Top Data Center Stocks

Data center plays are hot right now, but not all are the same. Know what you're investing in

In this article, I’ll provide an industry overview of the AI data center companies and Bitcoin miners that are transitioning to HPC data centers, while also covering some of them individually.

This article is part of a series:

Part 1: Initial look at the companies

Part 2: Analysis of deals, profitability, and valuation

Part 3: Deep analysis of the best opportunities

These are all the AI data center operators currently available in the market:

CRWV | CoreWeave | Market cap: 66B

NBIS | Nebius Group | Market cap: 32.8B

IREN | Iren | Market cap: 16.5B

FRMI | Fermi | Market cap: 17B

GLXY | Galaxy Digital | Market cap: 15B

APLD | Applied Digital | Market cap: 9.5B

CIFR | Cipher Mining | Market cap: 9B

RIOT | Riot Platforms | Market cap: 7.8B

MARA | Mara Holdings | Market cap: 7.5B

CLSK | CleanSpark | Market cap: 5B

WULF | TeraWulf | Market cap: 5B

BTDR | Bitdeer Technologies Group | Market cap: 4.7B

HUT | Hut 8 Corp | Market cap: 4.3B

BITF | Bitfarms | Market cap: 2.3B

HIVE | Hive Digital Technologies | Market cap: 1.2B

WYFI | WhiteFiber | Market cap: 1B

WLAC | Boost Run | Market cap: 214M

NUAI | New Era Energy and Digital | Market cap: 164M

SLNH | Soluna Holdings | Market cap: 200M

DGXX | Digi Power X | Market cap: 200M

The Data Center Trend

Data center operators are part of one of the strongest market trends in recent history. It’s unusual to see an entire sector rise almost in unison, and even more unusual to see it rise this much. Interestingly, traditional data center companies like Equinix or Digital Realty Trust never delivered the record-breaking returns that today’s AI data center operators are achieving.

Why? Because AI is unlike anything before, not even the internet. Traditional data centers sold a commodity that was easy to replace. You might think modern data centers are also a commodity, and you’d be right for the most part, but the difference is they’re not easy to replace. The world wasn’t prepared for the energy demands of AI, and if you have hundreds of approved megawatts and experience in data center construction and operations, you now hold a valuable asset.

Bitcoin miners fit perfectly into this trend. For years, they were criticized for being energy-intensive and polluting, but today they are being surpassed by AI in energy consumption. No one has more experience operating high-consumption, high-performance machines than Bitcoin miners. Their energy capacity, technical experience, and operational know-how have made this transition possible. But what about the future?

An Unsolvable Constraint

As long as energy remains scarce and AI continues progressing at its current pace, these companies will continue to be highly valued. Is this supply constraint expected to end anytime soon?

No one understands it better than those within the industry. As Satya Nadella recently emphasized, they’re simply lacking the necessary capacity to keep expanding:

Many Winners, but Not All

Although many of these companies have enormous secured capacity, performance doesn’t depend only on that. There are several key factors to consider:

Location

Sites near large metropolitan areas are preferred for their low latency. Most importantly, access to fiber optic lines and grid connections is essential. Many companies claim to have gigawatts in their pipeline, but that can be misleading. That’s why, in this analysis, I’ll focus on power that is already secured.

After that, the next steps are evaluating fiber connectivity and availability of skilled workers. Until all of these conditions are met, you can’t estimate the real value of the land. Balance sheets won’t help much either, since assets like land, buildings, power plants, and water usage permits are recorded at historical cost and depreciated over time, which doesn’t reflect their true market value, often much higher today.

Power

Power can come from grid connections (which must be approved with capacity limits) or from self-owned power plants or renewable sources, as in the cases of WULF(80-year lease), DGXX, and HIVE. Both options are valid, but not all power sources are equal. Analyzing the electricity cost per kWh is essential to understand each company’s competitiveness.Efficiency

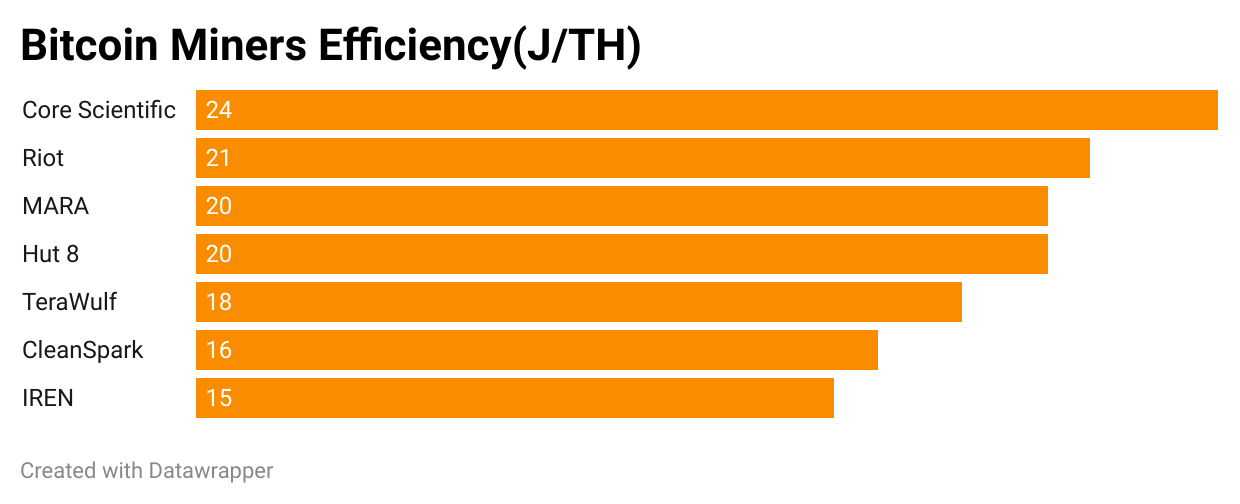

Building a data center is complex and must be energy efficient. Efficiency is measured by Power Usage Effectiveness (PUE). A strong PUE ranges between 1.1 and 1.3. Companies such as IREN, APLD, WULF, and WYFI operate or plan centers with PUE values between 1.1 and 1.2, while GLXY and RIOT expect around 1.5, indicating less efficiency.What affects PUE? Mainly location (colder climates reduce cooling needs) and construction quality. It’s no coincidence that Iren, the most efficient Bitcoin miner, has successfully applied that experience to its HPC data centers

Here’s the efficiency achieved by the main Bitcoin miners:

Management Quality

Strong management and negotiation skills are crucial in this industry. Companies that can secure more permits, build strong tenant relationships, and negotiate better deals will gain a significant edge. That’s why analyzing existing contracts and partnerships helps reveal which companies have the best leadership teams.

These are factors that affect the quality of the business itself, but there’s another factor that isn’t necessarily important for operations, yet it’s crucial for shareholder returns, and that’s execution speed.

Some companies are only now beginning to hire HPC specialists, such as MARA, which is slowly transitioning toward HPC. Others, like HUT, have no secured power dedicated to HPC and have only recently begun discussing their HPC project pipeline. In contrast, Iren and Nebius are rapidly securing as many megawatts as possible, while Applied Digital already has 700 MW of HPC-targeted secured power.

Over the short term, most of these companies are performing well and moving similarly. But this won’t last into 2026 and 2027. So far, returns have been driven by hype, but from now on, operational performance will be what truly determines outperformance. Investors must remember that, over the long run, the only thing that drives sustainable returns is what shows up in quarterly earnings.

Many investors fall into narrative-driven decisions, investing based purely on qualitative appeal. We’re seeing plenty of that in this market, where it seems that any company with a story can triple in value. People get attached to these companies, convinced they’ve figured it all out, and when earnings disappoint, they don’t understand what went wrong. The truth is simple: cash flow is what matters.

That’s why Palantir keeps rising, because it delivers strong results every quarter, and also why companies like Nano Dimension, once a 2021 bubble favorite, are now down nearly 90% and largely forgotten.

This is also why very few investors become billionaires. You might get lucky once and earn a 500% return, but without discipline, you’ll lose it all in the next trade. Luck doesn’t compound; execution does.

The bottom line is that you must choose carefully within the industry, even if all companies appear to be rising together. That won’t last forever.

Industry Overview

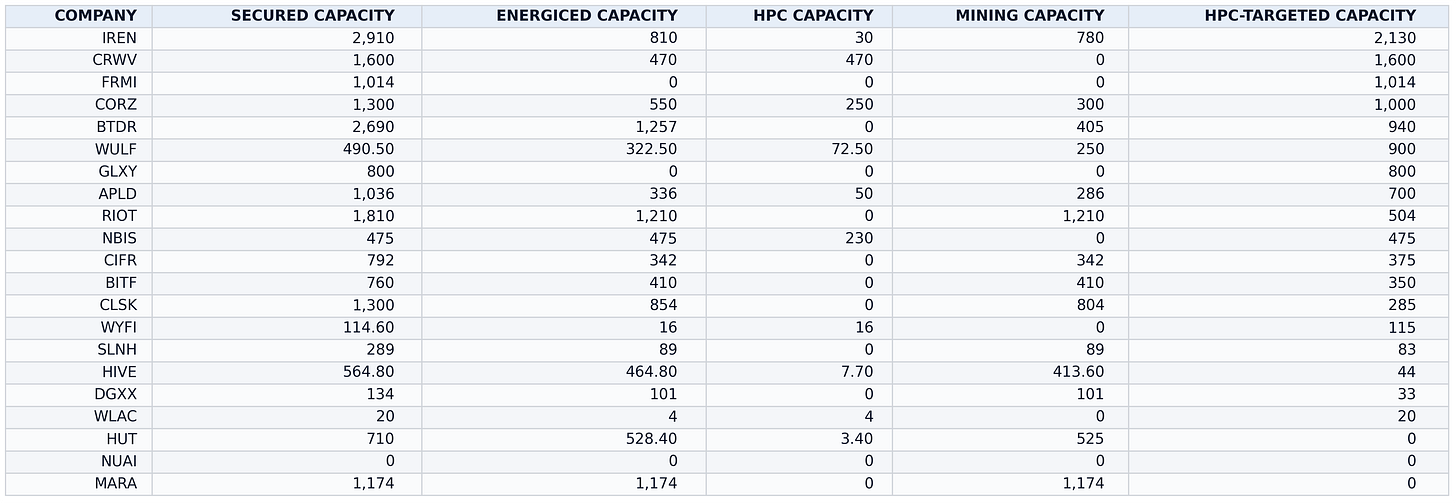

I’ve built two tables that serve as a quantitative summary of these companies. It took a long time because I gathered all the information myself. I’ve seen many people, even professional analysts, misreport figures or confuse metrics, so I knew I had to do it independently.

Now, these numbers aren’t 100% precise, because companies lack transparency and, in some cases, even they haven’t fully defined their own strategic direction yet. So, while the data isn’t perfect, it’s as accurate as possible and still highly valuable.

Here’s what’s included in the table:

Secured Power: All approved power plus any additional capacity the company controls, either through leased turbines, owned power plants, or other means.

Energized Power: The capacity already available for active use, whether for Bitcoin mining or GPU computing.

HPC Capacity: The portion of energized power currently used for HPC workloads.

Mining Capacity: The portion of energized power used for Bitcoin mining.

HPC-Targeted Capacity: The share of secured power explicitly allocated for HPC use in the company’s plans.

*(All in MWs of power capacity)

*Source: Company filings and presentations

Key Highlights from the Table

IREN has secured the largest capacity by a solid margin. This reflects how efficiently their management executes. They’re also, as mentioned earlier, the most efficient Bitcoin miners, which makes their strong performance this year understandable.

FRMI isn’t often discussed, but it controls a large amount of capacity. However, its capacity doesn’t come from the grid; it comes from gas turbines that the company has purchased or leased. These turbines that Fermi has purchased and leased have competitive with grid power in electricity costs, but come with large upfront CAPEX.

MARA holds a significant amount of secured capacity, but none of it is currently directed toward HPC. The same applies to HUT.

BTDR has the most energized capacity, which is an impressive achievement. However, being based in Singapore and having ties to China may be why it’s not getting the same market recognition as its U.S. peers.

NUAI is gaining traction on social media, but it currently has no approved capacity. The company plans to use gas turbines, yet hasn’t leased or purchased any, meaning its secured power remains at zero.

Out of all the listed companies, the only ones with hyperscaler deals are Nebius, Iren, Cipher Mining and Applied Digital. WULF also has a partnership with FluidStack, which is partly backed by Google. Meanwhile, CoreWeave, which can practically be considered a hyperscaler itself, has partnerships with Core Scientific (CORZ), Galaxy (GLXY), and Applied Digital (APLD).

Here’s the table that includes a valuation based on power capacity and the EBITDA each company is currently generating. While owning or controlling high-quality physical assets is ultimately more valuable than short-term financials, EBITDA helps estimate how much cash these companies can reinvest into growth.

Ordered by EV/HPC-Targeted Capacity(Out of the secured capacity)

Here’s the Table Ordered by EBITDA Multiple:

Key takeaways from the valuation table

I’m using EV over HPC targeted capacity because it captures both access to power and infrastructure and how quickly that power can be brought online. As I mentioned earlier, execution speed from management will be a key driver of outsized returns.

Nebius and CoreWeave are the most expensive relative to their HPC targeted capacity. This is logical because they are the only pure neoclouds in the group. They already own tens of thousands of GPUs, which increases their enterprise value, but that hardware is not reflected in the simple power capacity metric. They can charge 11 to 15 million per MW, while a simple power seller is closer to 2 million per MW. That is why I initially did not want to include them in the comparison, but I added them since people will ask about them.

It is also not just a matter of money. Other companies cannot simply buy NVIDIA racks and plug them in. Building GPU superclusters requires technical expertise. Both Galaxy Digital and Riot Platforms have already been asked by analysts why they lease capacity instead of buying GPUs and keeping all the value, and the answer was the same from both CEOs:

We are good at building data centers, not at building GPU clusters.

This is one of the reasons I am a bit skeptical of Iren. I really like their asset base and their data center capabilities, but they have now acquired 23,000 AI accelerators to build their own neocloud, which in my view unnecessarily increases business risk.

However, after striking a deal with Microsoft, IREN has effectively de risked the business with what everyone was waiting for, recognition from a hyperscaler and secured revenue, plus a prepayment to fund part of the buildout.

I know the first thing everyone wants to see is who is cheapest. In this case the cheapest group would be Soluna, followed by BTDR, CORZ, IREN, WULF, APLD, BITF and WLAC.

The most expensive group would be HIVE, CLSK, GLXY, CIFR, FRMI and RIOT.

I wish investing was as simple as buying the cheapest group, but it is not. There are many other variables to consider, as explained above.

Let’s do an overview

Soluna

Why is Soluna the cheapest compared to the secured capacity they are dedicating to HPC

I can find three main reasons.

Keep reading with a 7-day free trial

Subscribe to Daniel Romero to keep reading this post and get 7 days of free access to the full post archives.