Data Center Stocks Part 3

Valuing the Data Center Projects of Nebius, Iren, Cipher Mining and Terawulf

This article will focus on analyzing the hyperscaler projects of Cipher Mining, Terawulf, Nebius and Iren. I will show the profitability of these projects and how to value these companies based on that.

By the end of the article, you will have concrete figures you can assign to these companies, which will help you understand whether they are overvalued or if they follow a successful model that can deliver strong shareholder returns.

Let’s get into it.

In this article, I’ll calculate IRR.

IRR is the annualized return a project generates based on its cash flows. It’s the discount rate at which the project’s NPV becomes zero. A higher IRR means a more profitable project.

There are two types of IRR I’ll calculate:

Unlevered IRR

Unlevered IRR measures the project’s return before debt, using only operational cash flows. It shows the underlying profitability of the project itself.

Levered IRR

Levered IRR includes the effect of debt, showing the return earned by equity holders after interest and financing.

After calculating the IRR, I infer a net present value based on a conservative and a bullish scenario. For hyperscaler deals, the bullish scenario makes sense because of the solvency and reliability of these counterparties. All the companies covered here have high-quality tenants. In future articles, this won’t always be the case, and greater conservatism will be required.

The assumptions are based on what the companies have stated and what management has communicated. Some assumptions must be made on my part, but they remain aligned with what each company has expressed. I’ve built the models as close to reality as possible. The subjective variables, such as the discount rate and exit multiples, depend on company-specific factors like the type of asset involved in these deals and the quality of the tenants.

I won’t be showing all the exact calculations, as it would be too tedious. Instead, I state the assumptions and give a summary of the steps required to reach a final value.

This final value allows us to reach a per-share equity value that helps assess a fair value for these companies based on these projects. It also gives a sense of what future projects could mean for the share price. After each company’s project analysis, and at the end of the article, I’ll give my view and interpretation.

Cipher Mining

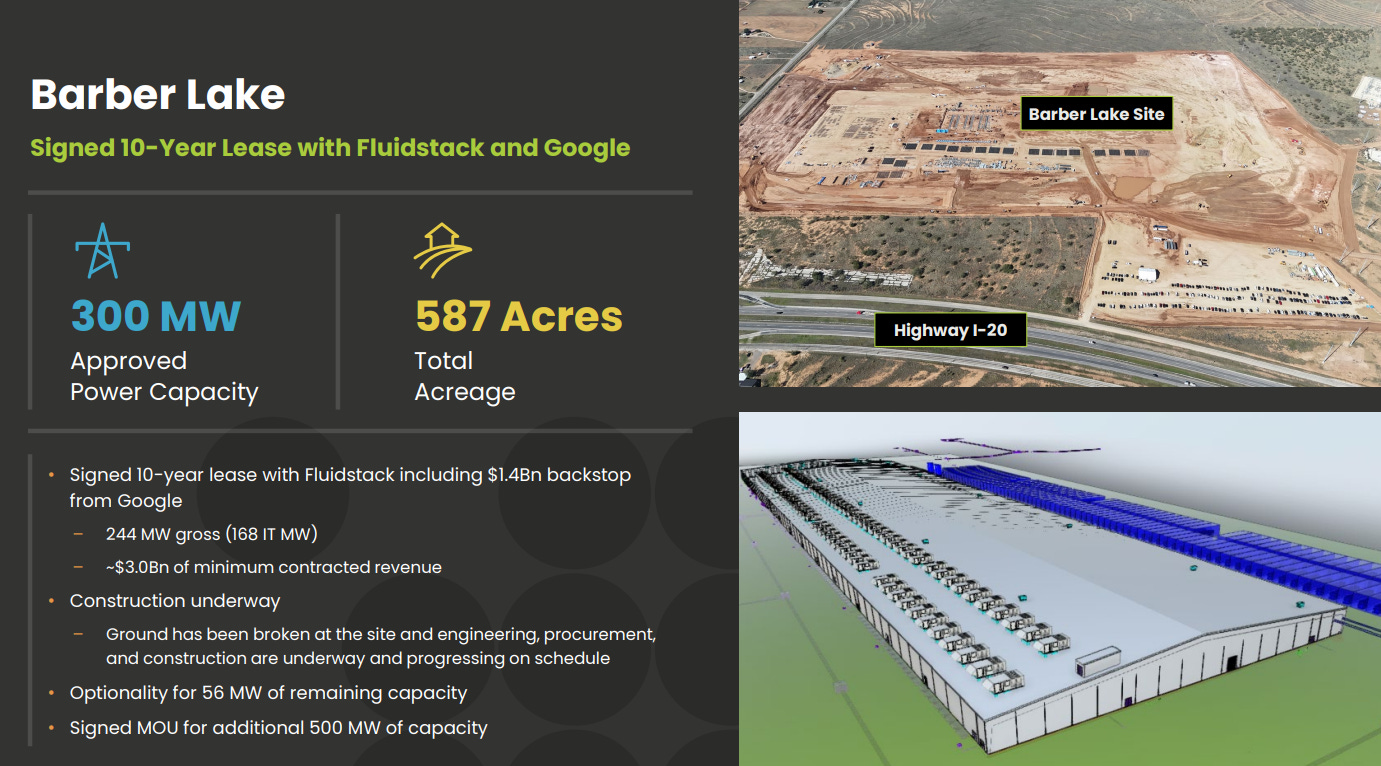

Barber Lake / Fluidstack

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.