2CRSI: An Undervalued AI Microcap

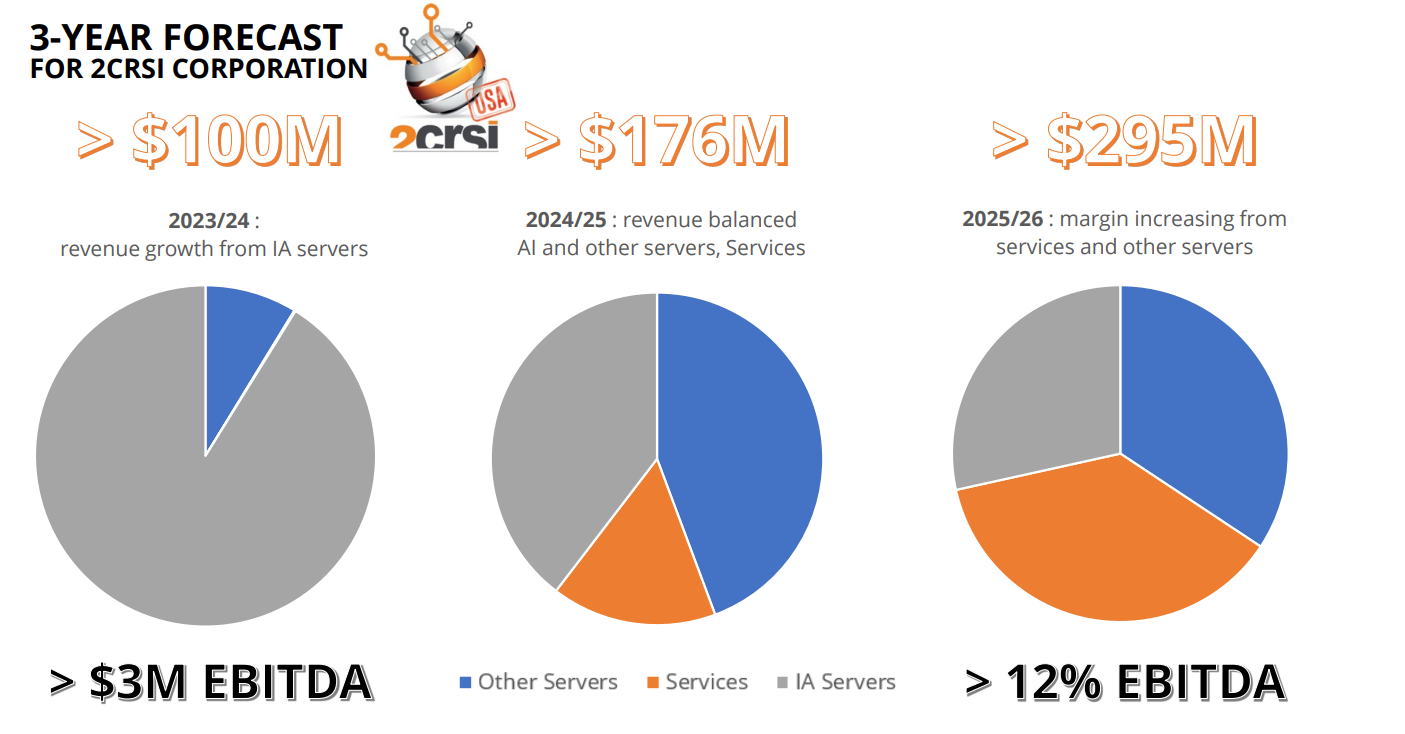

Trading at 0.45× forward revenue and projecting 50% revenue growth with 12%+ EBITDA margins in 2026, this company is one of the most under-the-radar AI stocks on the market

A Diversified AI Platform

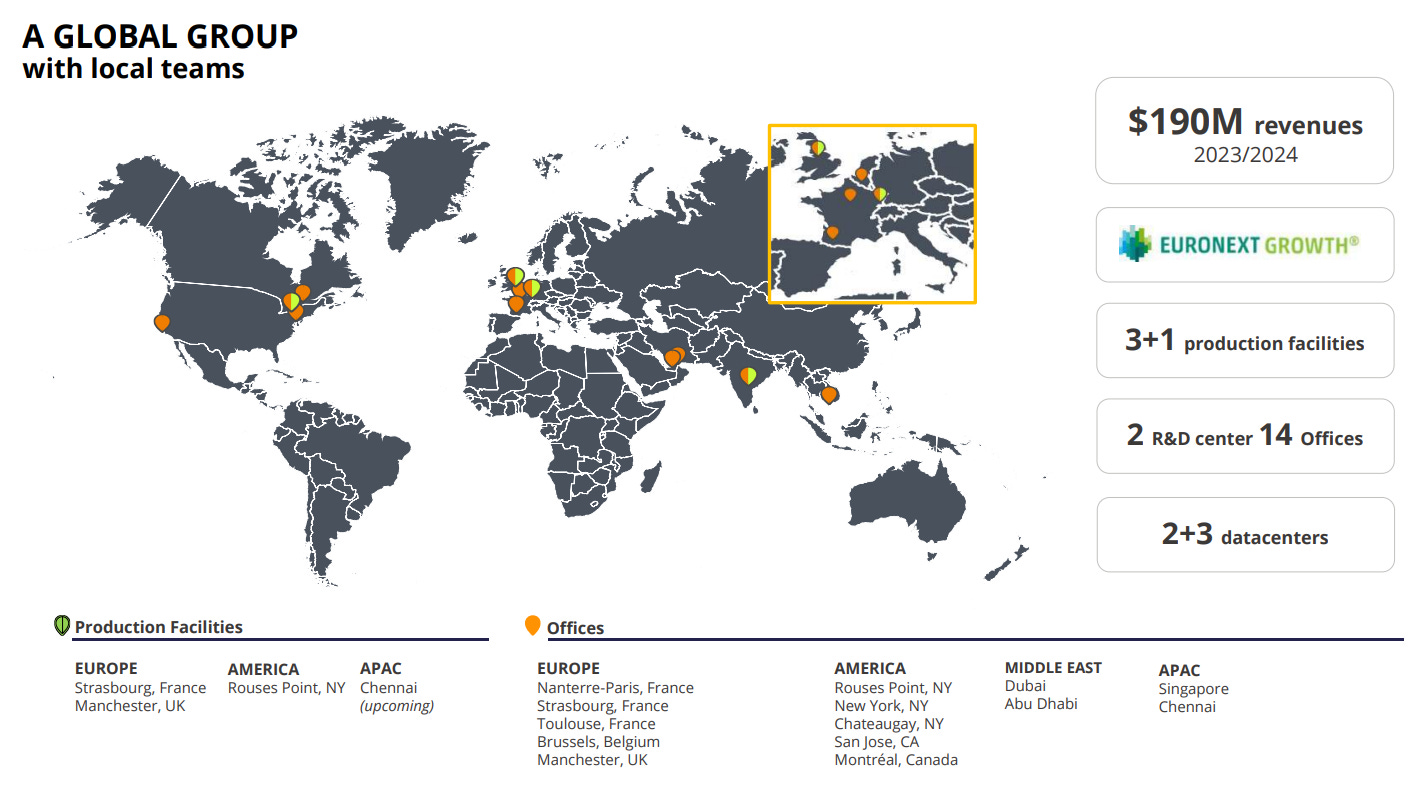

2CRSi is a French global tech group listed on Euronext Growth Paris. As a world-class player in high-performance and high-efficiency server technology, the 2CRSi Group develops, manufactures, and distributes end-to-end energy-efficient computing solutions.

Founded in 2005, 2CRSi has invested heavily in R&D and has built a vast global team perfectly positioned to seize the AI opportunity. With more than 200 employees and a presence in over 50 countries, it has become a trusted and prestigious company capable of leveraging its expertise, long-standing partnerships, and infrastructure base.

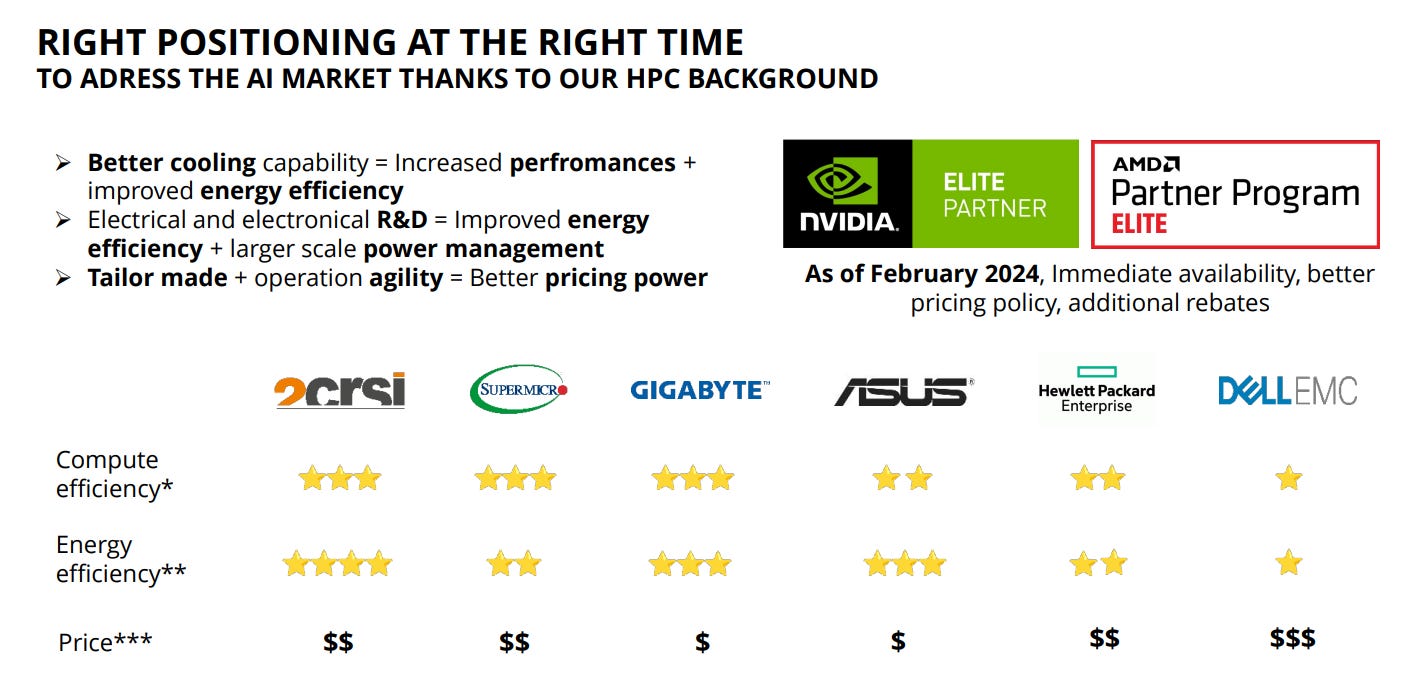

Thanks to its experience in high-performance computing, 2CRSi has built strong relationships that speak to its technical quality, reputation, and supply chain resilience.

NVIDIA Partner since 2010 → Preferred Partner in 2020 → Elite Partner in 2023

Elite AMD Partner

Hardware-neutral: uses whichever solution delivers the best price-to-performance

2CRSi serves a wide variety of sectors, including:

Aerospace, defense, and national security

Oil & gas, healthcare, scientific research

Education, telecommunications, and automotive

Banking, trading & finance, media & entertainment, and web services

It also maintains strong ties with the French government and the European Union. In 2021, the European Commission selected 2CRSi to design and manufacture 100% European pilot systems based on RISC-V accelerators, as a first step toward building future European exascale computing systems.

Business Units

The 2CRSi Group operates through four global and complementary business units:

2CRSi – Server and rack design, integration, and custom engineering

Adimes – Vertically integrated manufacturing across France, the UK, the US, and (from 2025) India

Tranquil IT – Specialized IT hardware for edge computing and secure environments

Green Data – Data center operations, including green AI cloud hosting and colocation services

Business Unit 1: 2CRSi

2CRSi specializes in rack and server design optimized for GPUs, FPGAs, and CPUs.

It can be compared to companies like Supermicro (SMCI), Dell, HPE, or ASUS. But unlike some larger competitors, 2CRSi offers a high level of customization, which has earned it contracts with:

Dassault (its most important client, provider of aircraft simulator racks for over 15 years)

Airbus, Siemens, CERN, BBC, Bosch, Thales, BMW, Rolls-Royce

US Departments of Defense and Energy

The company doesn’t specialize in large-volume hardware production, but rather in high-quality, highly customized hardware. Here’s a comparison from 2CRSI with other hardware manufacturers:

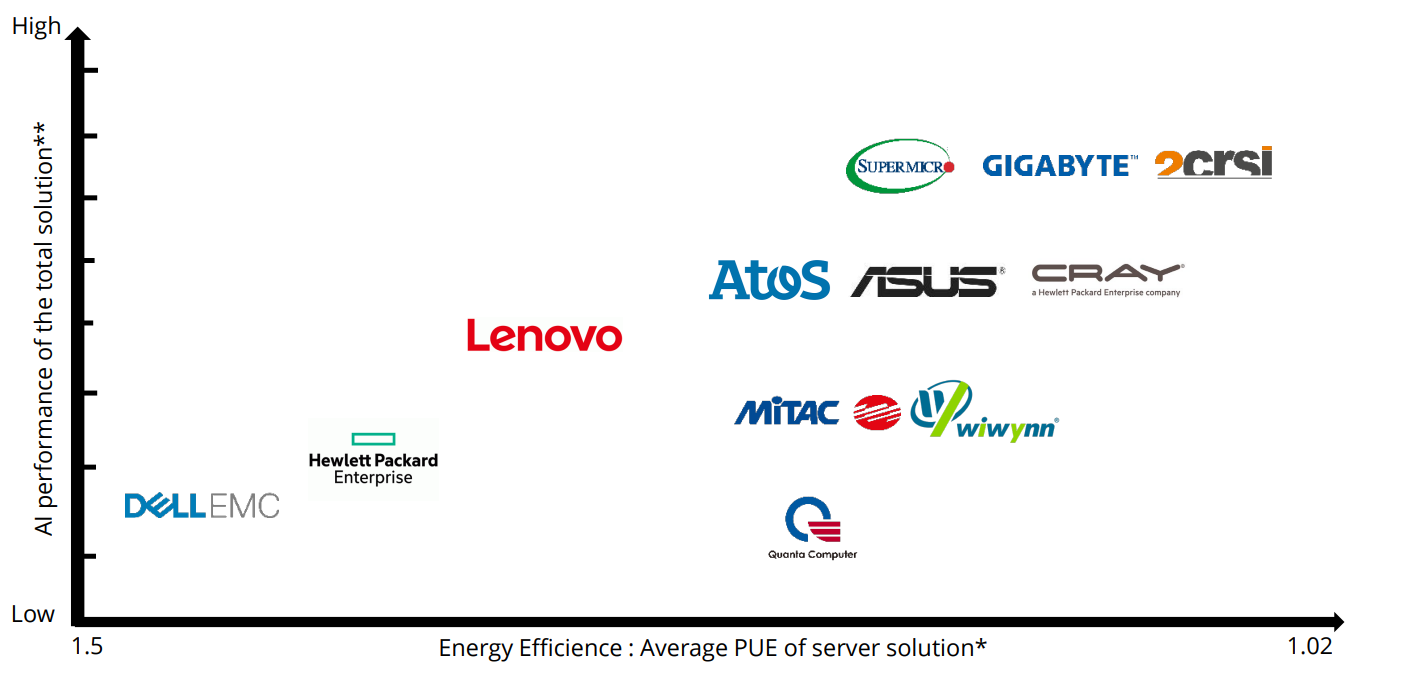

Their power efficiency and performance is also best in class, even when compared to the largest producers. This is something we’ll explore in more detail later.

The company is now transitioning from a niche supplier of specialized hardware to a full-fledged AI data center provider. They've secured a massive $610 million contract with a U.S. data center operator and are setting up a new large-scale production facility in India to handle higher volumes.

The initial U.S. project includes the construction of several 10MW data centers, equipped with:

Advanced liquid cooling technologies

Power sourced entirely from renewable solar energy

Thermal energy reuse for agricultural applications

Currently, four data centers are under construction, with a roadmap extending to 2030 that includes over 30 sites, totaling more than 1,700MW to be deployed across 20+ U.S. states.

This is a Made in America initiative, fully leveraging the Inflation Reduction Act’s fiscal incentives.

For this massive expansion, 2CRSi is closely partnering with a new data center operator with highly ambitious plans: New York GreenCloud(NYGC), which aims to power AI data centers with carbon-negative electricity generated from solar energy and biomass.

We will explore more about their US manufacturing capabilities in the next section and take a closer look at the financial implications of this massive contract, which is particularly relevant given the company’s current market capitalization of just $135 million, in the financials section.

Business Unit 2: Adimes

Adimes is the manufacturing arm of the group. With four facilities already operating and a fifth under construction, Adimes enables 2CRSi to function as a fully vertically integrated hardware provider.

Here’s a quick snapshot of their manufacturing facilities:

A key strategic advantage lies in their Strasbourg facility, which is:

Certified for highly classified production

Staffed with security-cleared personnel

Equipped with a locked, secure manufacturing environment

Thanks to this, they’ve gained access to high-security government and defense contracts that are off-limits to most competitors, working with names like the U.S. Department of Defense, Dassault Aviation, Lockheed Martin, and Airbus.

However, Adimes now aims to transition from a highly customized hardware solutions provider to a large-scale supplier, positioning itself to take advantage of the era of soaring AI-driven demand.

The new facility in Chennai will have nearly six times the combined capacity of all existing sites. This marks a strategic shift.

What began as a niche provider of secure, specialized infrastructure is now scaling to become a global supplier of high-performance AI servers and racks at volume.

This scale-up is what has fueled a new wave of market optimism around the stock. 2CRSi has found a massive gold mine, and they just happen to already own the right picks and shovels.

But they're not stopping there.

Business Unit 3: Green Data

Green Data is a wholly owned subsidiary of 2CRSi focused on data center operations.

It currently:

Owns and operates a small data center in Paris

Operates two data centers in New York in collaboration with U.S. partners

Summary of data center operations

In their new U.S. venture, 2CRSi provides the servers, racks, and integration expertise, Green Data manages data center operations, and their partners supply the construction infrastructure and power.

These deals allow 2CRSi to leverage two decades of industry experience. They’re transitioning from a pure hardware supplier to also a higher-margin service provider, taking on a key role as both advisor and operator in these large-scale data center deployments.

These US data centers will use 2CRSI infrastructure hardware, considered among the best in the world.

A testament to this is the power efficiency of their NA0 data center, which achieves an average PUE of 1.15 with direct-to-chip cooling, and 1.12 with immersion cooling. For comparison, the average PUE of data centers, according to Uptime Intelligence, is 1.56, while major cloud providers like Azure, Oracle, Alibaba, and IBM report averages between 1.12 and 1.46. This places NA0 among the most efficient data centers globally.

Of course, this data center isn’t that relevant in the grand scheme of things, but this isn’t about one specific location. It’s proof that 2CRSI’s technology can deliver top performance for AI data centers, something that is extremely valuable in the AI era. This level of overperformance helps explain why 2CRSI was selected by New York Global Cloud to be part of a massive data center investment. It also supports a bullish outlook for the company, as it positions itself to secure more contracts with other operators in the future.

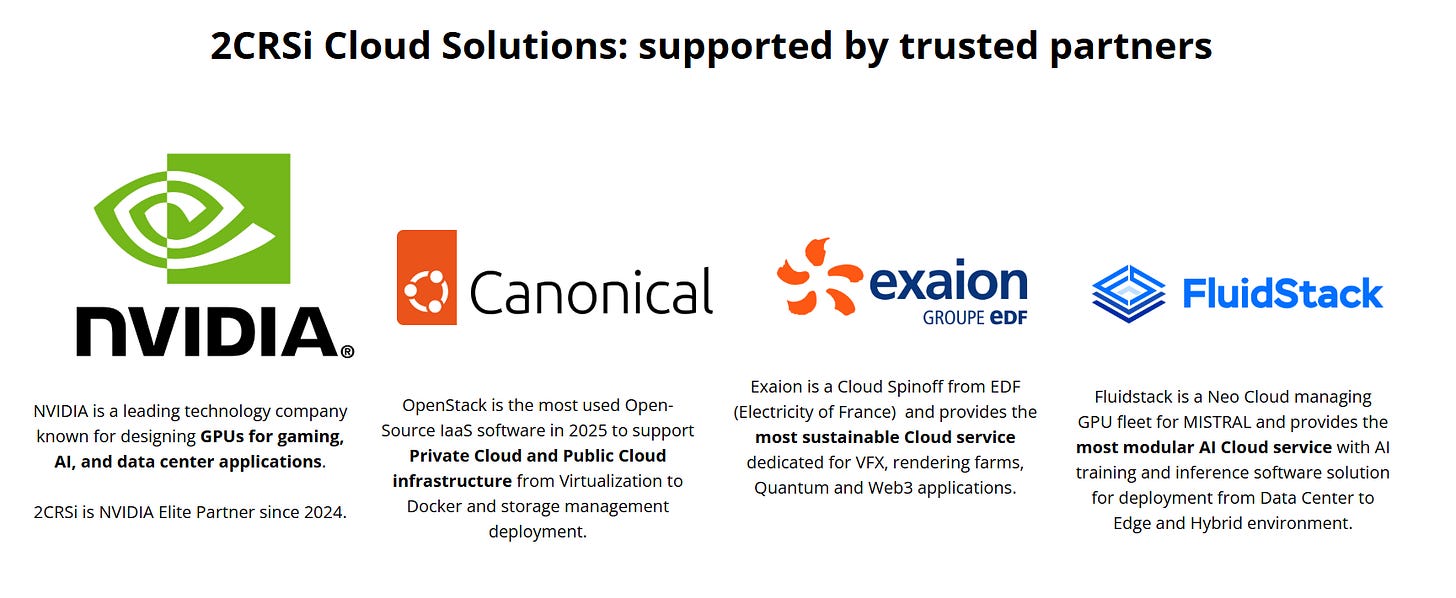

The long-term plan is to rent GPU and CPU bare metal through their collaboration with NYGC and part of their proprietary Paris data center. Additionally, they aim to offer AI cloud services via partnerships with Neocloud platforms like Fluidstack and Canonical, leveraging both NVIDIA and AMD accelerators.

This positions Green Data not just as an infrastructure provider, but as an active player in the AI cloud market, delivering compute-as-a-service tailored for sectors such as:

AI model training and inference

VFX rendering and simulation

Government and defense cloud workloads

Business Unit 4: Tranquil

Tranquil is a UK-based company that designs and manufactures rugged, fanless, and industrial-grade computing solutions. They specialize in high-reliability PCs and servers that operate silently and endure harsh environments such as defense, aerospace, industrial automation, and edge AI deployments.

Tranquil manufactures from its Manchester facility, which has the capacity to produce up to 10,000 embedded systems per year, using advanced CNC and molding processes.

The company also holds an impressive customer portfolio, serving world-class organizations such as:

Citrix

Rothschild

Canonical

Oxford Nanopore Technologies

Rolls-Royce

Lockheed Martin

AIB (Allied Irish Banks)

Drillinginfo

McDonalds

BMW

Financial Overview

The qualitative part of the business reinforced my bullish position, but it’s the financials that are the first striking positive point. This company looks super cheap, and the upside is hard to ignore.

Let’s look at some key performance indicators from their last report (covering the last 6 months of 2024):

Revenue: +95% year-over-year growth

EBITDA margin: 10%

Operating cash flow: improved from −€5.4 million to +€3 million

For the 12-month period from July 2025 to July 2026, the company is guiding for hypergrowth, targeting:

Revenue: €300 million

EBITDA margin: over 12%

*Although the image says $295M, the company re-guided to $300M.

These numbers look surprisingly high, but where is this growth coming from? There are two answers: their large U.S. contract and their new high-volume manufacturing site in India.

Growth Drivers

1. U.S. Expansion

Here are the economics of their new U.S. contract:

Total value: $610 million (€565M)

$210 million (€194M) as the first commitment, to be executed over 18 months

$400 million (€371M) as a second commitment, spread over the following 4 years

Self-funded: the customer provides all necessary working capital

This structure allows 2CRSi to scale significantly without upfront financial pressure.

2. India Manufacturing Site

The new India site is expected to open in the second half of 2025.

It will infuse substantial growth, tripling their manufacturing capacity and enabling them to support large-scale orders more efficiently.

Balance Sheet

This company has a balanced and healthy capital structure. Total debt stands at €11.1 million, which may seem high compared to €1.2 million in cash reserves, but €6.4 million of that debt is state-backed (COVID-era loans) with low interest rates. The rest is mainly lease liabilities and vendor financing.

Their total assets are €88.9 million, of which tangible assets are approximately €6.8 million.

Total liabilities are €60.4 million, which results in equity of €28.5 million.

Their debt will soon seem far smaller relative to the business they are building. I expect their market cap to grow considerably along with revenue and net income.

Most importantly, the U.S. contract won’t increase capex or place any financial burden on 2CRSi, as the client covers all upfront costs, and the company will rely on manufacturing partners for any production beyond its in-house capacity.

Valuation

2CRSI has a solid core business of customized solutions that generated over $100 million in sales for the year ending June 2024. Now, the company expects its US expansion to drive revenue to $300 million annually, and its new large-scale factory in India, set to open in the second half of the year, will likely take several months to reach full capacity, bringing further growth potential.

While the future remains uncertain, the company has signaled a growing focus on higher-margin service revenue, and more ventures could follow their US partnerships, possibly even larger contracts. But at that point, we enter the realm of speculation.

Using their guided revenue of $300 million and an EBITDA margin of 12%, and applying a forward EV/EBITDA multiple of 11, in line with SMCI, 2CRSi could be worth around $400 million. This implies a 175% upside, even after factoring in the company’s €11.1 million in net debt.

This valuation is reasonable given that 2CRSi is growing significantly faster than SMCI, and when compared with peers, it’s clear the company stands out for its exceptional growth rate and massive upside from a smaller revenue base. The ceiling here is meaningfully higher.

Snapshot Peer Comparison

Of course, comparing a microcap trading on Euronext Paris with limited capital access to a Nasdaq-listed company tied to the largest tech firms in the world isn’t straightforward. But considering 2CRSI's 50% year-over-year revenue growth and substantial margin improvement, it’s hard to ignore the company’s current trajectory.

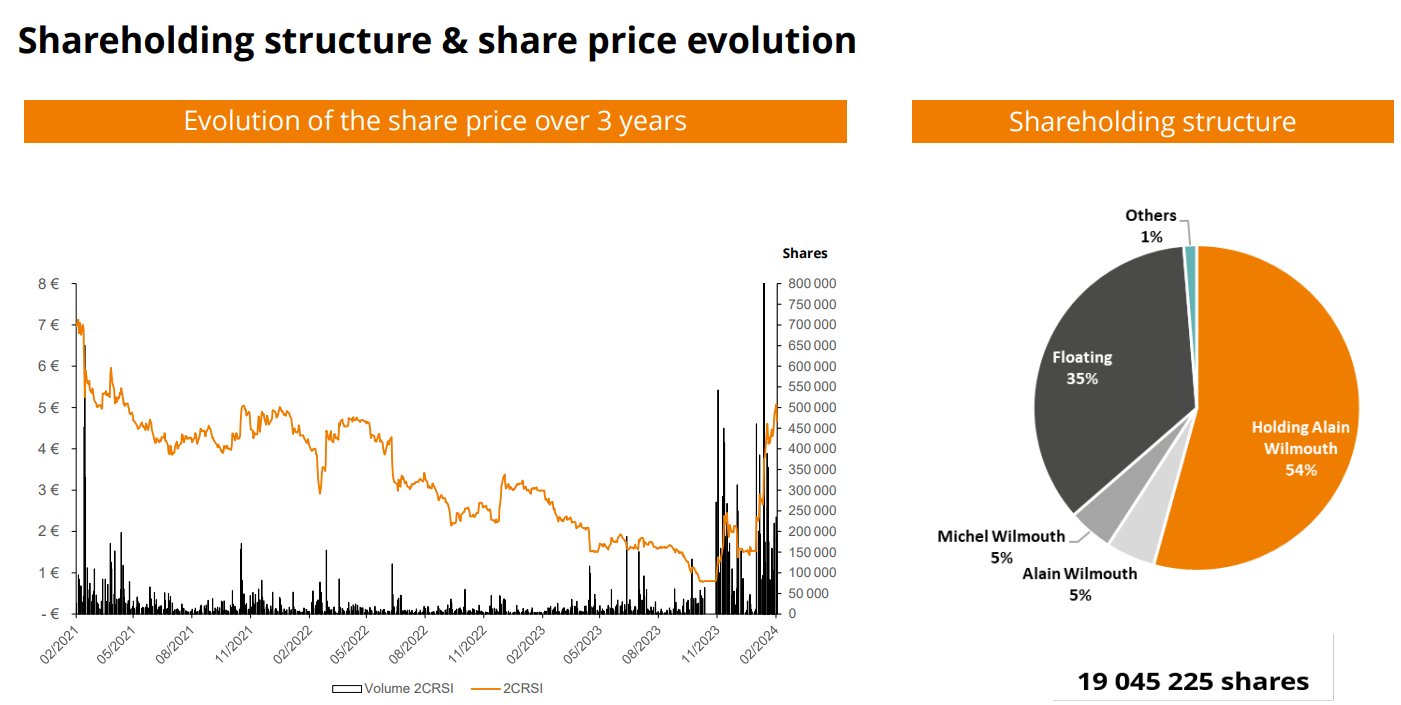

The French market seems to agree. After a difficult period during COVID, which included a failed acquisition, the bankruptcy of a major client, and a deep restructuring, 2CRSI hit all-time lows in October 2023. Since then, the stock has rallied over 700%. The company has successfully turned the ship around, leveraging 20 years of experience, manufacturing capacity, and leading-edge technology in a rapidly expanding AI market.

This is not some stagnant European stock. It’s a company that is quietly thriving, having signed a contract last year worth five times its market cap, and now delivering best-in-class technology to some of the world’s largest organizations. Yes, it remains a niche player in certain segments, but those specialized, high-loyalty product lines form a stable base. From there, 2CRSI is evolving into a full-scale AI hardware provider, operating and expanding its own data centers, with a contract to build 30 new facilities in the US, and preparing for mass production at its India plant.

Management and Ownership

Founder and CEO Alain Wilmouth owns 59% of shares, either directly or through his holding company. His brother Michael Wilmouth holds another 5%, leaving a 35% free float.

This structure has both positives and negatives. On the bright side, strong insider ownership means aligned incentives between management and shareholders. It also brings stability in decision-making and reduces the likelihood of hostile takeovers.

On the negative side, the low float may deter institutional investors due to limited liquidity and higher volatility when entering or exiting positions. Additionally, while management alignment is a strength, excessive control can result in unilateral decision-making and potential nepotism. Both aspects are worth keeping in mind.

Conclusion

This is a French microcap that trades cheaply for exactly that reason. It is small, undercovered, and listed in Paris. But that is where the opportunity lies. The company has massively outperformed major indices since its restructuring and is now riding the AI wave with impressive momentum.

Although risks remain, the valuation gap is striking, making this a compelling opportunity for investors who can tolerate volatility and take a long-term view. I’m personally initiating a 3% position, which I may expand if the opportunity deepens. I’m reallocating capital from non-core holdings like TMDX and DAVE, which have recently taken off, and using cash from a partial sale of HIMS after it crossed the $60 mark.

I believe we could see new all-time highs soon, potentially putting the stock in the $11 zone.

Dear Daniel, thank you for this interesting write-up. May I ask you what is your take on all the various risks and uncertainties described in the company half-year financial report 2024/2025 on pages 46 to 50 (e.g. possible difficulties in sourcing rare earths and metals, dependency on few customers, dependency on key personnel)?

Hey Daniel, Thank you for the insights. What is your investment horizon for this stock? Do you consider this as a long-term 3-5 year bet? Thanks!