3 Cheap, High-Growth Stocks

In this article, I’ll cover three rapidly growing companies that appear undervalued based on their fundamentals

I’m an advocate for concentration and focusing on your winners, but it’s always smart to stay up to date with ideas that could eventually turn into a position. Not necessarily overnight, but remaining active in the research process is the only way to consistently outperform the market.

That’s why, after reviewing dozens of stocks, I’ve found three very different companies, each presenting an interesting case for growth investors looking for undervalued opportunities.

Let’s get into it

Inter&Co ($INTR)

Inter&Co is the Nasdaq-listed holding company behind Banco Inter, a Brazilian digital bank that has evolved into a full-fledged “super-app.” It offers services across banking, investments, credit, insurance, mortgages, and e-commerce via a growing marketplace.

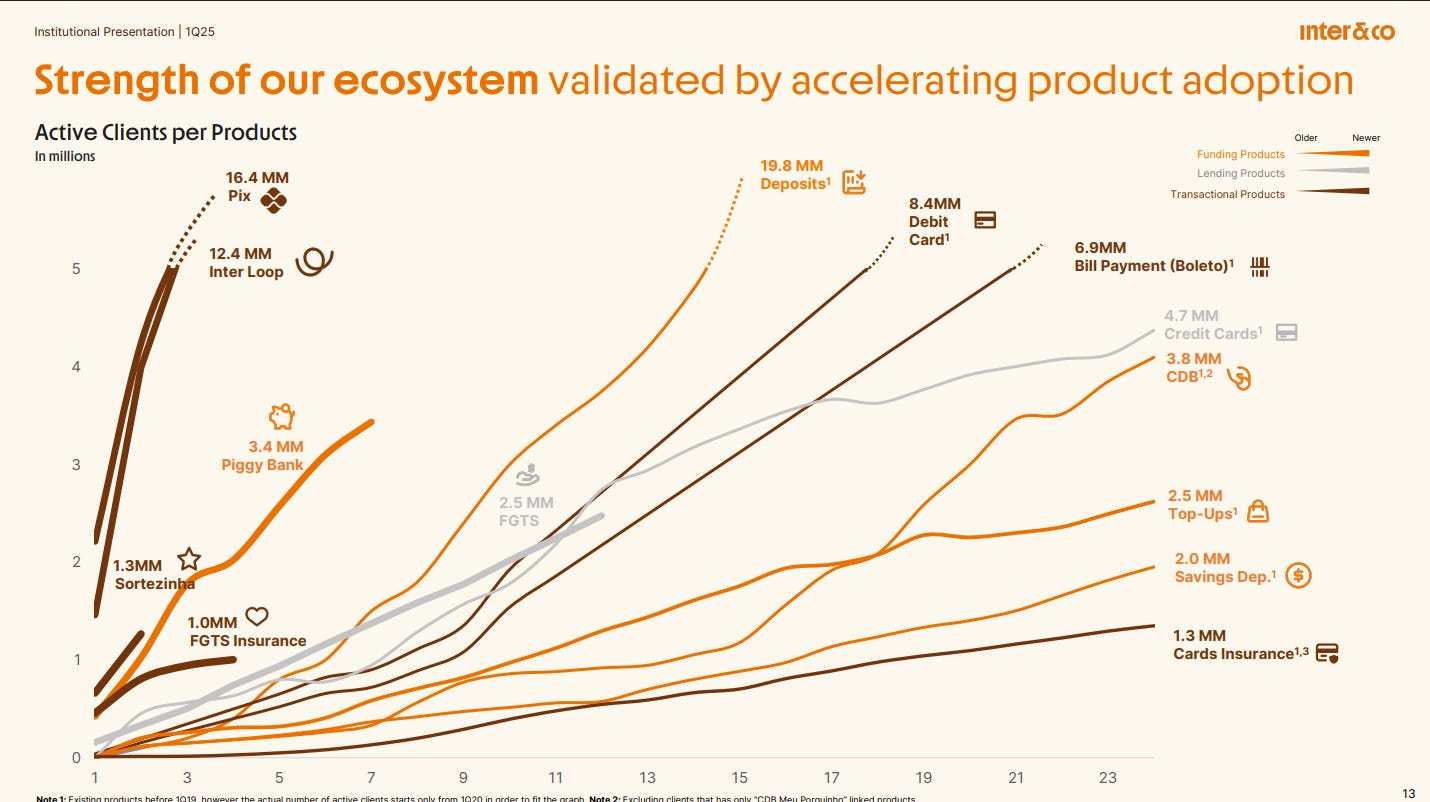

Inter&Co has achieved remarkable success in Brazil, now serving 21.6 million active clients, up from 13.5 million in 2023, representing a 26.5% CAGR. All key performance metrics are showing strong growth:

Clients: +60%

Business accounts: +23%

Assets under custody: +54%

Insurance policies sold: +776%

E-commerce Gross Market Value: +29%, with 3.5M active clients

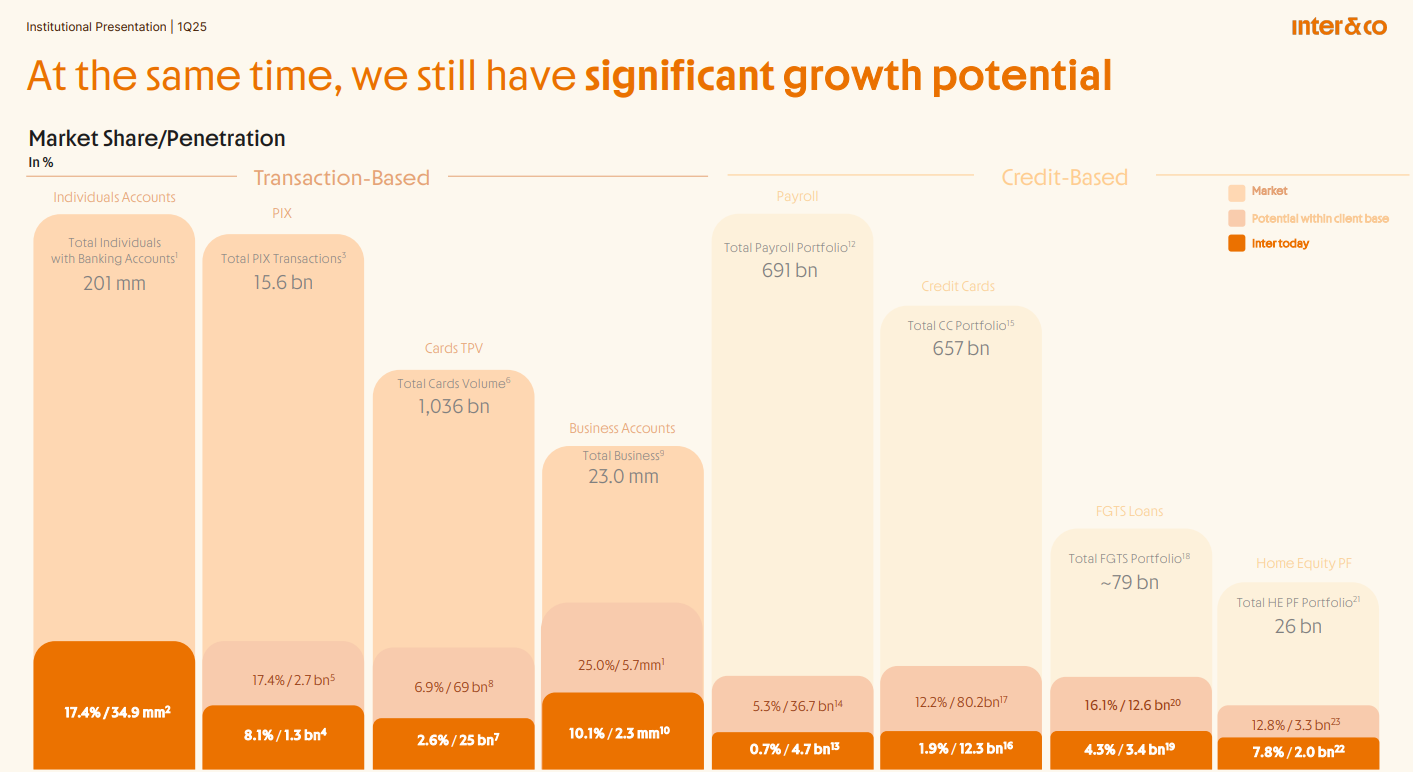

Their market share is already significant in all verticals, yet there’s still plenty of TAM to capture.

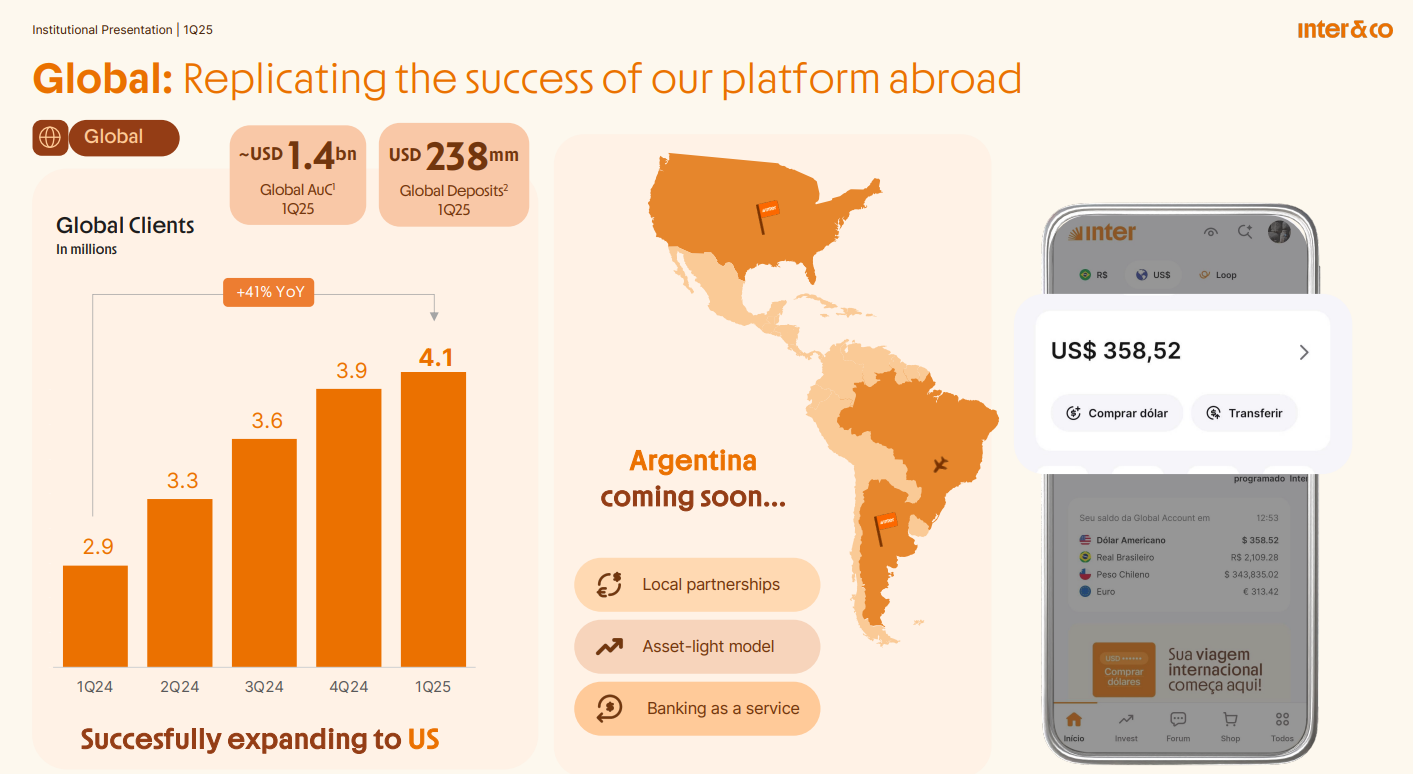

Inter&Co began its U.S. expansion in 2021, and the numbers are promising:

U.S. account holders: +41%, reaching 4.1 million

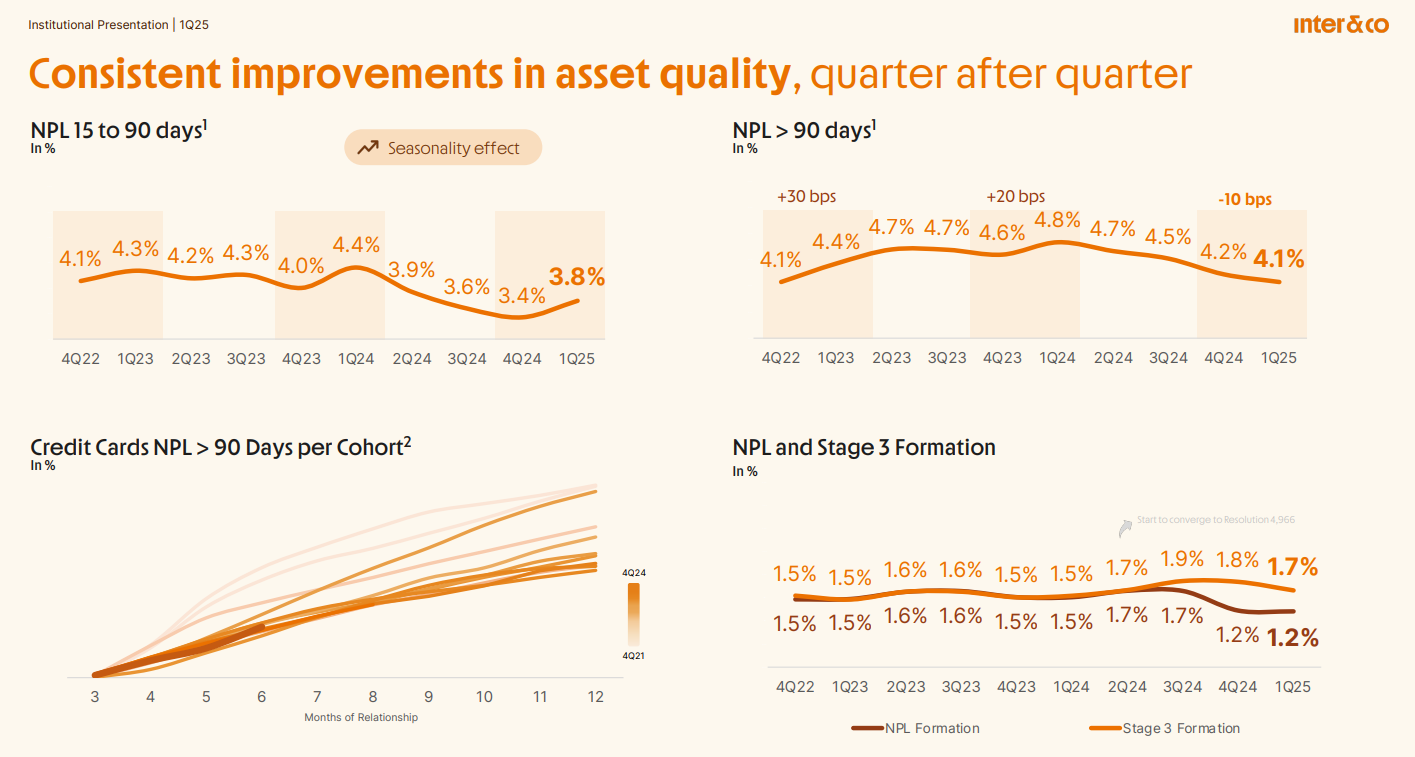

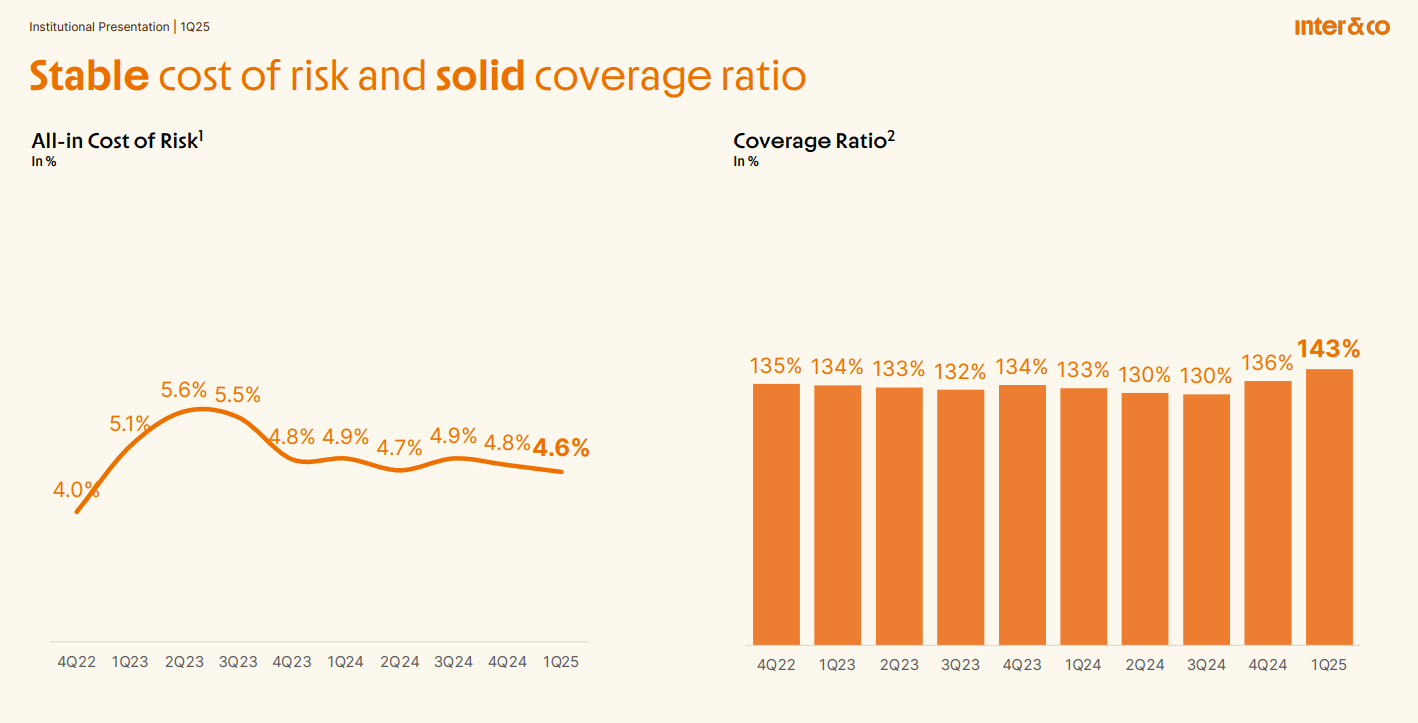

Crucially, Inter has maintained high client quality, which is especially important in developing markets. The gross loan portfolio is up 33% YoY and 3% QoQ, while non-performing loans dropped from 4.4% to 3.8% (short-term) and from 4.8% to 4.1% (long-term) over the same period.

Deposits per active client rose 9%, bringing the loan-to-deposit ratio down by 1.3 percentage points. The efficiency ratio improved from 62% in 2023 to 49%, signaling that the company now needs less non-interest expense to generate the same income.

Here are the key financial metrics from the past year:

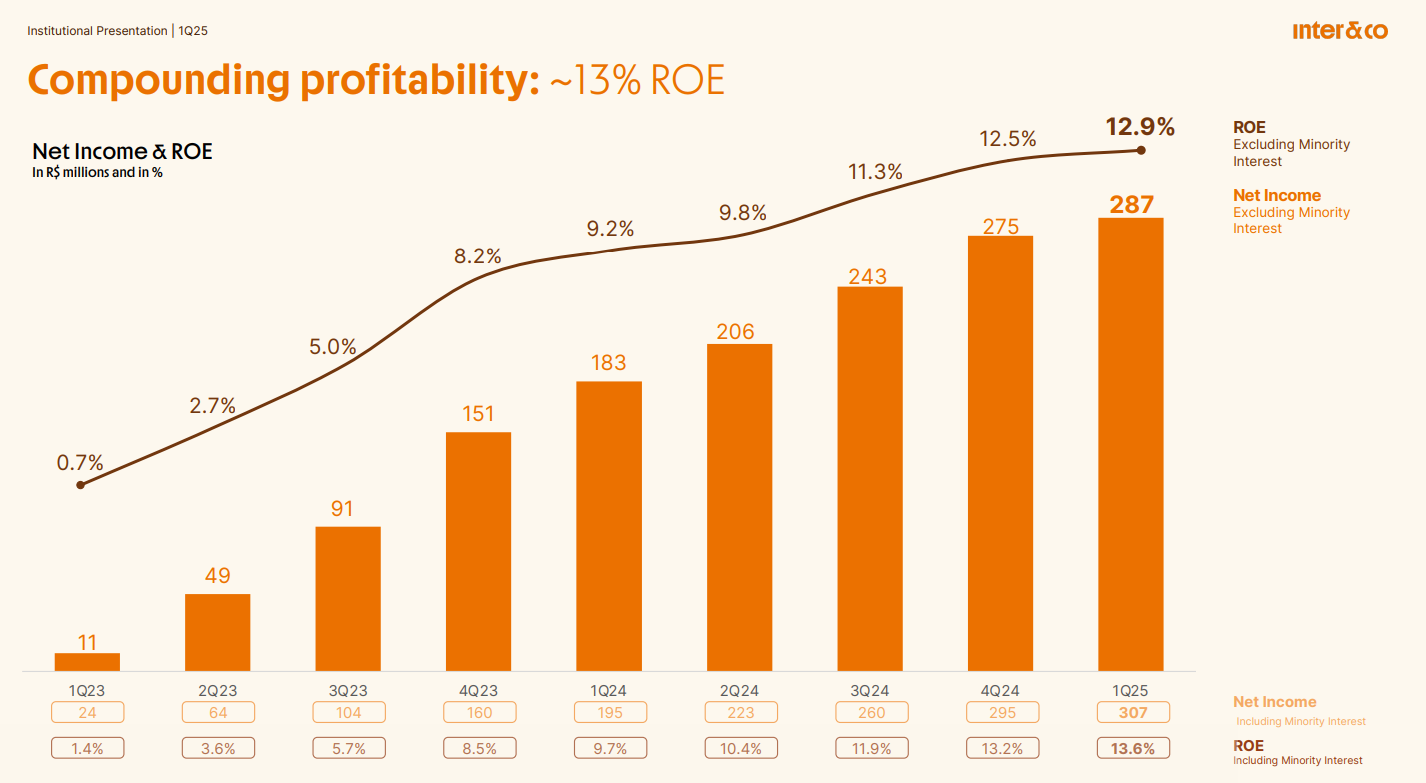

Revenue: +32%

Net income: +60%

ROE: Increased from 9.2% to 12.9%

The company is now accelerating international expansion. In May, they launched operations in Argentina via a partnership with Banco Industrial. Their first product is a global investment account, but they aim to replicate Brazil’s ecosystem model.

Mexico and Colombia are next on their launch roadmap. CEO João Vitor Menin also mentioned Europe as a future target:

“When you think about Europe, of course, Portugal and Spain come to mind first. Portugal speaks Portuguese, and Spain has a lot of Brazilians. Germany or Eastern Europe is harder. So I’d say Portugal and Spain are likely on the roadmap for the future.”

Inter is following a similar playbook to Nu Bank, building a comprehensive digital ecosystem and expanding abroad with a proven growth model. And clearly, there’s room for both.

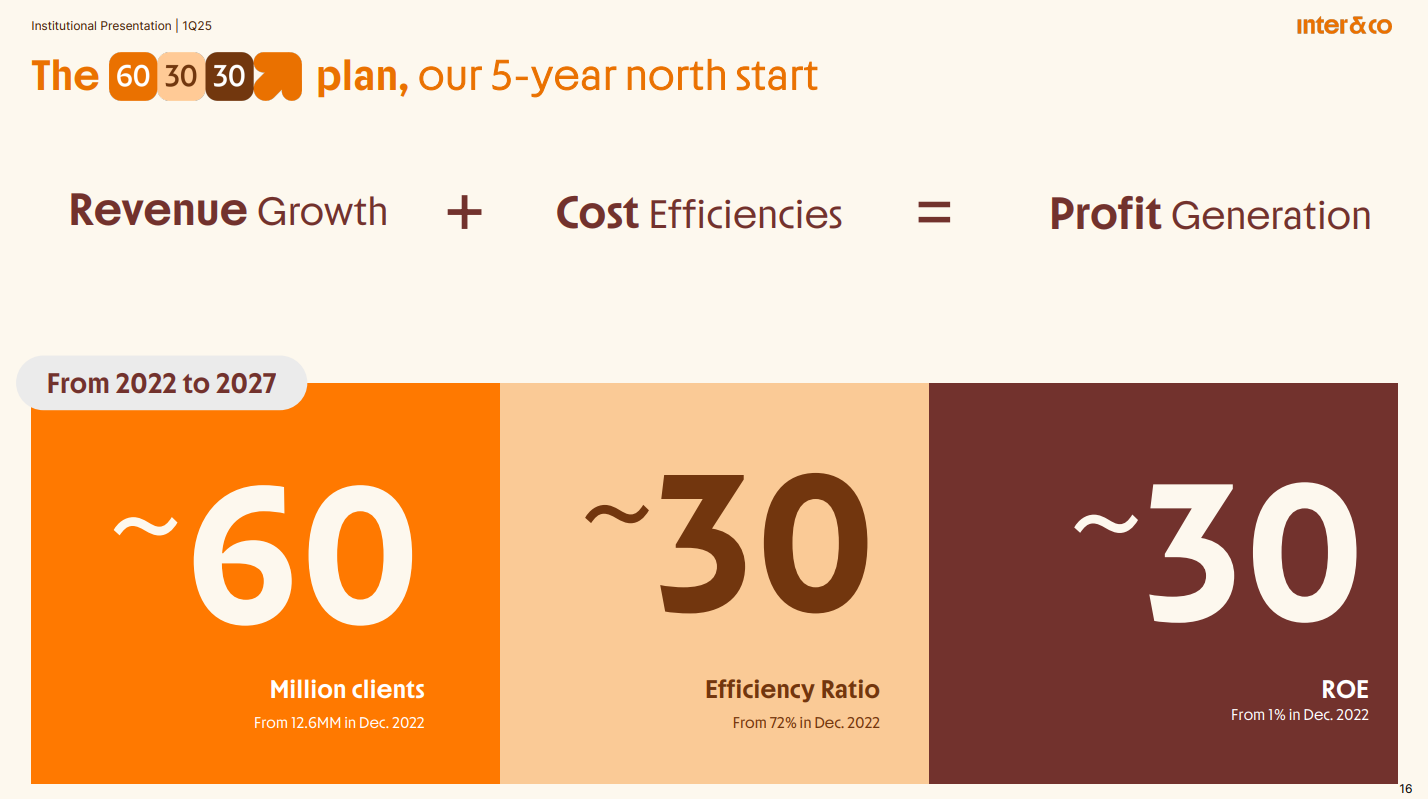

Looking ahead, Inter&Co has set ambitious 2027 goals:

60M clients — 27% CAGR

30% efficiency ratio

30% ROE

That’s tremendous growth, with a 30% ROE target that could make Inter&Co a generational compounder. For context, American Express has a 34% ROE as a mature bank growing at low single digits. Inter aims to hit 30% ROE while growing at 20%+ CAGR, a rare combo of quality and growth.

You might assume the stock trades at a premium. You’d be wrong.

Inter trades at just 15x annualized earnings. That valuation is nearly impossible to find in a U.S. growth company. The only real drag is Brazil-related risk. But Inter&Co has proven that regardless of political or economic shifts, they’ve stuck to their roadmap and kept growing. And their global expansion helps reduce country-specific exposure, further de-risking the bullish thesis.

If they hit their 2027 targets while maintaining a similar valuation, the bottom line could double, giving you a potential 2x without multiple expansion.

The execution has been flawless, the growth consistent, and management is clearly aligned, with 25% insider ownership.

I believe Inter&Co is one of the best opportunities outside the U.S. I’ve held shares for a while, and returns have been strong. Just like with Nu, I think this is a compounder you’ll want to hold for many years.

Total Site Solutions ($TSSI)

Total Site Solutions is a U.S.-based tech integration services company specializing in end-to-end deployment and management of data center and high-performance computing (HPC) infrastructure).

Let’s get straight to the point: the growth here is unlike anything I’ve seen before, but there’s a caveat.

Let’s start with the good part.

Growth has simply skyrocketed.

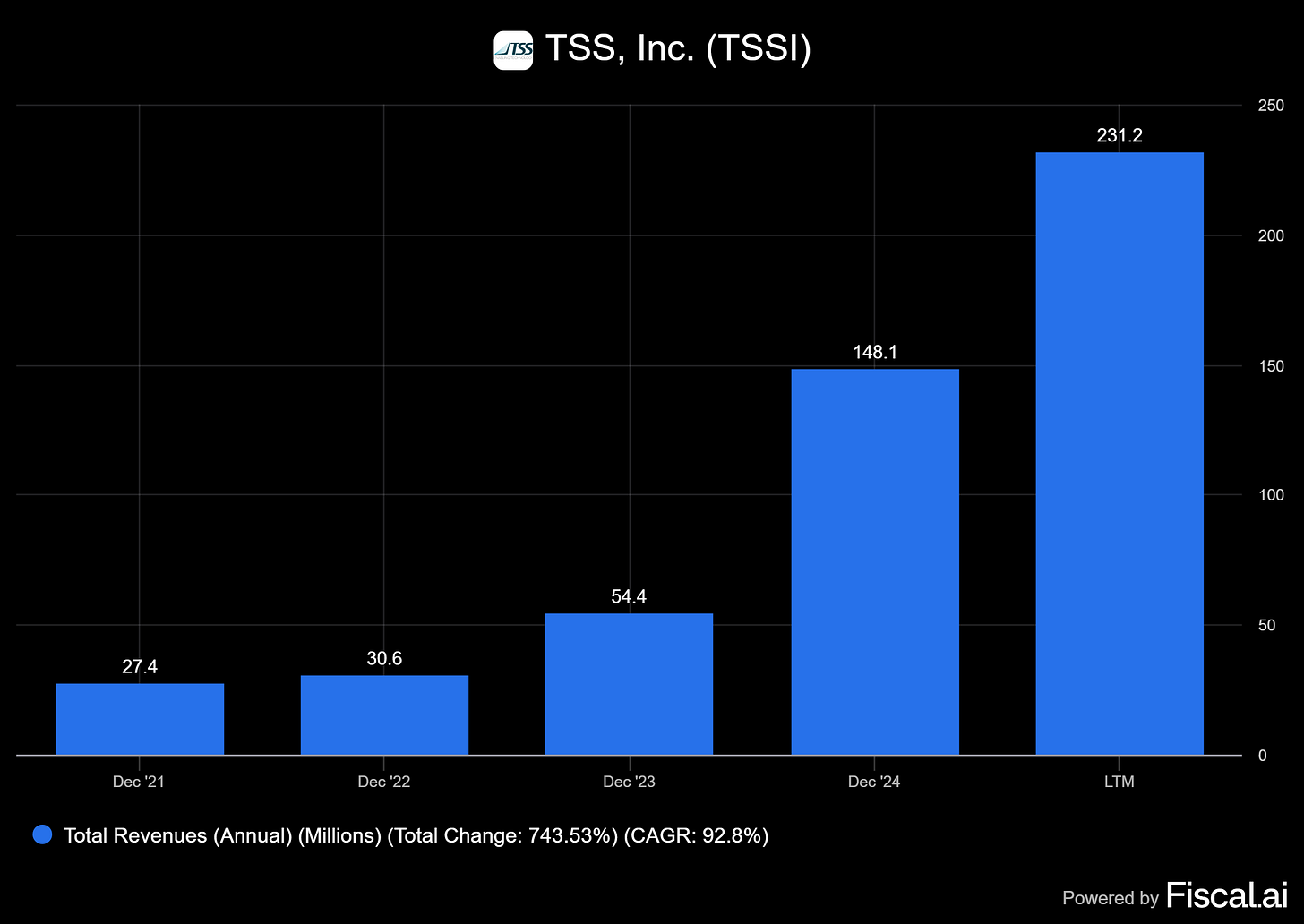

This company is capitalizing on the AI boom like no other, with 750% revenue growth in under four years.

The stock is already up nearly 100x since December 2023.

So I thought to myself: the opportunity must be gone.

This has to be an expensive stock by now.

But after reading their latest earnings report, I realized I was completely wrong.

Let’s take a look at the key financials from Q1 2025:

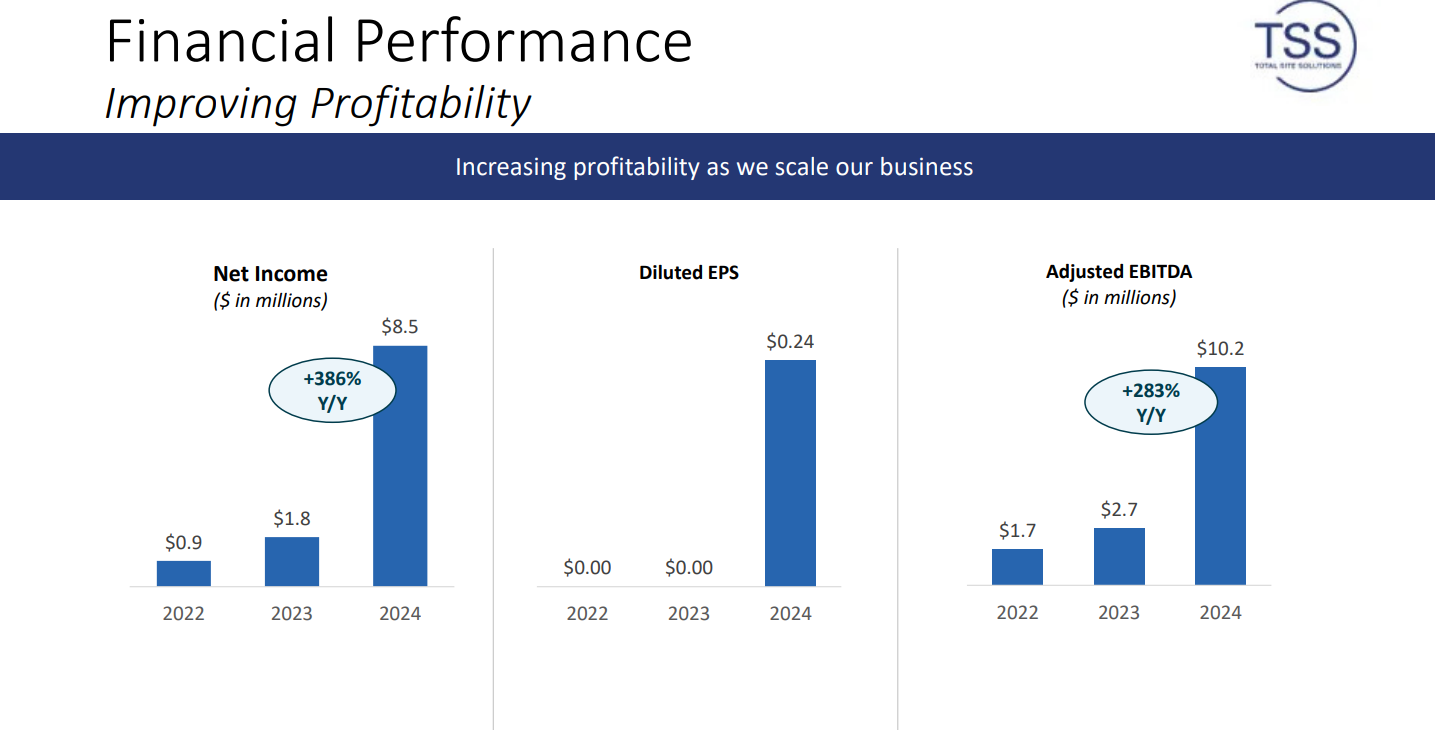

Revenue: $99M, up 523%

Gross profit: $9.2M, up 239%

Net income: $3M, up from $15,000

Adj. EBITDA: $5.2M, up from $475,000

Net cash: $19M

Given the $640M market cap, and using annualized figures, TSSI is trading at:

1.6x Price-to-Sales

53x Price-to-Earnings

31x EV/EBITDA

For a company growing at these rates, these multiples seem surprisingly low,

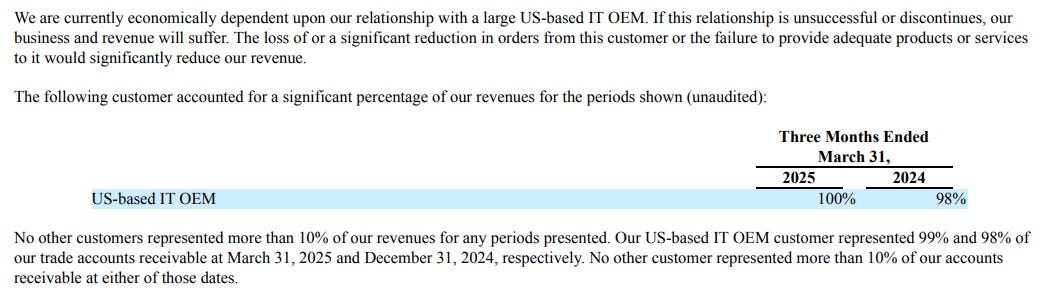

until you look at the customer concentration:

Basically, all of TSS's revenue comes from a single customer: Dell. That’s extreme customer concentration. With that level of reliance, could this company ever trade at a higher multiple? It's doubtful.

So, what does TSS actually do for Dell?

Procurement accounts for 91% of total revenue. TSS purchases third-party hardware, software, and professional services on behalf of Dell. In some cases, TSS modifies the hardware before reselling it to Dell. In others, they simply act as an intermediary, selling it unchanged.

In the first case, TSS recognizes the full sale as revenue.

In the second, they only recognize the fee for managing the transaction.

Procurement carries a very low 7% gross margin, as TSS doesn’t add much technological value; it’s essentially a hardware sourcing operation, filling logistical and administrative gaps for Dell.

TSS has two smaller revenue streams:

Systems Integration – integrating IT equipment for data center use.

Facilities Management – design, project management, and maintenance of data centers and mission-critical operations. This is also known as the modular data center (MDC) business.

The Bullish Angle: Modular Data Centers (MDCs)

TSS is attempting to pivot toward higher-margin services, particularly through modular data centers, pre-fabricated, self-contained units that include everything a traditional data center needs: power, cooling, networking, and IT racks. These units can be rapidly deployed anywhere.

CEO Darryl Dewan addressed this in the Q1 2025 earnings call:

“We expect MDCs to play an increasingly important role in our growth strategy in 2025 and beyond.”

And in the Q4 2024 earnings call, he gave a sense of the margin upside:

“Facilities management, primarily our MDC business, represented about 5% of our total revenue in 2024. Importantly, it’s a fairly predictable stream with gross margins generally exceeding 50%. Given the accelerating adoption of AI-enabled technologies, we expect demand for MDCs to be a key driver of growth in 2025 and beyond.”

Expanding Capacity to Sustain Growth

TSS isn’t just betting on MDCs, it’s scaling its production capabilities to support continued growth.

They’ve secured a new 213,000 sq. ft. facility in Georgetown, Texas, 60% more capacity than their previous one in Round Rock. They’ve also retained the option to use the old facility for additional volume.

From the last earnings call:

“To meet rising demand and support a long-term customer agreement in 2024, we secured a multi-lease agreement in Georgetown. It’s twice as big as what we have in Round Rock. We began production there in early May and expect to reach full capacity by June.”

But what’s more important than size is power capacity, which enables simultaneous testing of many racks, a necessity for next-gen high-performance computing.

From Q1 2025:

“We’ve been asked by our largest OEM customers to prepare to test many racks simultaneously, driving significant power needs. The new facility starts at 6 megawatts, and we’ve worked with the local municipality to scale that to 15 MW by summer. Our old facility only had 2.7 MW, so this is over 6x more power.”

Final Thoughts

TSS trades cheaply relative to its growth, but low margins and no clear technological moat are red flags. Their path to margin expansion depends heavily on a segment that currently represents just ~5% of revenue.

Their guidance calls for at least 50% higher EBITDA in 2025 vs. 2024, which would imply a 47x 2025 EBITDA multiple. Not exactly cheap at face value, but given the explosive revenue growth, it’s definitely a stock worth keeping on your watchlist.

That said, it’s clear the company is lowballing its guidance. Just annualizing Q1 revenues already suggests significantly higher EBITDA, and they expect growth to accelerate in the second half with the new facility ramping up production.

In reality, the stock might be trading closer to 25x 2025 EBITDA. And with their long-term contract with Dell securing stable cash flows, it’s possible that even after a 100x run, TSSI remains undervalued.

Oscar Health ($OSCR)

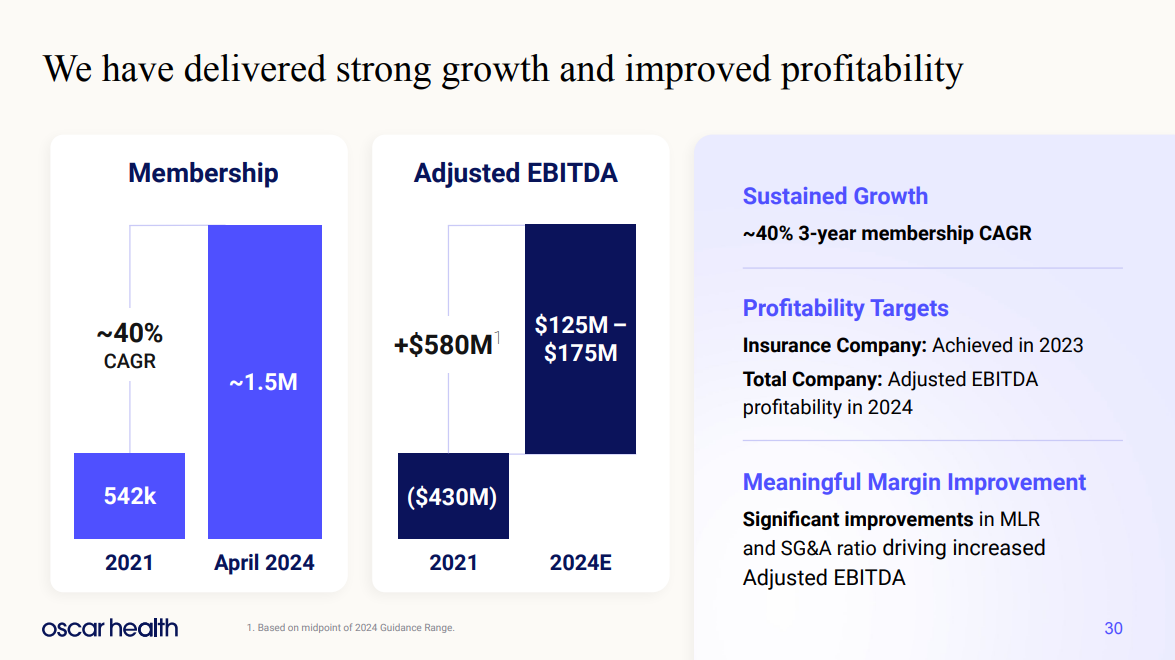

Oscar offers individual and small-group health plans, primarily through the ACA (Obamacare) exchanges, and previously through Medicare Advantage. The company is built around a full-stack technology platform that includes telemedicine, data analytics, transparent pricing, care guides, and incentives like $3 medications and step-based rewards.

It currently serves approximately 1.6 million members across 20+ states.

At first glance, and even after the recent surge, Oscar Health looks too cheap to be true. Here are the valuation multiples it trades at:

0.4x annualized sales

4x EBITDA

However, their entire business model is deeply dependent on the ACA. That brings clear regulatory risks that could cause the stock to drop double digits in a single day.

For example, ACA premium tax credits were extended through 2025 via the Inflation Reduction Act. If Republicans choose not to renew these credits, the stock would likely take a hit. Even more concerning, any broader changes to the ACA could directly impact Oscar’s operations.

The company addresses this risk clearly in its 10-K:

“If the ACA or its implementation is changed, including through legislative, executive or judicial action, our business, financial condition and results of operations could be adversely affected.”

“A repeal of the ACA, or any changes to the law or its implementation that reduce or eliminate public or private health insurance coverage, would materially and adversely affect our business.”

“We rely significantly on the ACA’s risk adjustment program. If this program is eliminated or changed, our financial performance could suffer.”

“A substantial number of our members receive subsidies under the ACA. A change in eligibility, amount, or availability of these subsidies would likely reduce our membership and revenue.”

In short, Oscar’s revenue and operations are tightly tied to the existence and structure of ACA subsidies and credits. If Republicans move forward with spending cuts or ACA reform, Oscar could be severely impacted.

Right now, the market is pricing in a worst-case scenario. I personally wouldn’t invest, simply because I’m not in a position to make bets on government decisions.

But for an investor with a clear and informed view on the future of the ACA, there could be a strong opportunity to earn significant returns if the market turns out to be wrong.

How big is the opportunity?

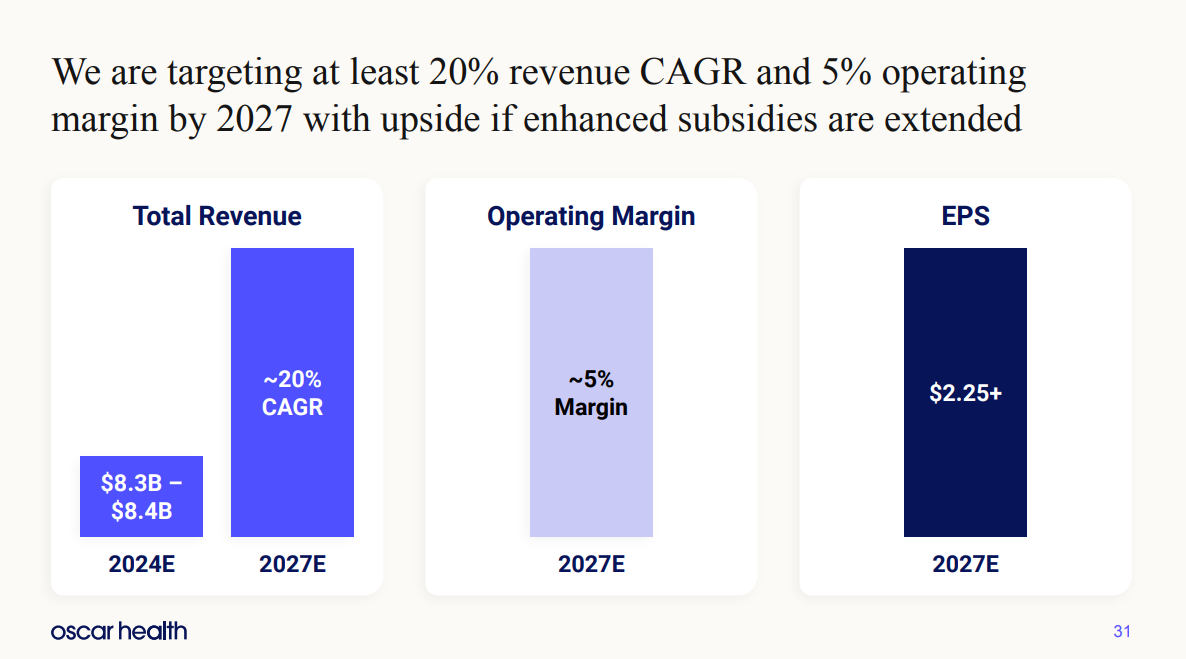

According to Oscar’s projections, if the subsidies are maintained, they could reach $2.25 EPS by 2027, growing at a 20% CAGR.

Using a conservative 20x multiple, that implies a $45 price target if government policy stays in their favor.

With today’s $19 share price, that would represent an upside of over 100% in less than two years.

Either way, I expect tremendous volatility with this stock over the next year.

I’ll be watching from the stands.

Closing Notes

I believe these are three interesting ideas, each with their own risks that explain their cheap valuations, but also create opportunities for investors willing to take a contrarian stance.

In the case of Inter&Co, the discount comes from regulatory risk in countries like Brazil and Argentina, as well as competitive pressure from players like Nu, Mercado Libre, and Revolut.

For TSSI, the concern is low margins and extreme customer concentration, which signal a potential lack of moat and differentiation, raising questions about the long-term sustainability of the business.

With Oscar, the explanation is the clearest of all. Their future depends heavily on the current administration. That’s something entirely outside management’s control.

Either way, all three are worth keeping on your watchlist. I’m personally an investor in Inter&Co and have been increasing my stake over the past few weeks.

My next articles will include a review of Micron’s earnings, a deep dive on ZETA, a piece covering High Tide and Auxly, and finally an article covering the rest of the stocks in my portfolio, a continuation of the one I already published. That’s roughly the timeline, unless something else interesting comes up.

Until next time.