy.

The company has already expanded into the United Kingdom with encouraging early results, giving it an operational playbook for additional countries.

While no specific markets have been announced, Hims has the capital, team, and infrastructure to make meaningful investments abroad.

It also announced an 870 million dollar convertible notes offering to support global expansion and broader use of AI in healthcare.

This gives Hims close to 1 billion dollars to invest in growth.

The key risk is capital allocation. If that capital is deployed poorly, the company could take on unnecessary debt without adequate returns.

Still, given management’s execution record, it is reasonable to trust the decision to raise capital and target strong returns on invested capital.

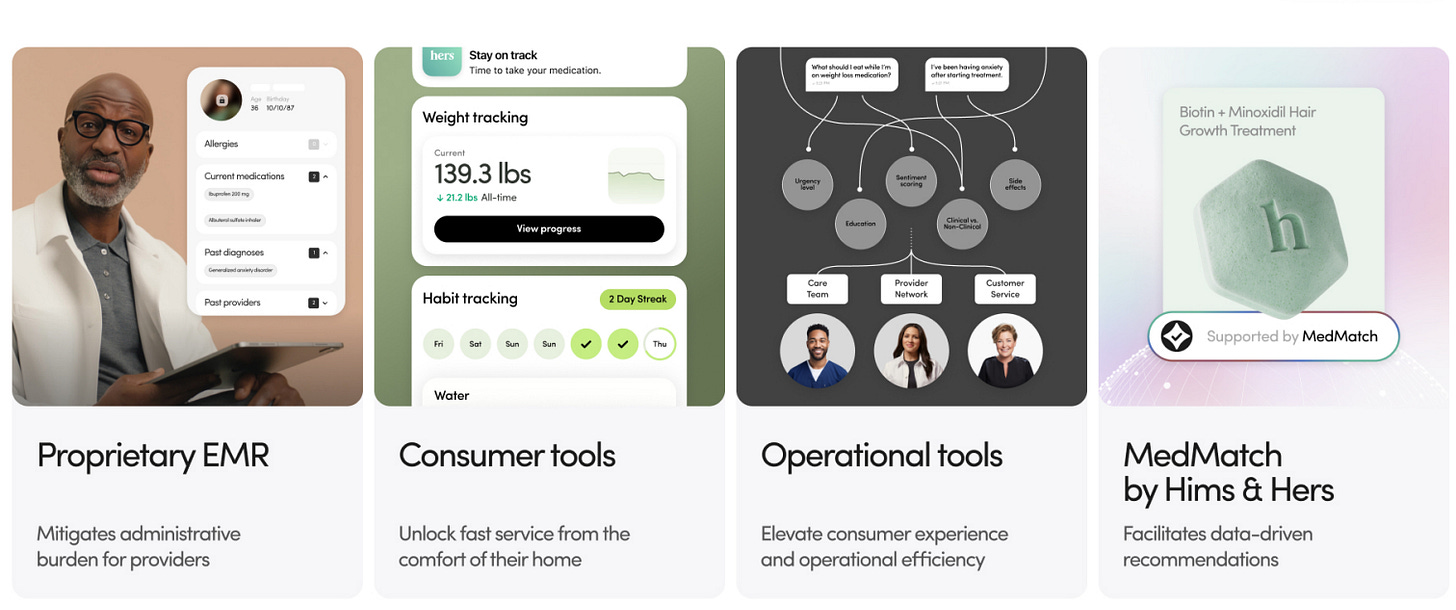

The Data Advantage

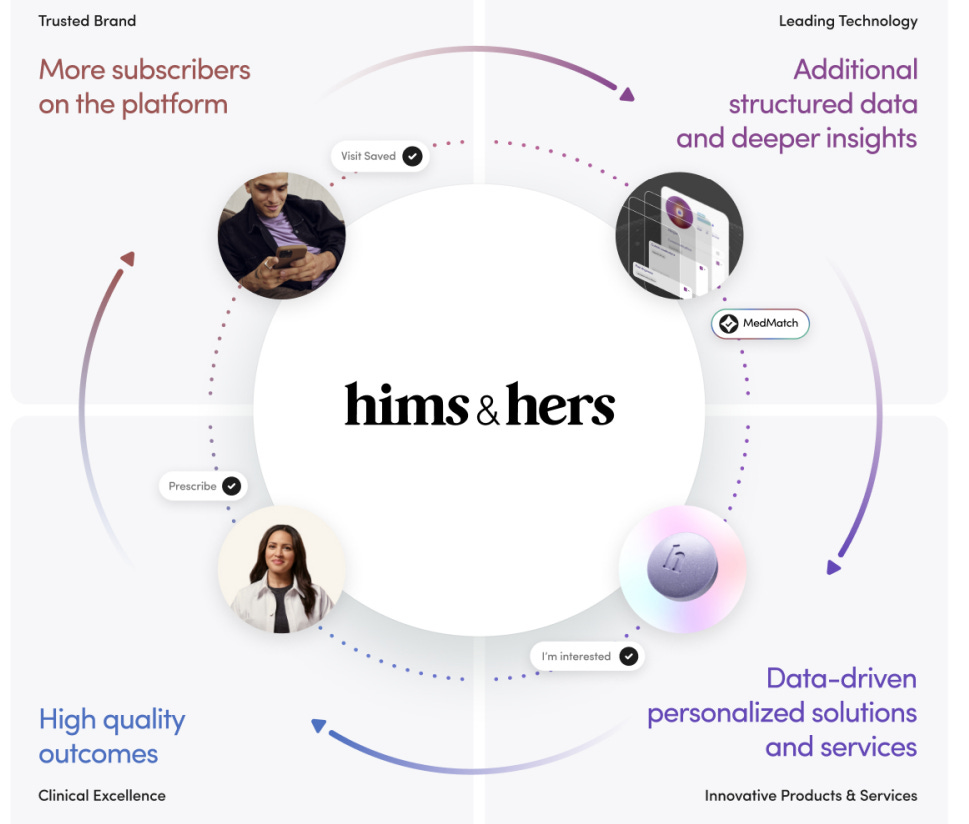

In late 2023, Hims launched MedMatch, an AI tool trained on millions of anonymized data points from its customer base and internal platform data.

With more than 2.4 million subscribers and an in-house lab, Hims can build a large proprietary dataset to train and refine its AI models.

This is a quiet but meaningful catalyst. If executed well, it can strengthen the company’s moat and accelerate long-term growth across verticals.

Insider Ownership

As with any company, management incentives should align with shareholder outcomes.

In Hims’ case, that alignment is clear.

Insiders still own more than 11% of the company, even at a roughly 12 billion dollar valuation, reinforcing strong long-term incentives.

Valuation Model

Hims expects revenue to grow at a 23% CAGR from 2025 to 2030.

If growth then decelerates to 15% from 2030 to 2035, revenue would reach about 13.1 billion dollars.

Using a long-term adjusted EBITDA margin target of 25% and a 15x EBITDA multiple, the implied valuation is around 50 billion dollars.

This may be conservative.

Hims has a clear record of outperforming its own guidance.

For example, 2022 guidance projected at least 1.2 billion dollars in revenue and 100 million dollars in adjusted EBITDA for 2025.

Now the company is tracking above 2.4 billion dollars in revenue for 2025 and already reported 91 million dollars in adjusted EBITDA in the first quarter alone.

If this pattern of overperformance continues, valuation potential could be materially higher.

Its total addressable market is expected to reach 1 trillion dollars this year. Given leadership in telehealth and consistent execution, a valuation above 50 billion dollars appears achievable.

Now let us look at a more aggressive scenario.

If Hims were to substantially exceed long-term guidance again and still grow at 15% CAGR from 2030 to 2035, using the same margin and multiple assumptions, it could support a 100 billion dollar valuation, around 8x today’s market capitalization.

That is the high-upside case, but it comes with caveats. Repeating the same level of overperformance without a catalyst as powerful as the GLP-1 shortage would be difficult. As the company scales, sustaining very high growth rates also becomes harder.

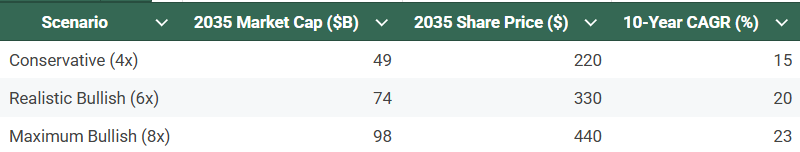

So in summary:

A conservative but bullish scenario could deliver about a 4x return over the next 10 years

A bullish but feasible scenario could lead to around a 6x return

A maximum upside case could reach roughly 8x, assuming near-flawless execution and additional unexpected catalysts

All of these outcomes are bullish and depend on continued high-level execution, something Hims has already demonstrated. In each scenario, the implied long-term CAGR for investors remains attractive.

Risks

Keep in mind that although the 4x case is labeled conservative, it still assumes successful execution. All three scenarios, 4x, 6x, and 8x, are part of a broader bullish view on Hims.

As with any company, there are risks.

Competition

The first major risk is competition.

Another company could replicate what Hims is doing and execute better. That risk exists in every industry. The key question is whether Hims has a weaker moat than other high-performing businesses, which would make this risk more relevant. I would argue that this concern is valid.

Hims does not have an impenetrable moat.

It is not Amazon, ASML, or a legacy pharmaceutical company protected by large patent portfolios and long-duration cash flow visibility. Hims operates in a category that is naturally more exposed to competitive pressure.

The most obvious potential threat is Amazon.

While Amazon has made attempts to compete with Hims, it has not broken through so far. Still, given its resources, Amazon could invest in a better user journey, create a more seamless healthcare experience, and bundle services into Prime. That could pressure Hims from angles that are difficult to defend.

Even so, this kind of disruption often fails to materialize. The largest player does not always win.

Smaller players are often faster, more focused, and better at execution. Larger companies can be slower, more bureaucratic, and less product-driven in niche categories.

At this point, Hims already has millions of satisfied subscribers, and healthcare is a category with strong switching friction. If a treatment works and the service is reliable, most users do not want to take risks by switching.

That creates a sticky customer base.

As Hims keeps expanding its offering, increasing manufacturing capacity, and delivering consistent quality, its position should continue to strengthen.

The company is growing in a market that lacked a centralized, convenience-first platform for health optimization. At the same time, strong profitability naturally attracts new competition.

Limited Differentiation

The second risk is closely linked to the first: limited differentiation.

The issue is not that Hims cannot differentiate, or that management is executing poorly. The issue is how far that differentiation can realistically go.

Hims is not a deep-tech business in the way companies like NVIDIA are. It is not building frontier models, advanced robotics systems, or highly technical infrastructure with extreme barriers to entry.

At its core, the company offers generics, supplements, and treatments that are not inherently unique.

Its strongest advantage, and likely the main driver of premium positioning, is personalization.

Owning internal labs and compounding customized medications is a real strength. Its website and user flow are also strong: intuitive, clean, and frictionless.

Beyond that, plus strong marketing, differentiation becomes narrower.

So yes, Hims does have a moat. It has differentiation, and that has translated into strong market share and healthy margins. But there are limits to how deep that moat can become.

Compounded personalized medications are valuable, but they are not frontier technology. A strong customer experience is important, but it is still mainly product design and execution quality.

Even its dataset and early AI efforts are promising rather than fully defensible at this stage. Other healthcare data companies may have greater technical depth in specific areas.

Bottom line

Hims is fundamentally attractive. The business is well managed, the metrics are strong, and the industry backdrop is favorable.

But there may be a ceiling on how far it can separate itself from future competitors.

Right now, it appears to be best-in-class in its niche, but there is no guarantee another company will not build a similarly strong offering.

No matter how much Hims expands its catalog or improves the interface, it is not operating at the frontier of hard-to-replicate innovation. That can limit long-term moat expansion.

That is why, despite confidence in the business, position sizing should stay disciplined.

I have been buying since 15 dollars, and based on fundamentals alone I could justify a much larger allocation. But I have kept it smaller, because the core risk is not the current moat, it is the uncertainty around how much that moat can deepen over time.

It resembles businesses like Nike in one important way: strong brand and execution can drive excellent outcomes, but competitive pressure never fully disappears.

They have a strong brand, high-quality products, capable management, and a long record of execution. Their differentiation comes from brand equity, consistency, and marketing.

That said, this type of differentiation has limits.

At the end of the day, shoes and sweatpants are not inherently unique products, and any well-funded player can outsource manufacturing in Southeast Asia and launch competing products. Nike’s brand offers meaningful protection, but product complexity does not.

Even a company like Nike, with global cultural relevance and dominant market share, has faced pressure in recent years. There is only so much it can do to block new entrants indefinitely.

The same principle applies to Hims.

Could that change over time? Possibly. Its growing health dataset and deeper AI integration could become stronger strategic assets.

For now, though, Hims is not building breakthrough biotech, and its ability to create a truly unreplicable business model remains limited.

Conclusion

Conclusion

Hims is a very well-managed company delivering hypergrowth, solid financial results, and execution in a rapidly expanding, multi-hundred-billion-dollar total addressable market.

The company is allocating capital intelligently to build a more vertically integrated, AI-enabled online health optimization platform.

As much as I would like to be more aggressive, I think a 10x outcome from current levels is unlikely. The maximum upside I currently see is around 8x over 10 years. That is still strong, but it is also a high-end scenario. This view is based on the current 55 dollar share price. If you can accumulate during pullbacks, your return profile can improve meaningfully.

The risks are clear, with competition and limited long-term differentiation depth at the top of the list.

How well Hims protects market share and executes in new segments will determine outcomes from here. So far, management’s track record supports giving the team the benefit of the doubt.

My final view is that Hims is a strong business and can be a valuable addition to many growth-oriented portfolios, as long as you actively monitor execution and make sure this high-performance story continues.

I think one critical thing you’re missing from the Amazon discussion is Hims ability to grow so effectively while refusing to take insurance. I think it is a fundamental competitive advantage relative to other companies figuring out how to involve insurance, especially Amazon.

Right now, insurers attract the majority of revenues in the health care value chain since they’re typically the “customers” of any care. They partake in insane levels of price fixing and manipulation to continue to grow profits year over year, even with a constant customer base (ie number of people insured). This is the main reason health care costs continue to skyrocket. On top of all this, there is no way for people to switch insurances since it’s provided by employers. Employers tend to just pick the cheapest carrier.

By not using insurance, and still having a large customer base, Hims is able to negotiate directly with care providers to get the best costs and pass those savings along to the consumer. Hims cannot partake in price gouging, as their subscribers would churn.

Over the long run, Hims has a realistic chance of usurping insurance providers as the primary distribution channel for care.

Daniel, what do you think of HIMS today? It’s down some 40% from the $55 when you’d published your view and findings.